House prices rise for third straight month as market readies for 2024 rebound

The UK housing market continues to beat expectations despite higher interest rates, with fresh figures today showing prices have risen for the third straight month.

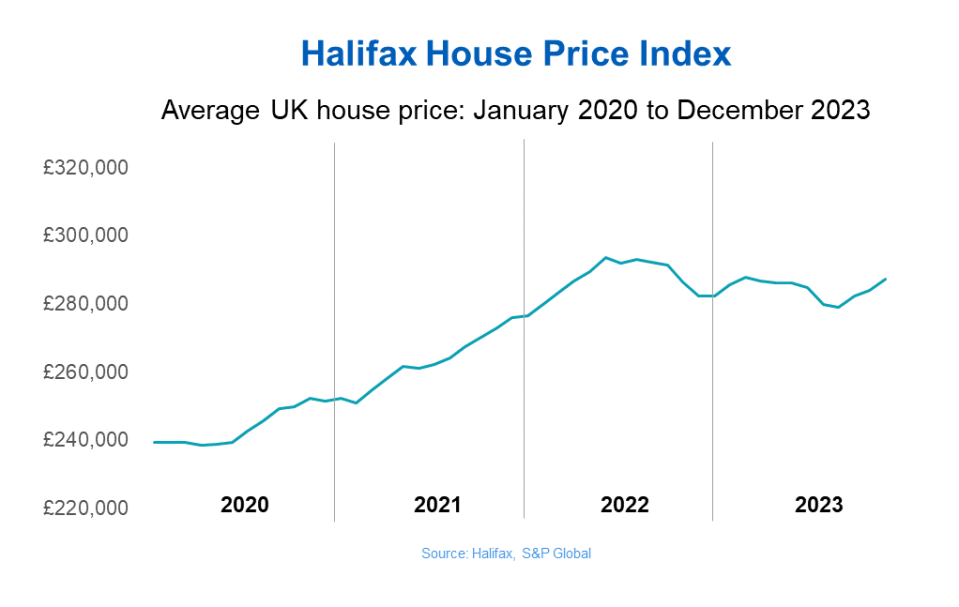

Halifax’s widely-read House Price Index (HPI) showed the price of a property in the UK had gone up 1/7 per cent on an annual basis, and the average home was now £4,800 higher than it was in December 2022.

This comes after 14 straight interest rate increases from the Bank of England raised the cost of mortgages for borrowers, leading to a decline in house purchasing activity. Prices initially cooled, but have now started to stabilise, following a number of consecutive interest rate holds.

Last month, house prices rose by 1.1 per cent across the country according to the index, meaning the typical home now costs £287,105.

Unsurprisingly, London retains the top spot for the highest average house price across all the regions, at £528,798, albeit prices in the capital have declined by -2.3 per cent on an annual basis.

The south east experienced the strongest downward push on house prices overall.

Yesterday it was reported mortgage approvals are on the increase, but experts warned the market is not yet out of the woods.

Kim Kinnaird, director of Halifax Mortgages, said: “The housing market beat expectations in 2023 and grew by 1.7 per cent on an annual basis. The average property price is now £4,800 higher than it was in December 2022.”

“Whilst it’s encouraging that we saw growth in the last three months of the year, this was preceded with property price falls for six consecutive months between April and September. The growth (in house prices) we have seen is likely being driven by a shortage of properties on the market, rather than the strength of buyer demand. That said, with mortgage rates continuing to ease, we may see an increase in confidence from buyers over the coming months.”

She added the “South East fell most sharply, houses here now average £376,804 (-4.5%), a drop of –£17,755.”

“As we move through 2024, the UK property market will continue to reflect the wider economic uncertainty and buyers and sellers are likely to be naturally cautious when considering making a move.

“While wage growth is now above inflation, helping to ease cost of living pressures for some and improving housing affordability, interest rates are likely to remain elevated for as long as inflation remains markedly above the Bank of England’s target. Our latest forecast suggests house prices could fall between -2% and -4% during the coming year, although, as with recent years, forecast uncertainty remains high given the current economic climate.”