House prices may tumble a fifth if Bank of England hikes rates steeply, economists warn

House prices could tumble as much as 21 per cent if the Bank of England is forced to hike interest rates steeply in response to the government’s tax and borrowing splurge fuelling inflation, City economists have warned.

Mortgage affordability – the ratio of a home purchase loan to the size of the borrower’s income – may have to drop from 3.5 to 2.5 if lenders start charging six per cent on mortgages.

“If that happened overnight, it would imply a 21 per cent fall in house prices,” according to Andrew Wishart, senior property economist at consultancy Capital Economics.

Higher rates on mortgages often result in demand in the housing market cooling due to prospective buyers shunning purchases because they cannot afford them.

The UK is highly sensitive to the health of the property market, meaning a drop in prices would generate a “negative feedback loop” that reverberates across the economy, Wishart added.

House prices have jumped 10 per cent over the last year to nearly £274,000, but the rate of growth is slowing, according to Nationwide.

Mortgage providers have pulled products due to uncertainty over how higher interest rates could go in the coming months.

If the Bank did hike rates to the market’s expectations of six per cent, it “would lead to a sharp rise in mortgage defaults,” Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said.

A sudden wave of borrowers being unable to service their mortgage debts may “set in motion a banking crisis,” he added.

The 2008 financial crisis was mainly caused by households being unable to afford mortgages.

Markets have stepped up their bets on the Bank hiking rates sharply over the next year to offset the government’s £45bn worth of tax cuts and borrowing splurge announced at the mini-budget.

Threadneedle Street was yesterday forced to reassure markets it will “not hesitate” to lift borrowing costs steeply to get inflation, running at a 40-year high of 9.9 per cent, back to its two per cent target.

Earlier this week, the pound tumbled to a record low of nearly $1.03 against the US dollar. UK borrowing costs, on some measures, also registered a record daily gain. Yields and prices move inversely.

The pound has since recovered some ground. Short-term yields have also edged lower, but longer dated debt rates continue to climb.

The Bank’s chief economist, Huw Pill, said today the recent market turmoil requires a “significant” response, signalling a rate hike of as much as 100 basis points at the central bank’s next meeting on 3 November could land.

Governor Andrew Bailey and co have backed two 50 basis point rises in a row. Before the first move, the Bank had never lifted borrowing costs more than 25 basis points in its 25 years of independence.

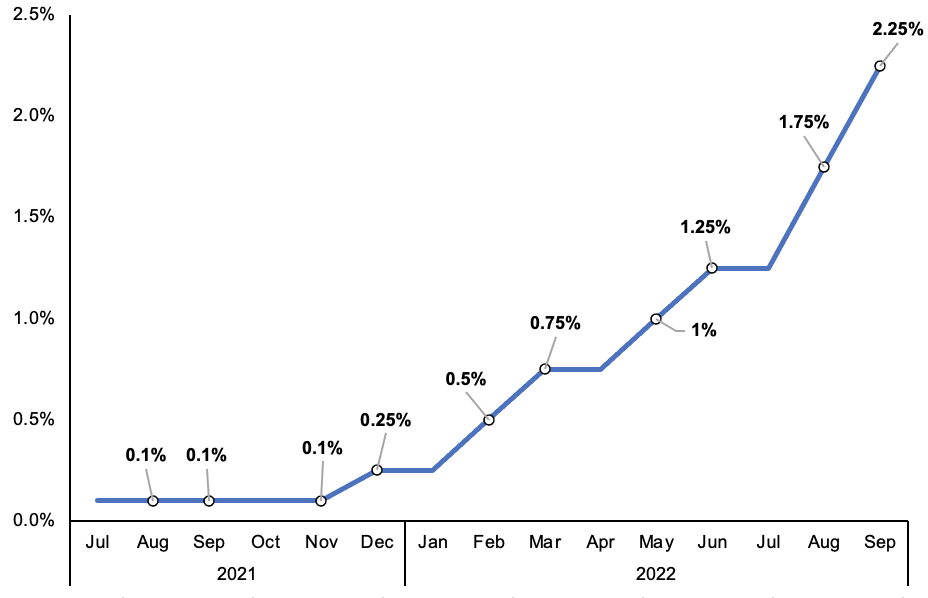

UK interest rates have risen sharply this year