House prices: Five things we’ve learnt from the latest data (and why we might still be set for a crash)

House prices remain a hot topic in Londoners’ conversation.

August proved to be more a summer of pain than it was a summer of love for the UK’s housing market. City A.M looks at the major takeaways from this month’s data from the ONS, Rightmove and Foxtons.

Private rents grew..again

Private rental prices rose by 5.3 per cent in the 12 months to July, up from 5.2 per cent in the 12 months to June 2023, the latest data from the ONS showed. In London, the figure rose to 5.5 per cent, up from an increase of 5.3 per cent compared to the prior month.

This is the highest annual percentage change since the ONS data series began in January 2006.

Why are rents going up?

In recent months, a cocktail of shrinking supply and rising living costs has led landlords to increase the rent on their properties. High mortgage rates have also led many owners to sell their homes, meaning more tenants are competing to secure a place to rent.

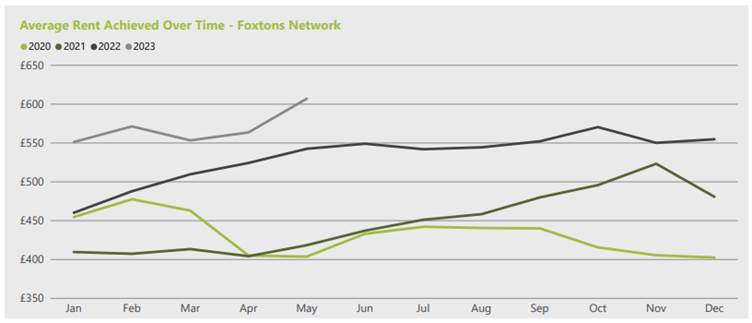

According to data from Foxtons the average amount Londoners fork out on rent grew 12 per cent year-on-year in July topping £597 per week.

“The squeeze on tenants will not end anytime soon. Landlords have left the sector in recent years due to extra red tape and tax as they became a politically expedient target for politicians,” Tom Bill, head of UK residential research at Knight Frank, said:.

“The unintended consequence has been more financial pain for tenants as the supply of rental property falls and rents rise. It is an imbalance compounded by the fact landlords now face higher mortgage rates.”

House prices slipped

The average price of a home also fell by 1.9 per cent in August, the biggest dip for the month since 2018, figures by estate agent Rightmove showed. During the tail end of the summer the cost of a home fell on average by £7,012 to £364,000.

In London, house prices dipped by 2.3 per cent and the average price of a home in the capital now costs £672,000.

Sellers have been forced to accept lower offers on their home because surging mortgage rates throughout June and July made the prospect of buying a home unattainable for most buyers.

But falling house prices are rarely an economic positive

While securing a cheaper deal on a home can be beneficial on an individual level, slipping house prices can often be an indicator of poor economic health. This is because how much the price of a home will cost or the rate of a mortgage is often linked to interest rates, which impacts public spending.

Also if house prices fall too low, households can become trapped in negative equity, meaning their property is worth less than what they paid for it.

“Despite a larger-than-expected drop in aspirational asking prices as opposed to selling prices, in many cases this hasn’t generated an increase in sales agreed, which remain disappointingly low,” Jeremy Leaf, North London estate agent and a former RICS residential chairman, said.

If rates remain high for a sustained period, we could see falls of 20 per cent as buyers demand cheaper prices as finance is more expensive

Samuel Mather-Holgate

Mortgage rates came down

However, many high street lenders cut the rates of their mortgage deals, after they soared to fresh highs at the start of the summer.

In August, many banks such as Halifax and Nationwide cut the price of rates as an unexpected drop in inflation helped offset the central bank’s consecutive interest rate rises – which had previously led them to ramp up costs.

The average five-year fixed mortgage rate is now 5.81 per cent, down from 6.08 per cent just three weeks ago, according to Rightmove figures.

Customers are still worried

While the prices are coming down, customers still appear to be worried about meeting the cost of their payments with terms such as ‘Mortgage help’ exploding by 1,366 per cent in the past seven days, a study from L&C Mortgages, said.

Furthermore, some 38 per cent of Brits have confessed to finding it difficult to afford their rent or mortgage payments over the past month, a study released by the ONS this month said.

A tough market is damaging businesses

During the month a number of house building firms also said they were suffering due to rising interest rates and a drop in buyer confidence.

Fellow house builder Bellway’s underlying operating margin has also contracted from 18.5 per cent to 16 per cent during the year and the selling price of its homes also dipped slightly to £310k compared to £314k last year.

What next?

The market will turn its focus to the Bank of England’s upcoming interest rate decision on the 21st September as an indicator of what buyer sentiment may look like during the autumn and winter months.

“If rates remain high for a sustained period, we could see falls of 20 per cent as buyers demand cheaper prices as finance is more expensive,” Samuel Mather-Holgate, independent financial advisor at Mather and Murray Financial, said.

Myron Jobson, senior personal finance analyst at interactive investor, told City A.M that these headwinds are expected to be “persistent” as the summer buying season draws to a close.

He added: “The Bank of England is looking increasingly likely to stay the course when it comes to upping interest rates, following new official analysis of inflation which shows that persistent factors, rather than temporary trends have kept prices elevated over the past year.”

“As a result, the muted market activity levels of recent months could persist, as fewer buyers are able to make the numbers work. Sellers may have to adjust to the new status quo in the housing market by being flexible on price given the growing challenges posed by high mortgage rates and inflation.”