House price growth plummets to lowest level in a decade as confidence and costs see off buyers

House price growth has plummeted to its lowest in more than a decade as a cocktail of high borrowing costs, inflation and low confidence has deterred buyers.

Properties dropped in value by -1.1 per cent year on year in February, according to Nationwide’s House Price Index, down from 1.1 per cent the previous month.

This comes after it was revealed Brits are being forced to accept an average cut of £14,000 on the price of their homes to achieve a sale, according to new figures from real estate firm Zoopla.

It was also highlighted that house prices grew by just £14 in January, as rate hikes chilled demand.

February had a 0.5 per cent month on month fall with prices 3.7 per cent lower than the August 2022 peak, before the disastrous mini-budget and rate hike.

Some analysts have warned however, that there is still a “chronic undersupply of suitable housing” in the capital, where house prices are considerably higher.

The HPI indicates the slowing of house price growth is the first annual decline since June 2020 and the weakest in more than a decade, since November 2021.

The average price sits at £257,406 in February, down from £258,297 in January, though London is considerably higher on average.

Commenting on annual house price growth slipping “into negative territory for the first time since June 2020″, Robert Gardner, Nationwide’s Chief Economist, said “the recent run of weak house price data began with the financial market turbulence in response to the mini-Budget at the end of September last year.

“While financial market conditions normalised some time ago, housing market activity has remained subdued.”

“This likely reflects the lingering impact on confidence as well as the cumulative impact of the financial pressures that have been weighing on households for some time.

“Indeed, inflation has continued to outpace wage growth and mortgage rates remain significantly higher than the lows recorded in 2021.

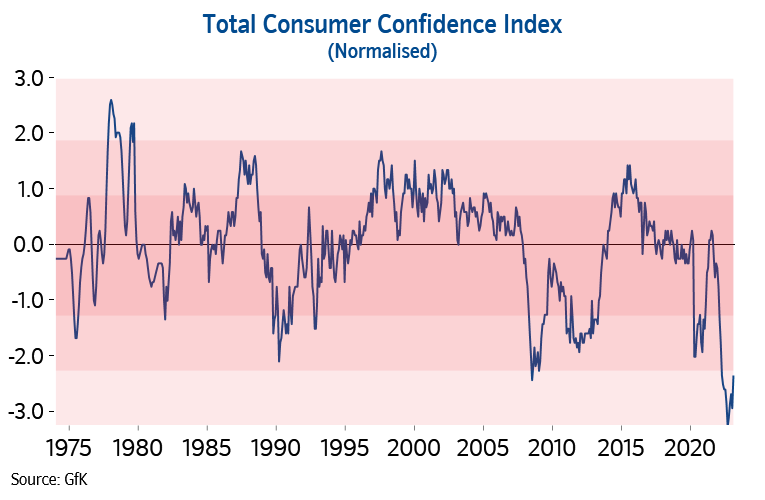

“Even though consumer sentiment has improved in recent months, it is still languishing at levels prevailing during the depths of the financial crisis.

Looking ahead to the immediate future he said it would be ““hard for the market to regain much momentum in the near term” citing continued speciation about whether the UK will enter a recession, high inflation, and the shrinking of the Labour market.

He added that “deposit requirements remain prohibitively high for many and saving for a deposit remains a struggle given the rising cost of living, especially for those in the private rented sector, where rents have been rising strongly”, meaning prospects for house price increases will be limited.

London is still struggling

Matt Thompson, head of sales at London-based Chestertons responded to the results saying that while the “UK economy has shown signs of recovery, we are beginning to see more sellers wanting to capitalise on the positive market sentiment.

“In February, our branches registered a two per cent increase in the number of properties being put up for sale compared to the same month last year.”

“Still, the capital continues to experience a chronic undersupply of suitable housing; particularly as demand has remained strong since the start of 2023 with more buyers booking in viewings.

“Simultaneously, the number of offers being withdrawn has decreased by 11 per cent which indicates that there are fewer window shoppers and more serious buyers entering the market.”

Still above pandemic levels

Meanwhile, Nathan Emerson, chief executive of Propertymark, warned that that “despite house prices falling, values are still higher than pre-pandemic.

“Because of this, our member agents recently reported an 80 per cent increase in new sellers entering the market, showing that despite not pulling in as much money from a sale than they would have done last year, sellers still have a healthy appetite to get moving.

“Previously, sellers were able to be more ambitious about the price, but buyers are most certainly now in the driver’s seat and are negotiating hard when hunting for their ideal home.”

Former RICS residential chairman Jeremy Leaf, who is now a north London estate agent added that the “comprehensive and widely respected figures reiterate continuing worries about interest rates and inflation, which are keeping prices in check.

“However, the market is definitely not in free-fall. On the ground, we are seeing more listings and protracted sales so buyers have more choice, are taking longer and negotiating harder when making offers.”

Mortgage concerns

Frances McDonald, research analyst at Savills, commented that “while the Bank base rate has continued to rise, we’re starting to see greater stability in the mortgage markets with fixed rate mortgage rates coming down from a peak in October and more mortgage products now available to borrowers, particularly at lower LTV ratios.

“This is likely a reflection of lenders trying to gain a greater share of a smaller mortgage market, but there is also an increasing expectation that inflation has peaked and that Bank base rate is likely to start coming down in 2024.

“Borrowers are still facing a considerable increase in their mortgage costs, whether new entrants to the market or those coming off of a fixed rate deal, which means we likely haven’t seen the end of house price falls. But we do expect them to continue to be more modest in the less mortgage-dependent prime markets.”

Meanwhile, SPF Private Clients’ chief executive of mortgage Mark Harris said the price drop was due to “higher mortgage costs, along with the rising cost of living” which have “an inevitable impact on affordability.

“Swap rates, which underpin the pricing of fixed-rate mortgages and have been falling since the turmoil created by the mini-Budget in September, have taken a turn and moved the other way in the past couple of weeks on the back of expectations of further base rate rises. Subsequently, several lenders who launched sub-4 per cent five-year fixed-rate mortgages have since increased these, with mortgage rates likely to be up and down in coming weeks.

“Borrowers should seek advice from a whole-of-market broker before either taking the plunge or holding off in the expectation that rates will come down further.”