Hopes of Christmas spending splurge nudges UK business confidence higher

UK businesses are hoping the Christmas spending splurge will give them a welcome boost before a long recession sets in, a new survey out today shows.

According to Lloyds Bank’s business barometer index, every UK region notched a positive business confidence reading for the first time since July.

Eight out of the 11 areas recorded a monthly rise in optimism. However, firms in London are more worried about the future prospect of the UK economy and their own performance in the coming year, sending confidence in the capital 14 points lower to eight per cent.

Overall UK business confidence climbed seven points to 17 per cent in December.

Analysts said companies are hopeful Brits will head out on to high streets and splash the cash over the festive period.

Hann-Ju Ho, senior economist for Lloyds Bank Commercial Banking, said: “Business confidence has received a boost in the run up to Christmas as firms anticipate a better festive trading period than last year.”

Parts of city centres resembled a ghost town in Christmas 2021 when the Omicron variant prompted people to reduce social contact.

Christmas generates a significant proportion of businesses’ income, especially leisure and hospitality companies, which can determine whether they notch a profit or loss for the year.

There are concerns pubs, bars and restaurants are set to miss out on this crucial revenue due to people struggling to travel as a result of railway strikes. Figures from Springboard this week revealed footfall in the centre of London plummeted nearly a third during last week’s strikes.

The UK is likely in the early stages of an at least year long recession sparked by roaring inflation triggering a spending slow down.

UK real incomes are on course to fall at the fastest pace on record over the next two years, according to the Office for Budget Responsibility, meaning Brits will have less spending power.

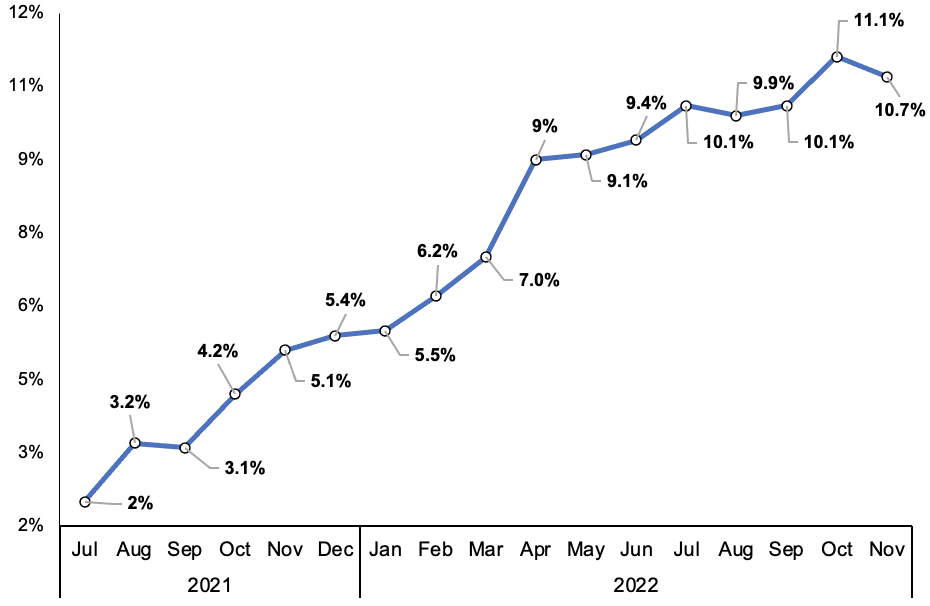

Inflation dropped to 10.7 per cent in November, prompting economists to forecast the rate of price rises has passed its peak.

However, pay growth is forecast to lag behind inflation next year.

Annual CPI UK inflation