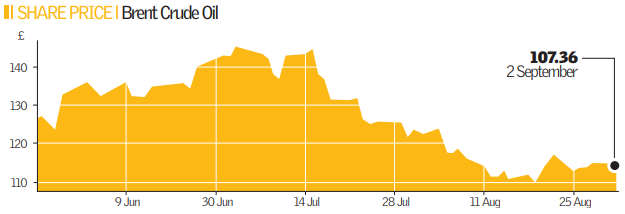

Hopes mount for inflation as oil slumps

$100 a barrel in sight as global demand drops and hurricane misses refineries

Oil prices could once again move back below the symbolic $100 a barrel level, analysts said yesterday. The forecasts, which were welcomed by consumers and economists, came after crude plummeted to a five-month low, boosting hopes that spiralling inflation would finally be brought under control.

Oil’s tumble to a session low of $105.46 a barrel, before settling at $107.36, came after Hurricane Gustav managed to avoid oil production facilities along the Gulf Coast. Shell and BP had battened down the hatches, evacuating staff from oil platforms, heightening fears that oil production could be hampered by the storm.

“If it were not for these (storm) threats, we would have been testing $100 already,” said Mike Wittner, energy analyst at Societe Generale, who expects prices to continue to fall.

Economists said the move would eventually cut inflation, which hit 4.4 per cent last month – more than double the Bank of England’s two per cent target – and make room for interest rate cuts.

“The basic story is that oil prices will weaken as the global economy does, bringing inflation back under control within two years,” said Graeme Leach, chief economist at the Institute of Directors. But he warned that with utility companies passing on higher energy costs to consumers in the form of higher tariffs, it would take a while before consumers felt the impact.

The drop boosted oil users such as travel group Thomas Cook, whose shares jumped 18p, and cruise ship operator Carnival, which gained 148p. Crude’s collapse saw the pound drop to its lowest level in 16 years, hitting a new record low against the euro, as markets moved to price in a higher likelihood of rate cuts.