Hooked on gas? How Europe could fare in a winter energy crisis

Experts are divided over whether Europe is in prime position to meet its energy needs this winter, with the continent depending on liquefied natural gas (LNG) to keep homes warm and the lights on over the coldest months of the year.

Market think tank the Institute for Energy Economics and Financial Analysis (IEEFA) and energy forecasters Cornwall Insight have offered contrasting outlooks for the coming months in differing research on capacity.

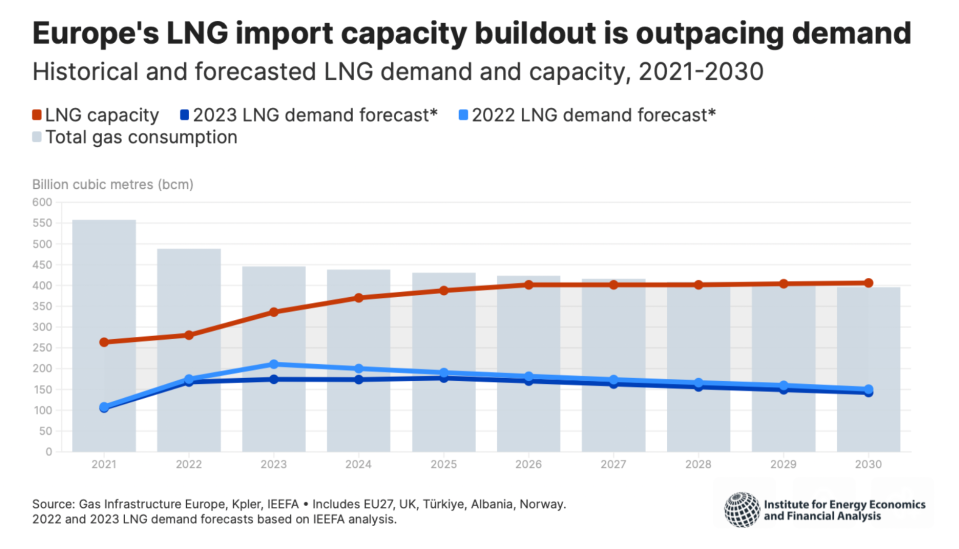

IEEFA has called on Europe to stave off future investment in liquefied natural gas storage, as it predicts new capacity should be enough to meet demand this decade.

It argued the continent is an increasingly robust position ahead of winter with the gap between LNG capacity and reduced demand widening.

It notes that the European Union (EU) has met its winter gas storage targets ahead of schedule with energy reduction measures and warmer weather, while imports of LNG have flattened.

In contrast to a 62 per cent rise in imports over the first nine months of 2022, there has been just a four per cent year on increase over the same time period this year.

Europe has added 36.5bn cubic metres (bcm) of new LNG capacity since the beginning of 2022, which includes six new terminals this year alongside a new floating storage regasification unit that is docked but not yet operational.

The bloc has spent vast sums on LNG to fill this increased capacity, including €41bn on imports between January and July 2023 – with the U.S. (€17.2bn), Russia (€5.5bn) and Qatar (€5.4bn) the largest beneficiaries.

IEEFA questions whether there needs to be any further additions — predicting that the annual import capacity of European LNG terminals is set to reach 406bn cubic meters (bcm) by 2030 while the continent’s total gas demand is expected to fall to around 400 bcm over the same period.

Instead it calls for Europe to shift towards more stable energy markets such as renewables.

“The decline in gas demand is challenging the narrative that Europe needs more LNG infrastructure to reach its energy security goals. The data is showing that we don’t,” said Ana Maria Jaller-Makarewicz, an IEEFA energy analyst.

“Despite significant progress towards reducing gas consumption, countries in Europe risk trading a reliance on Russian pipelines for a redundant LNG system that further exposes the continent to volatile prices.”

However, Cornwall Insight warns challenges could still emerge for Europe, such as growing competition from China as its economy rebounds, and price increases put pressure on the gas market.

The energy forecaster has published its own analysis, focusing on LNG security over the upcoming winter, and fears that heightened Chinese gas demand, driven by economic recovery following repeated COVID-19 lockdowns could intensify the competition to secure LNG.

China has seen a six per cent growth in gas demand so far in 2023 and while this is currently being covered by domestic production and higher pipeline imports from Russia, the winter could see a need for increased LNG imports, heightening global competition.

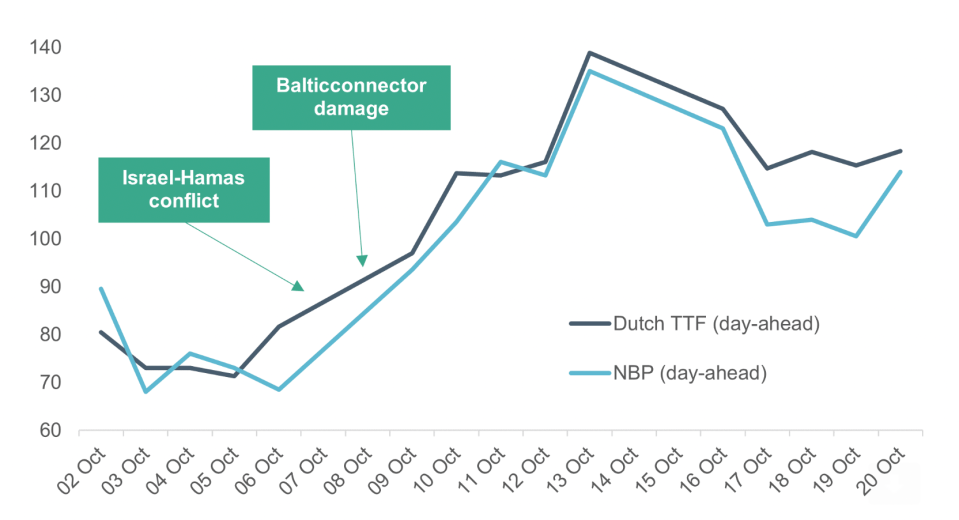

It also fears that recent global events, such as disruptions to the Finish Baltic connector and the Israel-Hamas conflict could cause gas prices to spike again, and raise the risk of Europe being priced out of the LNG market.

Cornwall Insight notes prices have spiked amid increased geopolitical uncertainty

Cornwall Insight warns that, in such circumstances, China has previously been willing and able to pay higher prices for gas compared to Europe — meaning the EU could lose out in any bidding wars if supplies shorten.

Dr Matthew Chadwick, lead research analyst at Cornwall Insight, said: “As China’s economic recovery drives up gas demand and worldwide events send prices skyrocketing, Europe can no longer cling to the illusion of on-demand LNG.”

Cornwall Insight urges European nations, including the UK, to focus on securing longer-term LNG supply deals to reduce exposure to volatile prices and intensifying competition.

Chadwick said: “To secure gas supply this winter, they must make a concerted effort to shred their reliance on short-term, risky LNG purchases. It is crucial they focus on building strong partnerships, improving infrastructure and securing supply chains, so Europe can safeguard its energy security while working towards its longer-term decarbonisation goals.”