Hong Kong to San Francisco: How office workers are returning across the globe

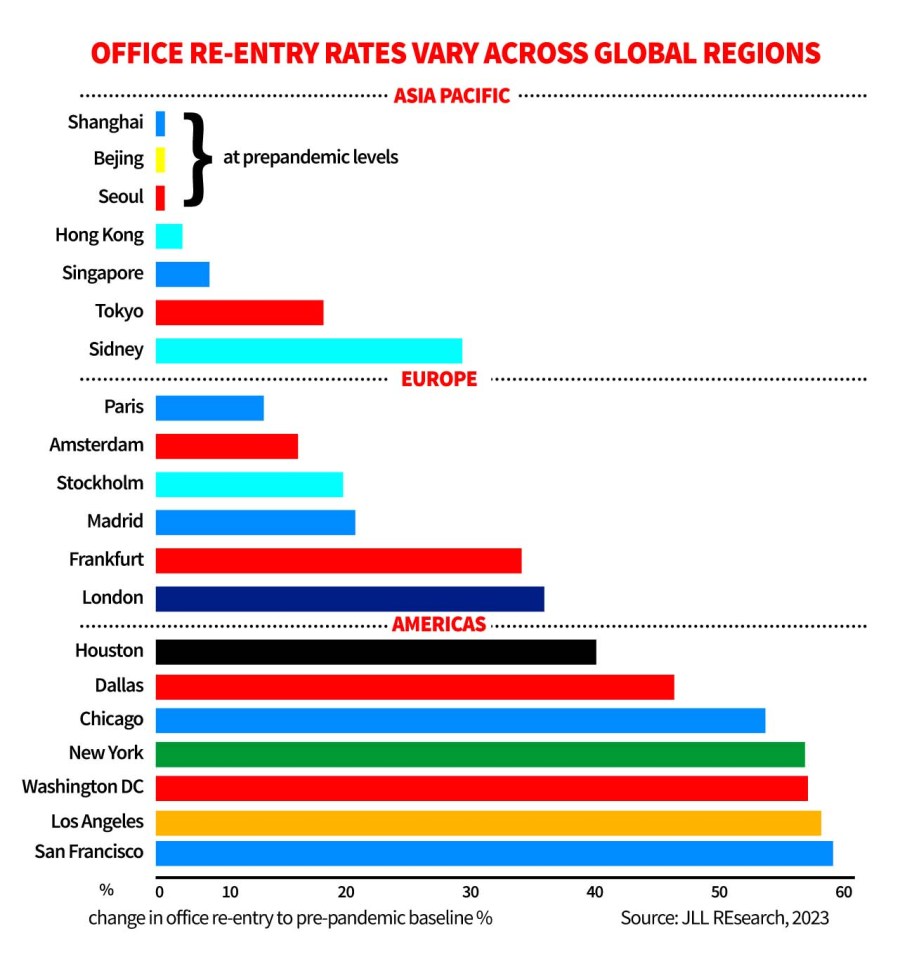

The rise of hybrid working and working from home during the pandemic has left cities across the world facing up to new challenges – but the rate at which staff are returning to their offices is different across the world.

Asian cities, despite more strident restrictions on mobility during the pandemic itself, have seen their office desks fill up at speed.

US cities, however, continue to lag – with San Francisco’s struggle to attract tech workers back to the office well covered, with serious knock-on effects for the city itself.

In London, the ‘tw*t’ has become part of everyday lexicon for those who turn up at the office Tuesday through Thursday, with Fridays now almost universally viewed as a work from home day.

But how do global cities compare?

JLL’s research into the future of the central business district, released today, gives an insight into the different speed at which staff are returning to the office.

London lags European neighbours

According to the JLL research, London’s ‘re-entry’ rate is still 35 per cent down on pre-pandemic levels; the biggest gap in any of the major European cities it studied.

Paris and Amsterdam, for instance, sit at just a 15 per cent gap.

But even London is way ahead of even the most ‘returning’ US cities, with Houston down 39 per cent and New York down a whopping 54 per cent.

The lack of office workers has had a knock-on effect across the world’s cities, with businesses serving those commuters – from pubs to sandwich shops to train companies – feeling the pain.

Just this week campaigners at Centre for Cities said Mayor Sadiq Khan should do more to encourage workers back to the office to avoid a productivity slump and an “unintended economic impact.”

Changing the city for the future

JLL say global cities are at an “inflection point, navigating structual changes to how people live and work due to the pandemic.”

The New York listed commercial real estate company though believes that changing as little as 10 per cent of older, less popular central city office space into residential units could tackle housing affordability challenges as well as bring mixed-use vitality to quieter, previously commercial-only areas.

“After three years of dramatic shifts to how we live and work within CBDs, significant opportunity exists to reimagine how we use and interact with city centers,” said Phil Ryan, Director of Global Research, City Futures at JLL.