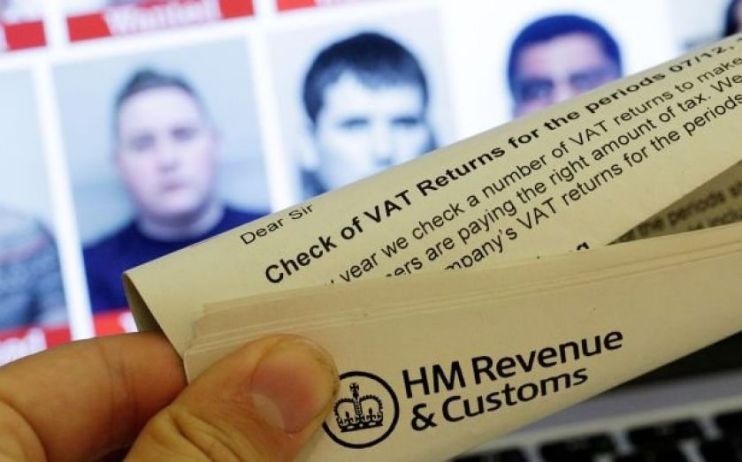

HMRC’s plans for second self-assessment helpline closure sparks outrage

HMRC is preparing for another closure of its tax self-assessment helpline after it gave users a 48-hour warning, MPs have been told.

The tax office shut its self-assessment phone lines for three months this summer, causing outrage among taxpayers and entrepreneurs after users were given just two days’ notice.

Officials said the closure was a trial of its so-called seasonal model pilot, in a bid to shift queries from taxpayers who complete a self-assessment on their income tax to online.

Now HM Revenue and Customs bosses say another trial will take place as it continues to move the department’s customer services from time-consuming post and phone calls over to digital chat support.

It came as MPs at the Treasury select committee grilled top tax office mandarins about the trial’s outcomes, with chairwoman Harriett Baldwin branding the system “about to fall over”.

Angela MacDonald, second permanent secretary, told MPs HMRC is planning a further pilot of the seasonal helpline closure, as the department receives fewer calls over the summer.

“We absolutely believe a shift to the usage of digital services is and has to be part of the HMRC operating model,” she said.

MacDonald also admitted “we were somewhat late” in notifying people about the closure and said it “definitely wasn’t part of the plan” to only give the public two days’ notice.

And she said that consulting internal stakeholders meant “we ran out of the time we would have ideally had to communicate further and more fully”.

While HMRC board member Dame Jayne-Anne Gadhia told MPs: “We were not aware that the communication was delayed. The board wasn’t aware it was only two days’ notice.”

And Baldwin said to officials: “I’m really quite worried… we are where we are now which doesn’t sound like a particularly good place… it feels like a system that’s about to fall over?”

She added: “It just sounds like no one was really very satisfied. This pilot doesn’t seem to have worked, does it? This seems to have taken everyone by surprise.”

First permanent secretary Jim Harra told MPs HMRC now had five per cent fewer customer service staff and a lot of calls involved simple requests like changing an online password.

“The challenge is tougher and tougher,” he said. “We are not resourced to deliver customer service through traditional channels like phone and post.

“We estimate that we need to reduce our contact demand by about 30 per cent by the end of next year compared to 2021-22 to be able to hit service standards with reduced resources.”

But he said demand was going up meaning staff had to “swim against the current”.

Harra admitted there was a drop in satisfaction during the trial from 29.4 per cent to 24 per cent but said more resources had been added during the trial and rates had gone up.

“Filing and payments kept up with the previous year and customers were able to do what they wanted to do during the trial,” he added.

An HMRC spokesperson said: “We make no apology for testing a new digital-first approach to serving our customers, so they can get their queries answered quickly and easily without having to wait on the phone or write to us.

“During the first trial 1.75m returns were filed, more than over the same period last year, and customer satisfaction for our self-assessment digital services were at 80 per cent.”