HMRC: We are ‘actively challenging’ multinationals on tax with additional £94bn raked in during last decade

HMRC told City A.M. this afternoon that it is “very actively challenging” multinationals when it comes to tax as the taxman secured £94bn in additional revenue from large businesses in the last decade.

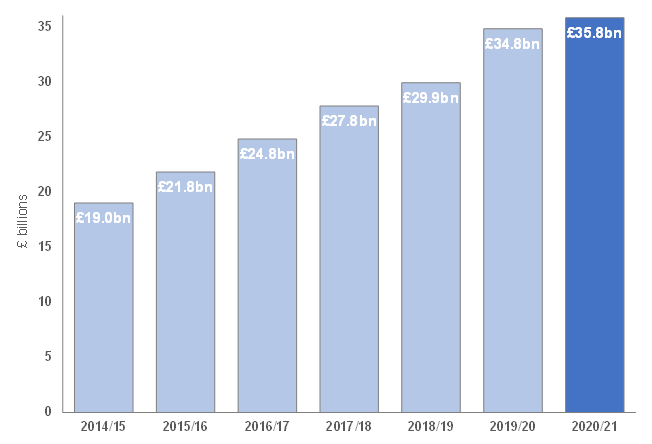

HMRC was responding to claims that big businesses’ underpaid tax has risen by another £1bn in a year to £35.8bn, up from £34.8bn a year ago, as calculated by City law firm Pinsent Masons.

The figure includes £8.1bn in tax believed to have been avoided through ‘transfer pricing’ – the way multinationals allocate their costs and income between different countries.

The firm said that HMRC suspects that this practice results in some large businesses artificially reducing their tax liabilities in the UK. A multinational business could pay less Corporation Tax in the UK by charging an inflated price for services to its division in the UK.

Another £1.2bn is believed by HMRC to have been underpaid by large businesses due to ‘base erosion’ – the practice of businesses shifting profits from UK sales to lower-tax countries by claiming not to have a taxable presence in the UK.

However, a spokesperson for HMRC said: “The figures show that HMRC is very actively challenging multinationals on tax due. Between 2010 and 2021, HMRC secured over £94bn in additional revenues from large businesses – tax that would have been lost without our proactive intervention.”

Base erosion has been in the political spotlight over recent years, with the OECD announcing in October that 136 countries have signed up to a deal to enforce a minimum corporate tax rate of 15 per cent from 2023.

The deal will also allow countries to tax multinationals that make sales within their jurisdictions even if they do not have a physical presence there.

Another major contributor to the rise is suspected underpaid employment taxes, which have risen 49 per cent to £1.3bn in the past year from £900m the year before, the law firm pointed out.

HMRC is concerned that businesses are underpaying National Insurance by classifying employees as self-employed contractors.

April 2021 saw a major change in how the status of ‘off-payroll’ workers was assessed, with many more workers expected to be classified as employees rather than self-employed, potentially increasing the amount of tax owed.

Steven Porter, partner at Pinsent Masons, said that the amount of tax HMRC believes has been underpaid by the UK’s biggest businesses has now risen for six years in a row.

Porter told City A.M. this morning: “Multinationals underpaying tax is one of the biggest areas of concern for HMRC. The biggest businesses can expect to see HMRC continue to toughen its stance on it.”

“The Large Business Directorate is particularly effective at bringing in the underpaid tax it identifies. It prefers to do this through negotiation initially but it is certainly not afraid to move to large-scale investigations and litigation if it has to,” he added.

“Issues like transfer pricing and base erosion remain firmly on the political agenda.”

Steven Porter, partner at Pinsent Masons

Porter pointed out that “from 2023 governments will have another tool to increase their tax take from multinational businesses when the new OECD rules come into force. That could see the suspected underpaid tax figure finally start to drop after rising for many years in a row.”