Hipgnosis share price rockets after £376m Round Hill Music takeover

Shares in Hipgnosis Songs Fund jumped as much as 16.5 per cent on Friday morning following the news that rival music royalty firm Round Hill Music (RHM) is set to be rescued by a multi million dollar buyout.

Los Angeles based Alchemy Copyrights has offered to buy US company RHM for $469m (£376m), causing its shares to blast up nearly 65 per cent after it has struggled to reverse its stubbornly low stock price.

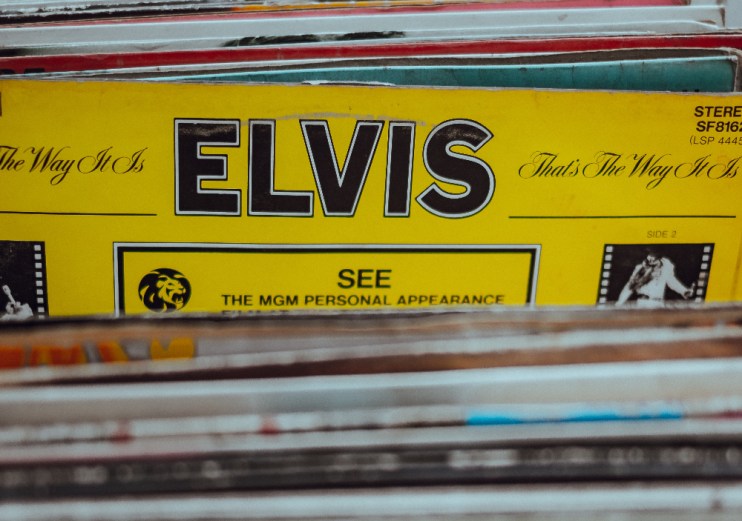

London-listed RHM, which holds over 150,000 songs across its catalogues, owns the royalties of iconic tracks by The Beatles, Elvis Presley and the Goo Goo Dolls.

The offer is “highly likely to be successful”, according to analysts at Jefferies, and directors of RHM unanimously recommend that shareholders vote in favour of it.

“Shareholders have the opportunity to get out at a price higher than the shares have ever traded since listing,” explained Russ Mould, investment director at AJ Bell.

“That is a relief to them, but hardly chimes with the expectations for the company at the time of its listing in 2020.”

Both RHM and Hipgnosis own catalogues of songs which allow investors to receive returns when the tracks generate cash.

Explaining the boost in Hipgnosis’ shares on Friday, Mould said investors have “suddenly perked up, wondering if it too will be rescued out of the doldrums with a bid.”

Music royalty investments went through a period of popularity but as interest rates trended skywards, the picture changed.

“A higher discount rate used to calculate the present value of expected future cash flows made these vehicles less appealing, hence why the listed ones struggled with weak share prices over the past 18 months or so,” Mould explained.

After RHM listed on London’s stock exchange in 2020 at the height of music investment fashion, its share price drifted flat before spiralling downwards as interest rates went the other direction.

Hipgnosis is also grappling with a tumbling share price, leading investors to urge the company to sell some of its holdings.

Merck Mercuriadis, Hipgnosis boss and founder, said he was “aligned” with shareholders in this regard and is working on options to increase value for them.