Hinkley Point C could have saved customers £4bn this year, says financing chief

Hinkley Point C (Hinkley) could have saved households over £4bn in energy bills this winter, argued one of the leading financing experts in the nuclear industry.

Julia Pyke, director of Sizewell C (Sizewell) financing and economic regulation, told Parliament that if the Somerset-based nuclear power plant was already in the UK’s energy mix – it could have made a hefty dent in record energy bills over the coming months.

She said: “If Hinkley was online today, it would be saving consumers more than £4bn per year. So, while people have commented extensively on whether Hinkley is expensive, it would bring down consumer prices very considerably today, especially as energy security has not beec priced in to localised costs of activity.”

Pyke was speaking to the House of Commons’ Science and Technology committee, where she defended the cost of Hinkley, and the likely use of public funds to boost Sizewell’s initial construction phase.

The financing director recognised the steep upfront costs involved in developing in building nuclear power plants.

However, she highlighted that nuclear power lowers bills with its low operating costs and long-term generation.

She said: “The case for Sizewell was made well before the Ukraine crisis, and the case for Sizewell is having the right amount of nuclear in your mix brings down household bills.

“We could never deny nuclear is expensive to build, the fact it then runs on very low operating costs mean it brings down household bills.”

Sizewell edges towards greenlight

Brits are coughing up record energy bills this winter, driven by soaring wholesale costs powered by Russia’s invasion of Ukraine, market volatility, and rebounding post-pandemic demand.

The Energy Price Guarantee limits the cost of household energy to 34 per kWh for electricity and 10.3p per kWh for gas, equating to an average household bill of £2,500 per year over the next six months- with the deficit between wholesale costs and limits placed on to Government borrowing.

This is still markedly higher than household bills only a year ago, and approximately double the price cap

Hinkley and Sizewell are the next nuclear power plants in the UK’s energy pipeline, both overseen by energy giant EDF – which has hefty stakes in the projects.

The two projects are near-identical in design and woudl generate 3.2GW of power each, enough to colelctively power 12m homes and meet 14 per cent of the UK’s energy needs.

This is nearly as much as nuclear’s current contributions to the energy mix – calculated at 16 per cent.

The Hinkley plant is currently under construction and is set for completion by 2027 at a cost of around £26bn.

This is eight years later than initially envisaged after several delays to the project, and a 44 per cent hike in costs from its initial budget of £18bn.

Meanwhile, the Sizewell development in Suffolk is in the late approval stages, with Boris Johnson backing the project with £700m in one of its last acts as Prime Minister this summer.

It has been selected as an eligible candidate for public funding, via the regulatory asset base model, during the initial construction stages.

This would then be supported by private backing in the later stages, comparable to the Thames Tideway Tunnel which is also under contstruction.

Pyke confirmed a final investment decision for Sizewell is expected in the next 18 months, and she hopes to see commitment to the project in the upcoming autumn statement.

It is expected to cost between £20-35bn, while EDF hopes the plant will begin generating electricity in the 2030s and last for at least six decades.

Commenting on the role of public funds in the project, Pyke said: “In return for a small payment up front, consumers are literally better off with Sizewell on the system than not.”

Nuclear essential to Government energy plans

Downing Street has targeted an expansion of nuclear power production from 7GW to 24GW and a minimum role of 25 per cent in the UK’s energy generation.

This is part of the UK’s energy security strategy announced after Russia’s invasion of Ukraine, with the Government pushing to boost domestic energy generation to ensure supply security and energy independence.

It has also announced Great British Nuclear, a state-backed vehicle which will help push projects through the development pipeline, with eight sites already selected for development as part of Whitehall’s push to get eight reactors approved by the end of the decade.

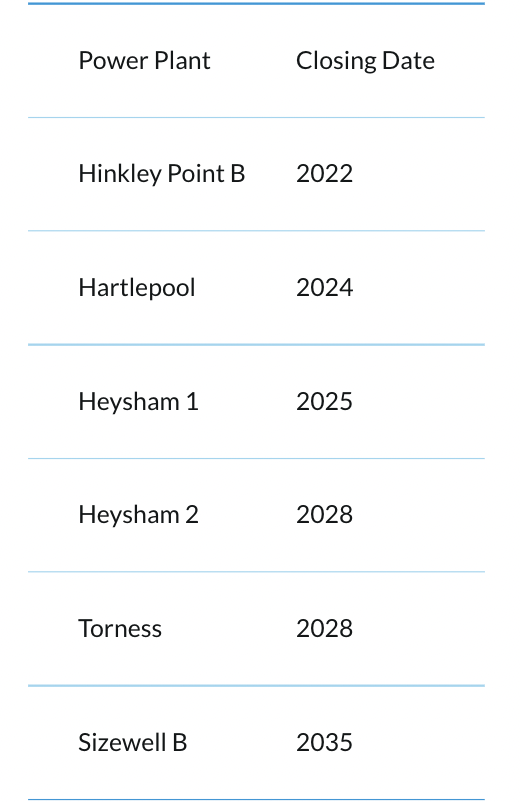

Currently, six nuclear power plants are set for closure, which threatens to severely reduce nuclear’s role in the UK’s energy mix.

City A.M. covered the proposed construction of Sizewell C earlier this year, when Pyke argued the long-term dividends such as supply security overpowered issues such as costs and disruption.

She said: “To me this is a bit like: Was the 1858 sewerage system late and over budget? Yes, it was. Do you wish London didn’t have a sewage system? No, you don’t. Was the London Underground in Victorian era built late and over budget? Yes, it was. Do you wish you didn’t have the Circle Line? No, you don’t. So, there’s a lack of proportionality in the way that people look at the cost of these mega projects.”