Here’s what early and seed-stage investor Seedcamp’s portfolio looks like: UK tech startups, fintech and blockchain

One of the UK and Europe's leading investors in startups at an early stage has lifted the lid on its portfolio of companies.

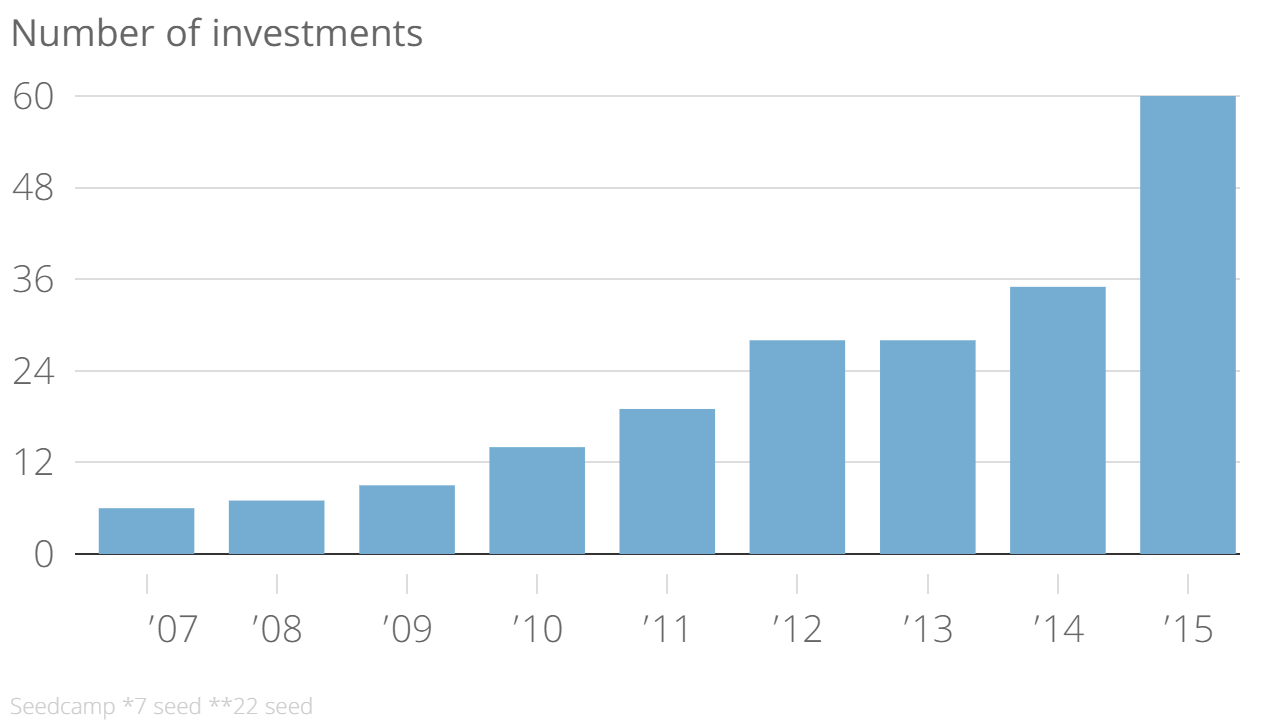

Eight-year old Seedcamp which initially started life as an accelerator but now concentrates on first-round funding, has backed more than 200 companies, which went on to pick up a further $365, in their next stage.

Investments include fintech unicorn Transferwise, online property agent eMoov and pet sharing website BorrowMyDoggy.

"Since we launched, the tech scene has changed dramatically," said Reshma Sohoni who co-founded the investment firm with Saul Klein and now runs it with Carlos Espinal.

Read more: Three very important lessons from a startup investor

"We have multiple tech hubs that are creating multi-billion dollar businesses. We have an influx of capital, particularly in London, with sizeable capital available that you didn’t see in 2007.

"We’ve had hugely successful exits. But, we have some way to go to be on the same scale as the Valley. However, Seedcamp has clearly shown that we can build big businesses based on what makes Europe great.”

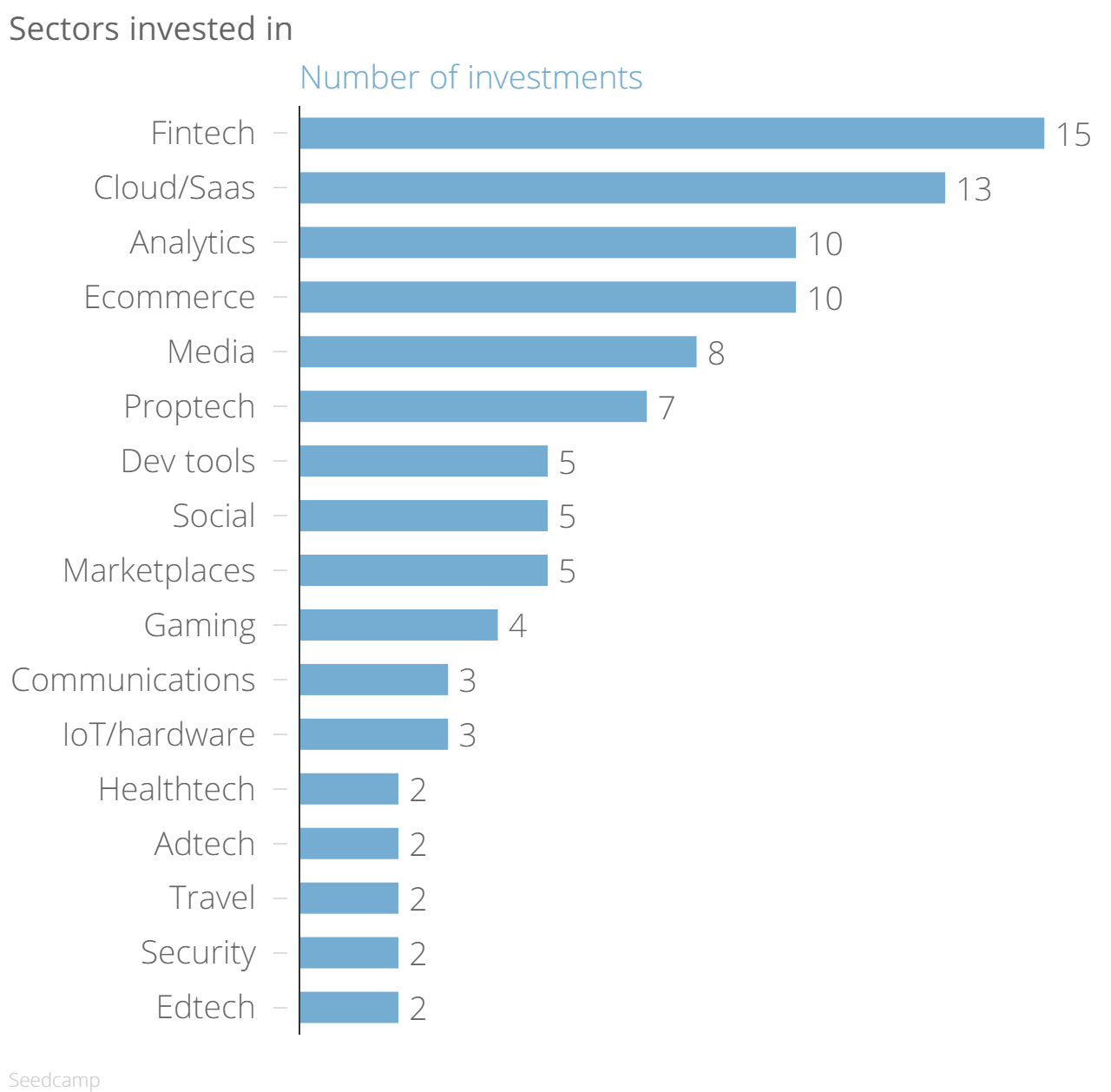

The numbers behind Seedcamp's investments reveal that fintech is now among its top sectors. It has 15 fintech ventures at the pre-seed and seed stage, and the sector was the most funded last year and in 2012.

Of the 206 companies it has invested in over that time, 81 are based in the UK. Over the same period,149 are still operational, 45 have shut down and it has exited 12.

“We’ve always been sector agnostic when considering companies for investment, but there are waves of innovation that emerge, and we do our best to get ahead of them and invest early," said Espinal.

"For example, 15 per cent of our portfolio is fintech, a growing and exciting space in Europe, and recently we’ve made more investments into proptech (property tech) which now makes up seven per cent of our companies.”

He said that potential future investments could include emerging industries such as blockchain, cyber security and artificial intelligence.

Seedcamp has now revealed its latest round of investments, they are:

- Alterest alternative investment management platform

- Authentiq Password-free authentication app

- Beeline Bike navigation devices

- Buildcon Construction management tool

- Cardlife Subscription management platform

- Finance Fox Insurance advice and comparison service

- Greenhouse app testing service

- Nanoget rental management platform

- Open Sensors Internet of Things data platform

- Repositive Genome database

- Rock Pamper Scissors Hair salon discovery platform

- Swiftshift Workforce management tool

- ThingThing Keyboard app for sharing photos, documents, calendars and more

- Unlease Short and medium-term sub letting platform

- Unmanned Systems Drone as service platform