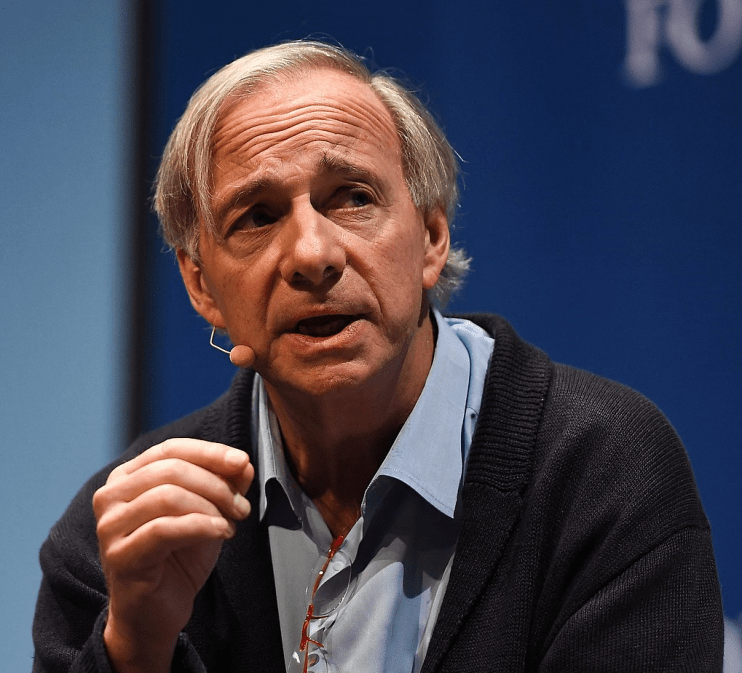

Hedge fund legend Ray ‘cash is trash’ Dalio ditches bonds for Bitcoin as losses hit $12bn

“I have some Bitcoin, and I have a very particular set of skills”. Ok, US billionaire Ray Dalio didn’t say the second bit, but it would have been good if he did.

“The guy hates cash; we know this, but now he hates bonds too,” commented Neil Wilson, chief market analyst at Markets, this morning.

“For the founder of Bridgewater Associates, even the most volatile asset out there is better than picking up dimes from in front of the inflation steamroller,” he added.

In a recorded interview shown yesterday at CoinDesk’s Consensus 2021 conference, Dalio said he would rather own Bitcoin than bonds.

“Dalio has a very particular set of skills: he’s good at making investment calls. Or at least, he has been good for a long time,” Wilson pointed out.

Losses of $12bn

Last year, his main macro fund, the Pure Alpha II fund, lost 12.6 per cent, however. Over the course of 2020, Dalio lost over $12bn whilst peers excelled, Wilson said.

“It was not a great performance in a year in which many investors were able to successfully call the bottom and ride the recovery in the stock market.”

“He also famously said that ‘cash is trash’, which is kind of a pro-crypto statement in that it tells you he thinks that owning a depreciating asset, such as cash, is pointless,” he noted.

Dalio previously presented his views on Bitcoin in January, saying that Bitcoin “has features that could make it an attractive storehold of wealth”.

The only problem with this argument is that anything that can depreciate by more than 30 per cent in 24hrs is demonstrably not a good store of value, Wilson continued.

“That’s a heck of a lot of years of inflation erosion compressed into a single day. Ok, it’s back up now a bit, but who’s telling where it will head next?”

Bitcoin bounced on Monday after a steep fall over the weekend. Price action ran into resistance at the $40k level and this morning trades a little below around the $39k area, but well above last week’s multi-month nadir of $30k.