Headline inflation slows again but Bank set for further rate rise

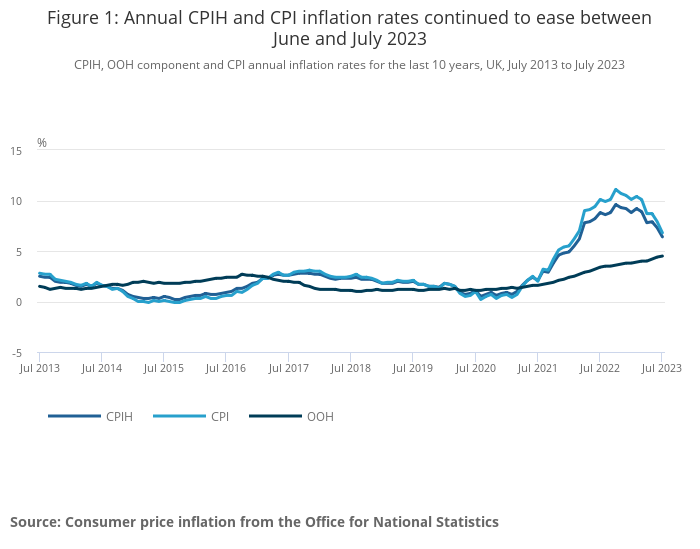

Inflation has slowed again to 6.8 per cent in July but the Bank of England is still likely to implement a 15th straight interest rate rise to bring it further down to its target of two per cent.

Latest figures from the Office for National Statistics this morning show the Consumer Price Inflation index dropped from 7.9 per cent in June to 6.8 per cent, a welcome relief for millions of cash-strapped Brits.

The rise however may still not be enough to prevent a fifteenth straight rate hike from Andrew Bailey and his Monetary Policy Committee when it meets in mid-September.

Despite dropping to 6.8 per cent, it is still well below the Bank’s two per cent inflation target, with the fall attributed to plummeting gas and electricity prices.

Meanwhile, the ONS said the summer tourism bump of hotels and passenger transport offset some of the gains made from falling energy prices.

Core inflation, which excludes energy, food, booze and tobacco, was unchanged from June but rose on an annual basis.

Despite this, food inflation rose again, by just 0.1 per cent, compared to a spike of 2.3 per cent in the two months a year ago. This is the slowest annual rate of growth in food inflation since September 2022, and is down from 17.4 per cent in March 2023, which was the highest ever.

The ONS said milk products led the negative contribution with the price of whole milk falling almost six per cent and low fat by 3.2 per cent.

The second-largest downward contribution came from the bread and cereals , where the annual rate eased to 14.4% from 16.7% in June.

ONS Deputy Director of Prices Matthew Corder said: “Inflation slowed markedly for the second consecutive month, driven by falls in the price of gas and electricity as the reduction in the energy price cap came into effect.

“Although remaining high, food price inflation has also eased again, particularly for milk, bread and cereal.

“Core inflation was unchanged in July, with the falling cost of goods offset by higher service prices.”

This comes after record wage growth was reported yesterday, with real-term levels the highest since records began in 2001.

It is expected that despite the fall in inflation today, the rise in real-pay is likely to convince the Bank of England to notch up inflation one more time, the 15th straight hike.

Commenting on today’s figures, David Henry, investment manager at Quilter Cheviot said: “With inflation falling to 6.8 per cent and yesterday’s data showing wages increased by nearly 8 per cent over the past year, the cost of living crisis may finally be beginning to wane.”

“Households are still under immense pressures however, and inflation isn’t going to fall dramatically, but it will be pleasing to millions to see their take home pay now seeming to keep up with inflation. However, the headline numbers only tell a fraction of the story. Food prices continue to hit consumers, while core inflation is refusing to budge substantially.

” With the surprise in earnings growth added in and the economy holding up in the face of adversity, the Bank of England will probably determine that more interest rate rises are required to get the job done.”

“However, the BoE is reaching a tricky point now. Interest rates have been rising for more than 18 months and this is when they traditionally begin to bite on the economy.

“As a result, given the speed in which rates have reached more than 5%, the toll on the economy in the next few months could be quite severe and may be enough to tip the country into a recession. With the Federal Reserve now increasingly looking like they may now pause interest rates rises, this could naturally feed into the BoE’s thinking given how they have seemingly followed in the Fed’s footsteps in the past. But with inflation remaining especially elevated, and this being the primary reason for rate rises to date, the BoE is left in somewhat of a no-win situation.”

Meanwhile, Dr Roger Barker, Director of Policy at the Institute of Directors, said: “It will be a relief to business leaders that the headline rate of inflation is continuing its downward trend.

“However, any celebrations will be blunted by concern that the core rate of inflation, which excludes energy and food prices, is entirely unchanged. This month’s headline drop was primarily a result of the scheduled readjustment of the energy price cap.

“It’s hard to avoid the conclusion that inflation has to some degree become embedded into the behaviour of businesses and consumers. This was reflected in yesterday’s figures for annual wage inflation. Getting back to the Bank of England’s 2% inflation target will be a challenging process.”