HBOS City advisers rights issue storm

Investment bankers at Morgan Stanley and Dresdner Kleinwort will have breathed a collective sign of relief yesterday when they managed to find buyers for 29 per cent of the HBOS rights issue rump.

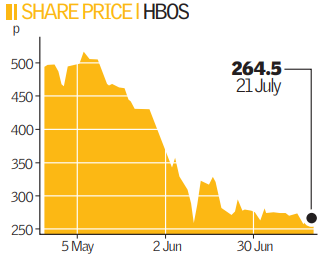

The whole experience has been an unnerving one for the bank and its advisers, left holding billions of pounds worth of HBOS shares. When the pricing of the rights issue was first decided on April 29 – in what now seems like almost a different era – HBOS shares stood at a healthy 500p. But various crises, mainly external to the bank, saw its share price slump and eventually dip below the rights issue price of 275p, putting off shareholders.

The aborted rescue of Bradford and Bingley by private equity group TPG dented confidence in UK banking, while Barclays also failed to shift more than 19 per cent of its recent rights issue, leaving Asian and Middle Eastern funds to shoulder the remainder.

The US mortgage lending crisis exacerbated by the recent troubles at Fannie Mae and Freddie Mac depressed the market further, adding to HBOS’ woes just as it sought to encourage investors.

But there is some good news: the underwriters lived up to their reputation and stuck with the issue, allowing HBOS to accrue the full £4bn of funds it was seeking.

HBOS spokesman Shane O’Riordain said: “We knew stock markets would be volatile which is why we went with a fully underwritten issue. Our bottom line was to raise £4bn capital and we’ve done that. Just as ships take on more ballast in stormy seas, banks need to take on more capital in difficult times.”

“There’s no elegant solution to how to raise capital in volatile markets. Like capitalism, rights issues are the least worst way of raising cash.”

While HBOS has come out of the affair relatively unscathed, there is much concern in the City that underwriters will now be very nervous about backing future capital raising efforts in the sector.

Analysts argue the length of the rights issue process, which is far slower than in the US, where pre-emption rights are not a factor, should be shortened.

Although a collapse in the sector has been averted, the current rights issue system has been exposed as highly vulnerable in volatile market conditions. It’s time for a change.

What are the prospects for HBOS after the rights issue?

Mark Durling (Brewin Dolphin): “HBOS management underestimated the extent of the fragility of shareholders and their fears about the market. The decision was taken in the perfect storm of rising interest rates, higher inflation and lacklustre management. However, in the long term they’re likely to emerge in a stronger position as some of their competitors fall by the wayside.”

Nic Clarke (Charles Stanley): “In the short term, a lot will depend on the movement of the market. It’s being relatively kind to HBOS at the moment but if it falls, things could get quite a lot harder. Long term, HBOS believes that banks with a superior capital will outperform less well capitalised banks in the next three or four years. It’s a sound bank with diverse income sources.”

Richard Hunter (Hargreaves Lansdown): “From an investor’s perspective, the Halifax is the UK’s biggest buy-to-let lender, so by investing in HBOS you are taking a view on UK property. Most expect the property market to fall further. General consensus currently is that HBOS is a ‘hold’. A bank like Standard Chartered is preferable as it has little housing exposure and a lot more exposure to Asia.”

Darren SInden (Lite Financial): “Not all is lost. This could well be an opportunity for a sovereign wealth fund to secure a significant stake in HBOS at a relatively rock bottom price. The shares traded very strongly, suggesting somebody is holding the stock up. It is difficult to know where the shares will go from here, but the underwriters could start to unwind positions today.”