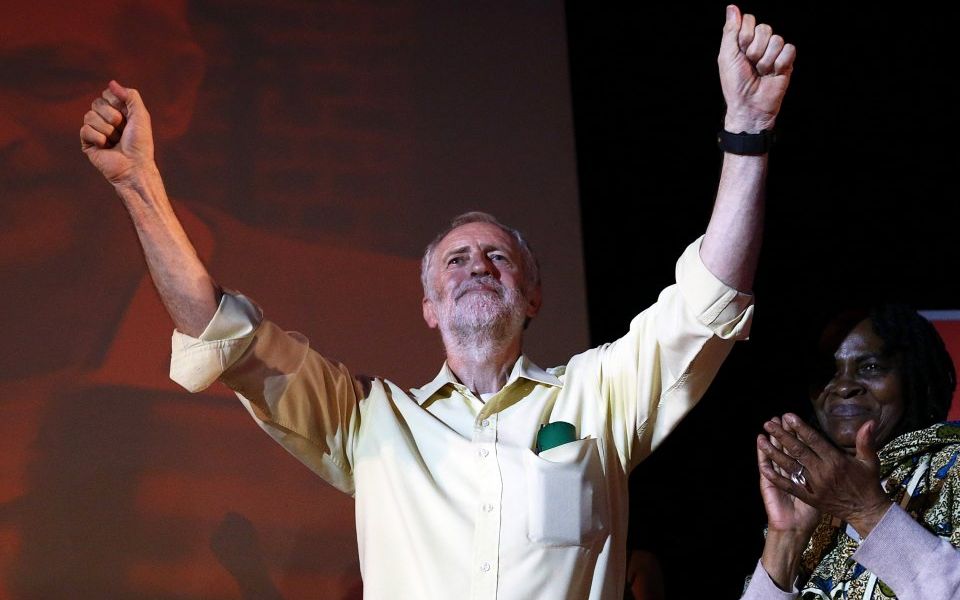

What will happen to sterling if Jeremy Corbyn’s Labour wins the General Election? We asked the experts

Labour has surged in the polls in the last fortnight, closing the Conservative party lead to as little as five points. The pound moved in the opposite direction against the dollar as traders started to consider the previously unthinkable: a Labour General Election victory.

Before everyone gets too excited, it should be remembered that Labour polling surged before the last General Election in 2015. Meanwhile, Labour leader Jeremy Corbyn’s personal approval ratings are still wince-inducingly behind Prime Minister Theresa May’s.

Yet stranger electoral things have happened in the last year than a Labour General Election victory.

What would actually happen to sterling if Corbyn emerges as the next leader of our country? And could it even lead to a stronger currency?

The Corbyn knee-jerk

Analysts are not exactly falling over themselves to talk about a Labour win; to say a Labour majority is not a base case for most is something of an understatement.

Nevertheless, when pushed there is little doubt about the immediate effect of a Labour victory on currency markets: a knee-jerk movement downwards.

Alexandra Russell-Oliver, an analyst at Caxton FX, says:

A Labour victory would be quite a shock. Regardless of whether polls narrow between now and the election we would see further weakness.

At the last General Election the Tory victory, first revealed in exit polls, saw an immediate upwards move of about one per cent as traders discounted the possibility of another coalition government (more of which later).

The reverse would likely be true of a Corbyn victory, with a hefty uncertainty multiplier as a cabinet largely lacking in governmental experience took shape. Then there’s the approach to one of the key questions of our time.

Brexit (red or blue)

Brexit is the biggest issue facing our nation for decades, but it has not dominated the electoral conversation as might have been expected.

If Labour wins, Corbyn’s approach to Brexit will be a key determinant of the pound’s prospects. For now that is a major source of uncertainty, according to Martin Arnold, global forex strategist for ETF Securities.

We don’t really know about the position that Labour are coming from in terms of their relationship with the EU.

“That would be another source of uncertainty and another source of weakness” for sterling, he added.

The Labour parliamentary party is mostly against a “hard Brexit”, but many analysts think Corbyn himself supported the decision to leave the EU – while a fair chunk of Labour voters voted for Brexit.

The Labour manifesto tries to negotiate that tricky situation by saying it will try to leave the EU but “retain the benefits” of the Single Market and Customs Union. But how that is actually worked out in practice would be hugely uncertain.

Jordan Hiscott, chief trader at Ayondo Markets, said: “With a Labour victory, the dual effect of a hugely unexpected result and Labour’s general view on negotiating with the EU over Brexit, which is softer than of the Conservatives, would in my opinion see sterling quickly fall back to $1.2 – and even as far as the October 2016 low of $1.1755.”

Could a spending boost push the pound higher?

There is little doubt the election presents voters a genuine choice between two different views of how government should act. Labour’s manifesto offers a big expansion in fiscal spending for investment as well as the prospect of multiple big re-nationalisations.

Edward Hardy, an economist at World First, said: “With foreign investment, access to talent and tax burdens already such an unknown quantity in post-referendum Britain, the last thing UK Plc needs now is concern that a wave of nationalisation could sweep away incentives for private enterprise.”

From a macroeconomic point of view the consequences of Labour’s agenda are controversial. Some analysts even ask if a big boost in government spending could spur sterling higher.

We should not discount that possibility, says Jordan Rochester, forex strategist at Nomura. In a note to clients he says:

If it is a Labour victory it’s perhaps not as bad for the pound as you’d expect given the fiscal spending would likely eventually lead to higher real yields once the initial uncertainty passes.

To fund higher investment the government would have to issue more debt, and offer higher bond yields (which move inversely to prices, which would fall) to tempt in investors.

That could theoretically lead to investors moving money back into sterling assets as they chase the higher returns – boosting the pound. Meanwhile increased government spending would also provide a boost to growth and potentially even productivity, at least in the short term.

Consensus on this point is, shall we say, somewhat lacking.

Higher interest rates on debt are generally correlated to stronger currency in developed markets. However, if investors lose faith in the government’s ability to pay its debts that relationship will break down, says Alvin Tan, forex strategist at Societe Generale.

“When that relationship breaks, it breaks in a very extreme manner,” he says, arguing a widening current account deficit (as the UK asks the rest of the world to fund its spending) would be negative for the pound.

“From a fundamental point of view that will be negative for the UK’s external account,” Tan says, and therefore negative for sterling.

Hung Parliament

These arguments go to the heart of some of the biggest questions on how we fund our government. They will probably also be moot, as a Labour majority is still seen as a distant prospect.

Of more immediate concern is the possibility that a Labour poll surge brings a hung Parliament – which would be the worst of both worlds for markets as the UK re-enters the murky world of coalitions and deals in smoke-filled rooms.

With the UK now within the final fortnight of the General Election campaign, the universal consensus is that further poll narrowing will lead to a weaker pound. It could be a bumpy ride.