Halma raises payout as profit grows 14 per cent

Halma, the global life-saving technology company, increased its interim dividend today on the back of record first half results.

Read more: Lidl brings hourly pay rate in line with living wage

The figures

The FTSE 100 company saw revenue grow 12 per cent to £653.7m, up from £585.5m in the same period in 2018.

A combination of organic and acquired growth saw profit before tax rise 14 per cent, from £112.9m last year to £128.8m in 2019.

Earnings per share also rose 14 per cent to 22.4p. The blue chip declared a interim dividend of 6.54p, up from 6.11p in 2018.

Halma’s net debt was £310.4m.

Shares in the company rose over 10 per cent on the back of the results.

Why it’s interesting

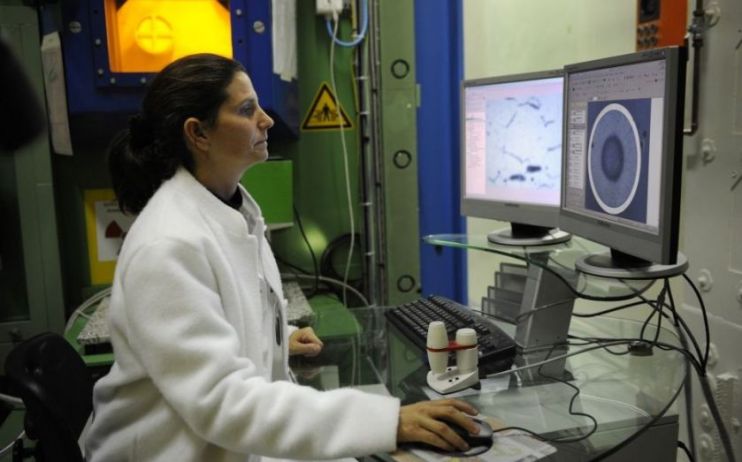

Halma, which makes products for hazard protection across the medical, infrastructure and environmental sectors, said that revenue grew in all four of its major regions.

The US remains the company’s largest sales destination, contributing almost 40 per cent of total revenue.

Read more: Moss Bros appoints ex-Ted Baker finance chief as CFO

The company also announced that it had completed five acquisitions in this financial year across three sectors and four geographies, part of its strategy to expand into core and adjacent markets and expand the firm’s geographical reach.

What Halma said

Andrew Williams, group chief executive of Halma, commented:

“Halma made good progress in the first half, delivering record revenue, profit and dividends, while increasing strategic investment to remain well positioned in global niche markets which have resilient, long-term growth drivers.

“Our strong purpose and culture, our portfolio and geographic diversity together with our agile business model are enabling us to deliver a good performance in varied market conditions and to sustain growth and returns over the longer term.

“Since the period end, order intake has continued to be ahead of revenue and order intake last year. Halma remains on track to make further progress in the second half of the year and deliver another good full year performance.”

Main image credit: Getty