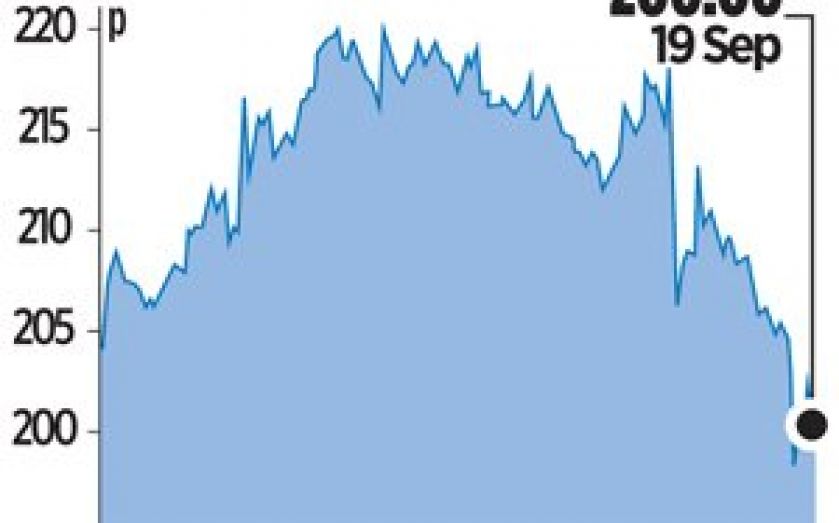

Gulf Keystone shares dive as court win fades

OIL AND gas explorer Gulf Keystone Petroleum yesterday said it is confident that it can more than double production at a Kurdistan oil field by the end of the year, yet its stock dropped by over eight per cent having soared last week.

An arduous court battle over the Kurdistan assets ended in its favour last week, causing shares to jump nearly

17 per cent, but yesterday’s half-year update left investors unimpressed.

The firm said that production in the Shaikan field had hit 12,4000 barrels of oil per day (bopd) by early September and is targeted to reach 40,000 bopd by the end of the year.

While brokers including Westhouse Securities were sceptical that GKP could reach this target, chief executive Todd Kozel told City A.M. he felt “very confident” that the target would be hit. “We’re aiming to reach 40,000 bopd by October, so we’ve got a couple of months of wriggle room,” he added.

An English court last week dismissed all claims by Excalibur Ventures, which argued that it was owed a 30 per cent interest in GKP’s assets in the Shaikan field. The case’s conclusion was seen by some as the removal of a final obstacle towards a potential sale of GKP.

Kozel said GKP is not actively looking to be acquired. “We’re keeping our heads down and focusing on ramping up production and moving from Aim to a main market listing by the end of the year,” he said.

“However, we’re answering our phones, opening our doors and opening our mail,” he added, referring to the company’s receptivity to potential offers. Shares closed down 8.15 per cent at 200p.