GSK cuts profit outlook as lung drug sales slow

GLAXOSMITHKLINE (GSK) cut its full-year outlook yesterday after posting a 13 per cent decline in second-quarter sales, as it struggled to maintain its position in the significant lung drug market.

The FTSE 100-listed pharmaceuticals giant posted a 25 per cent slump in core operating profit to £1.4bn in the second quarter, while turnover fell 13 per cent to £5.56bn. The company now expects full-year earnings per share to remain flat, down from previous guidance of a four to eight per cent increase from last year.

To add to the company’s woes, it is currently embroiled in a corruption scandal in China, where it has been accused of offering bribes to doctors to use its medicines.

But it is the 12 per cent fall in second-quarter sales of inhaled lung drug Advair, which makes up nearly a fifth of GSK’s revenues, spooking investors. Advair particularly struggled in the US, where sales plunged 19 per cent.

GSK hopes two new respiratory medicines – Breo and Anoro – will restore its foothold in the market, but the uptake so far has been slow.

“Our strategy to transition and diversify our respiratory portfolio is underway,” said chief executive Andrew Witty. “We expect the transition of this portfolio to continue over the next two to three years.”

US performance was also hampered by generic competition to heart drug Lovaza, which GSK said was “more substantive and began earlier than expected”.

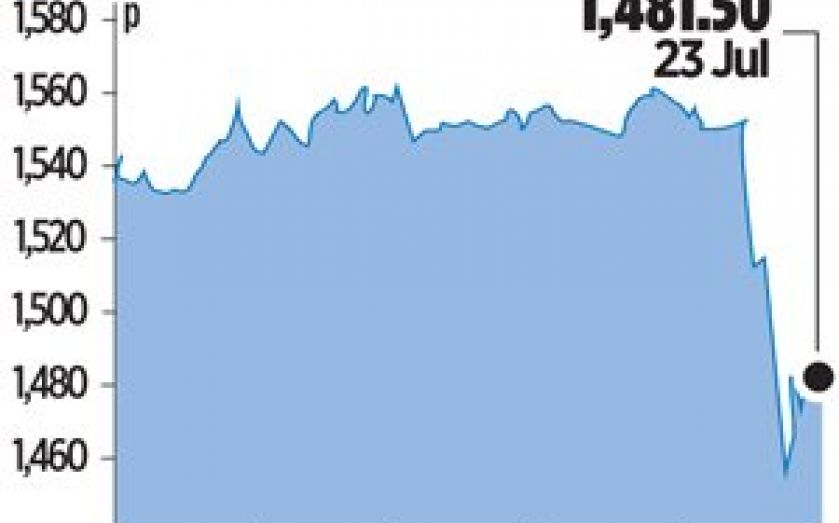

Shares closed 4.7 per cent lower, at 1,481.50p.