Green Day’s Good News: Here are the winners in the energy sector

Green Day is over.

In both a failure of ambition and communication – Grant Shapps cobbled together a piecemeal array of previously pledged policies and minor updates, while failing to halt a runaway train of industry briefings to an expectant media.

This had built up hopes of a robust response to vast US subsidies that never materialised – drawing the energy sector’s ire.

Among the more colourful criticisms, Renewable UK warned the country “risks falling behind and surrendering our global lead,” while Good Energy feared “Shapps has had his head turned by the mythical beasts promising business as usual.”

In the aftermath, Chancellor Jeremy Hunt has cautioned that the UK will not go “toe-to-toe with friends and allies in some distortive global subsidy race,” following the US Inflation Reduction Act, which includes $368bn of financial support for new energy projects set up Stateside.

If we are being generous, the government achieved one of the six targets put forward in my column last week: a new competition for small modular reactors, overseen by the freshly-launched Great British Nuclear.

However, now the dust has settled on Shapps’ plans, which were officially named “Powering up Britain,” City A.M. can highlight some of the winners that could still lead to a greener future.

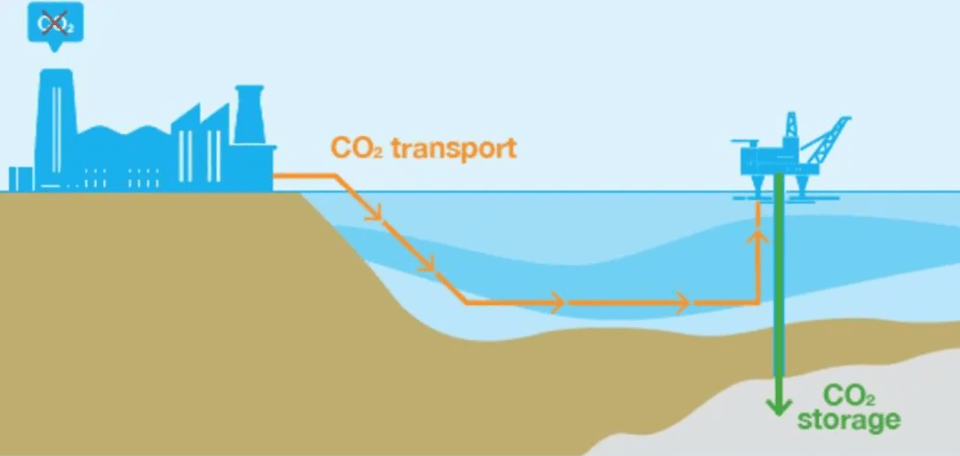

Carbon capture, usage and storage

The government announced £20bn of support for carbon capture, usage and storage earlier this month, but Shapps has now confirmed where the money is going – meaning the wheels are finally in motion for the UK’s first energy projects which will capture their carbon emissions.

Eight proposed developments were shortlisted for “Track-1” funding, the first round of allocated taxpayer support, which will help finance the projects for the next two decades.

Downing Street has shortlisted projects from two carbon capture and storage “clusters” – the East Coast Cluster and HyNet Cluster.

The East Coast Cluster looks to capture emissions from the northeast and store them in a saline aquifer in the North Sea, while HyNet aims to capture emissions from the northwest and store them in disused gasfields under the Irish Sea.

The government hopes these two regions will be capturing 20m-30m tonnes of CO2 a year, equivalent to the annual emissions from 10m-15m cars.

BP are the big winners with three projects selected for funding including the UK’s first carbon capture and storage power plant, which could produce enough electricity to power 1.3m homes per year, alongside plans to develop low-carbon hydrogen from natural gas with carbon capture and storage, known as “blue” hydrogen, and green hydrogen using electrolysis.

Meanwhile, exciting projects were shortlisted by the government as leading contenders for “Track-2” funding in the future: the Storegga-operated Acorn CCS project in Aberdeenshire, and the Viking CCS project in the Southern Humber region.

There was bad news for other Humber projects, with SSE developments missing out on shortlisting despite the region being part of the East Coast Cluster.

The biggest loser, however was Drax, whose £2bn-plus biomass carbon capture project missed the cut for “Track 1” selection, despite suspending financing for the facility unless it was greenlit for subsidies and approval, raising doubts over the future of the project.

Floating Offshore Wind

Taller than the Shard, and with twice as much concrete as the Eiffel Tower – floating offshore wind turbines are as extraordinary in size as they are in invention.

Propped up with buoyed platforms and supported with undersea cables, they can be located in deep, challenging waters not suitable for fixed turbines – with developments earmarked for the North Sea and Celtic Sea.

The government is targeting 5GW of generation by the end of the decade, and has now launched its £160m Floating Offshore Wind Scheme to upgrade ports so that manufacturing and towing can meet demand.

Renewable UK has been pushing for £4bn in funding – calculating a £26bn boost to the green economy in exchange – but the UK is still well positioned to become a global leader in floating wind technology, with the biggest project pipeline in the world of 37GW (one-fifth of global projects).

The value of floating offshore wind is not just in generation targets – it is in utilising a nascent industry to revitalise declining regions of the country, helping to meaningfully realign the economy alongside reaching the UK’s energy goals.

Heat pumps

Energy security starts in the home, and while heat pumps are not a silver bullet for all customers, they could have a highly constructive role in slashing our reliance on fossil fuels and overseas suppliers to meet our energy needs.

To this end, Shapps has unveiled £30m for the Heat Pump Investment Accelerator.

This is designed to leverage £270m private investment to boost the manufacturing and supply of heat pumps in the UK.

Currently, 85 per cent of the UK’s housing stock is heated by gas, but Downing Street is targeting 600,000 installations of heat pumps every year by 2028.

Last year, just 42,779 heat pumps were installed, but the government hopes industry players such as Octopus Energy offering installations at £2,500 per year could lure more people to the technology.

The discounted rate includes the £5,000 grant from the Boiler Upgrade Scheme, which will be extended to 2028.

It has also allocated some of £12.6bn in energy efficiency funding this decade to installing heat pumps across vulnerable households and public buildings.