Green Bonds vs. Traditional Bonds

Are environmental, social, and governance (ESG) investing returns higher, lower, or the same as those of comparable traditional investments?

This question is the source of constant debate. Because ESG investing integrates non-traditional sources of risk that are not always priced by the market, some theorize that ESG approaches might generate higher returns than traditional assets.

Contrasting green and non-green bonds

How do we test this hypothesis? The simplest way is to look at bonds. Many issuers issue traditional as well as certified green bonds that explicitly contribute to ESG-related goals. Municipalities, states, governments, and development banks, among other international organisations, issue bonds that are linked to specific projects.

If the same issuer sells traditional and green bonds, both varieties have identical credit risk from the issuer’s perspective. But the traditional bonds may have higher yield and higher risk than the green bonds. What’s the source of this higher risk in traditional bonds? Maybe investors view ESG risks differently.

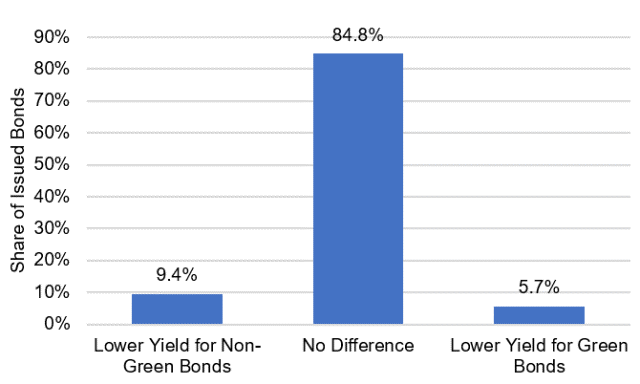

Green bonds from the same issuer do indeed trade at lower yields, or higher prices, compared to their non-green counterparts, according to a Bank for International Settlements (BIS) study. But while green bond yields at issuance were between 10 basis points (bps) (AAA-rated issuers) to 45 bps (A- and BBB-rated issuers) lower than those of non-green bonds from the same issuer, the variance of this premium was very high. With a 27 bps standard deviation between issuers, the observed green bond premium in this study was not statistically significant.

On the other hand, studies of US corporate and municipal bonds show green bonds trade at a yield premium relative to non-green bonds. Two researchers from the Sorbonne found an 8 bps average yield premium for green versus non-green bonds from the same issuer. In their study, this difference was significant.

Analysis from University Paris-Dauphine examined bonds issued by French companies that, because of regulatory changes, had to provide more transparency into their ESG risks. The authors found no yield premium for green bonds or bonds of companies with lower ESG risks in the market.

Examining US municipal bonds

This result echoes that from a new study of US municipal bonds by David Larcker and Edward Watts from Stanford University. The advantage of this study is that it examined munis that were issued by the same issuer at virtually the same time. Some tranches of munis were certified green, others weren’t.

Larcker and Watts found virtually no difference between the yields of green and non-green bonds once the controlled bond pairs in the comparison sample are properly adjusted for such fixed features as callability terms and other specific tax differences.

These results sparked some discussion between the two of us as we worked on a related ESG investing project. The question we kept coming back to: why do green bonds have no observable risk premium or discount?

We found that these studies measure performance based on radically different assumptions about investor preferences in the green bond market. We believe that a better understanding of how investors assess performance might provide important clues to determine how to measure this ever-illusive green premium.

This is where it gets complicated

These results sparked some discussion between the two of us as we worked on a related ESG investing project. The question we kept coming back to: why do green bonds have no observable risk premium or discount?

We found that these studies measure performance based on radically different assumptions about investor preferences in the green bond market. We believe that a better understanding of how investors assess performance might provide important clues to determine how to measure this ever-illusive green premium.

And this is where we get to the answered questions that you may know some of the answers.

What struck us was that there may be structural differences between investors that buy green bonds and those that buy traditional bonds. This raised a host of questions we’d like your input on.

Are there any studies that explore why investors buy green bonds to begin with?

Do you work at an organization that invests in green bonds and are willing to share why and how you invest in them?

What goals do investors pursue with green bonds? Are they motivated by risk management or something else? Does it just make them feel good?

And do you hold green bonds to maturity or actively trade in them to maximize total return measured over shorter intervals?

And what about the systemic differences between issuers of green and traditional bonds? Why issue green bonds at all? Do managers at these companies have different incentives?

As active participants in the green bond market, we want to hear your views on how it has evolved over time. Have you seen improvements in depth and liquidity?

Hopefully, in time, we together can build a more accurate picture of green bond market structure, one that goes beyond routine statistics.

For more on environmental, social, and governance (ESG) investing, check out Handbook on Sustainable Investments from the CFA Institute Research Foundation.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

Bill Fung, PhD and Joachim Klement, CFA, are trustees of the CFA Institute Research Foundation and offer regular commentary to the Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images/RoschetzkyIstockPhoto