Grant Shapps cracks down on suppliers forcing households to use prepayment meters

Business secretary Grant Shapps has told energy suppliers they must stop forcing financially vulnerable households to switch to prepayment meters.

In a letter to firms across the industry, Shapps warned he would “name and shame” suppliers who were doing “nowhere near enough” to help vulnerable customers.

However, the government will stop short of an outright ban due to concerns over a subsequent increase in bailiff action if firms are unable to opt for prepayment meters.

Shapps has presented the industry with a five point plan, as “part of a drive to increase transparency around prepayment meter installations”.

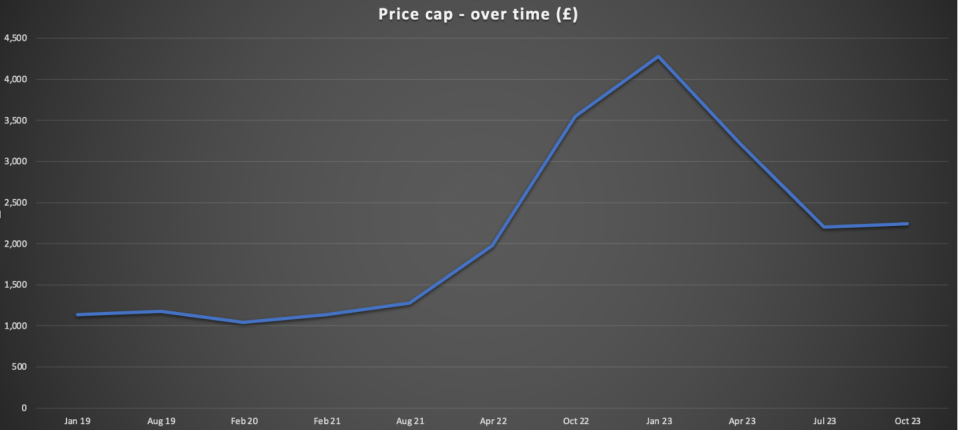

He wants to ensure customers are protected from bad behaviour from suppliers amid record energy bills which are squeezing households.

Alongside calling for suppliers to stop the practice of forced prepayment meter installations, Shapps is requesting the release of supplier data on the number of warrant applications they have made to forcibly enter homes to install meters.

He has further demanded a list of supplier redemption rates for the Energy Bills Support Scheme vouchers – showing who is meeting their responsibilities and who needs to do more. Shapps is also looking to launch a public information campaign reminding eligible consumers to redeem their vouchers.

He also wants more coordination with Ofgem to ensure the regulator takes a more robust approach to the protection of vulnerable customers and conducts a review to make sure suppliers are complying with rules.

The government has revealed courts are being overwhelmed with mounting applications from energy firms for warrants to install prepayment meters – amid reports huge batches are being approved in a matter of minutes, with the number of customers being switched to prepayment meters soaring.

The business secretary is planning to work with Ofgem and the justice secretary to ensure the process by which suppliers bring these cases to court is “fair, transparent and supports vulnerable customers”.

Energy minister Graham Stuart has asked to meet with energy firms next week, along with Energy UK, which represents the energy industry, regulator Ofgem and Citizens Advice.

Suppliers react to prepayment clampdown

Prepayment meters, which allow customers to pay for gas and electricity on a pay-as-you-go basis, are supposed to help households avoid debt and court action.

Citizens Advice has recently called for a ban on forced remote switching, urging for “further protection” for customers.

Under Ofgem rules, forced switching to prepayment must only ever be a last resort – however, with households facing record bills, more and more have struggled to pay their bills.

In recognition of this, some energy suppliers are already taking steps to support consumers such as by pausing remote switching of smart meters to prepayment mode or providing additional credit to customers struggling to pay.

Octopus Energy told City A.M. its use of prepayment meters as a tool to control debt is “vanishingly rare”.

An Octopus spokesperson argued that the energy firm believes “there are more effective and better ways to help customers who aren’t able to pay for their energy on a regular basis”, with the supplier opting for prepayment meters less than 200 times out of 3.5m customers.

This is in contrast to around 500,000 warrants issued across the industry to customers over the past 18 months, as first revealed by the i.

The spokesperson added: “It’s also important to note that before we get anywhere close to switching customers to prepayment, we try to contact them numerous times over a period of at least six months, emailing, calling, texting, writing letters and visiting in person. If we discover the customer is vulnerable at any point, the entire process is cancelled and we look to offer other support instead.”

Meanwhile, EDF confirmed to City A.M. it “has and continues to suspend debt collection from customers who are experiencing financial difficulties”.

An EDF spokesperson said: “Our focus remains on providing sustainable support to customers who are experiencing financial difficulty, whilst calling for government to consider how further targeted support could be provided to those who need it.”

The other Big Six energy firms have also been approached for comment.

Industry body Energy UK confirmed it will work with the government to ensure any future measures protect customers.

Energy UK chief executive Emma Pinchbeck said: “We have been discussing energy suppliers’ growing concerns about customer debt with ministers, the regulator and consumer groups. We will continue to work with them to see what more can be done do to support vulnerable customers.

“Any measures and their consequences must be properly and honestly assessed to make sure that they will genuinely protect the interests of customers, especially in the context of the cost of living crisis.”