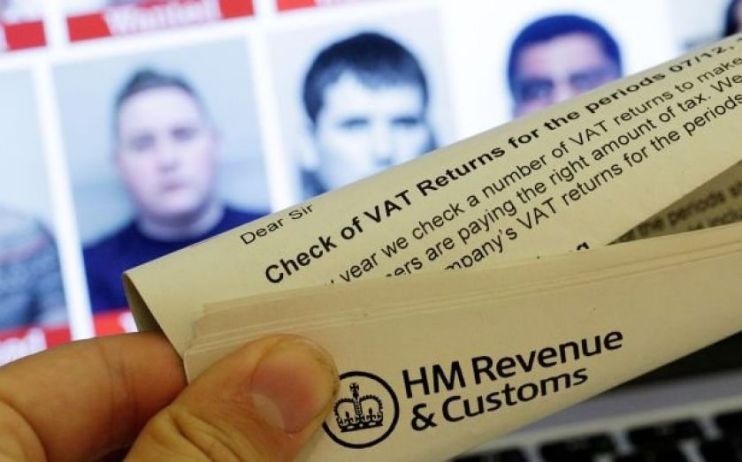

Governments expected to come down hard on tax enforcement in coming years

Business leaders have predicted greater tax enforcement in the next three years, as governments look to balance their books following pandemic pressures.

More than half (53%) of business leaders in tax expected greater tax enforcement in the near future, according to research carried out by EY.

They anticipated a far more diverse tax risk environment spanning everything from scrutiny of routine business activity, to billion-dollar settlements in court.

Europe was seen as the region representing the highest tax risk to businesses in the coming three years, with the Americas and Asia-Pacific close behind.

The leaders highlighted issues around workers stranded overseas, treatment of financial losses linked to the pandemic, the claiming of tax refunds and even the receipt of stimulus measures as top pandemic-related tax risks.

Research respondents were also concerned about tax risk related to transfer pricing – skewed by the pandemic – and an acceleration in the digital transformation of tax authorities.

Kate Barton, EY’s global vice chair of tax, said Covid-19 had “greatly amplified the tax risk profile” of organisations.

“As governments look to balance budget deficits, tax authorities are resuming suspended tax audits and litigation. Meanwhile, the digital transformation of the global economy – and the increasing volume of data and compliance requirements from tax administrations – means that organizations will inevitably face more risk for tough audits,” she said.

“Without a change in approach today, organisations face a real risk of financial penalties and reputational damage tomorrow.”

Managing tax risks and resulting disputes has rapidly risen on the corporate agenda, according to EY.

Two-thirds (66%) of businesses told the Big Four firm tax risk had becoming more important to their tax department, and the same amount said executives were taking a greater interest in tax issues.

Luis Coronado, EY’s global tax controversy leader and global transfer pricing leader, added: “The risks of non-compliance are high. Financially, there may be a greater risk of higher tax assessments, double taxation, penalties, interest and surcharges.

“As tax transparency and commitment to long-term value creation intensify in the public domain, tax controversy can create reputational harm, whereas operationally, tax controversy management can see internal resources redirected from other core tax department activities.”