Government risks higher wind power prices as industry slams lack of funds for auction round

The latest ongoing auction window for offshore wind projects could result in higher generation prices and a shortage in bidders, the UK’s leading wind industry body has warned.

Renewable UK told City A.M. the government had failed to commit sufficient subsidies to reflect the pressures of inflation on critical minerals, supply chains and financing on wind developments, which are likely to cause the strike price to rise.

A spokesperson said: “Like all parts of the economy, the energy industry is being hit by the impacts of inflation with the cost of key inputs and commodities, like steel and copper, rising to record levels in the last 18 months. It’s hard to say where these price will go in the future, but the short term impact is that new wind farms are facing higher costs.”.

The latest application round for new projects is underway, with energy firms bidding for sites to develop offshore wind farms.

The round will run until 24 April, with results of the auction expected later this summer.

Renewable UK has previously criticised the level of funding for the ongoing allocation round, set at £205m by the government.

Its analysis suggests that the current budget is likely to secure less than half of the 5GW of offshore wind capacity eligible for this year’s auction.

The contracts for difference (CfD) scheme is Downing Street’s chief mechanism for supporting new low-carbon electricity generation projects.

It is designed to deliver low carbon deployment at low-cost to consumers so that when wholesale electricity prices are higher than the price agreed in the CfD, generators pay back the difference.

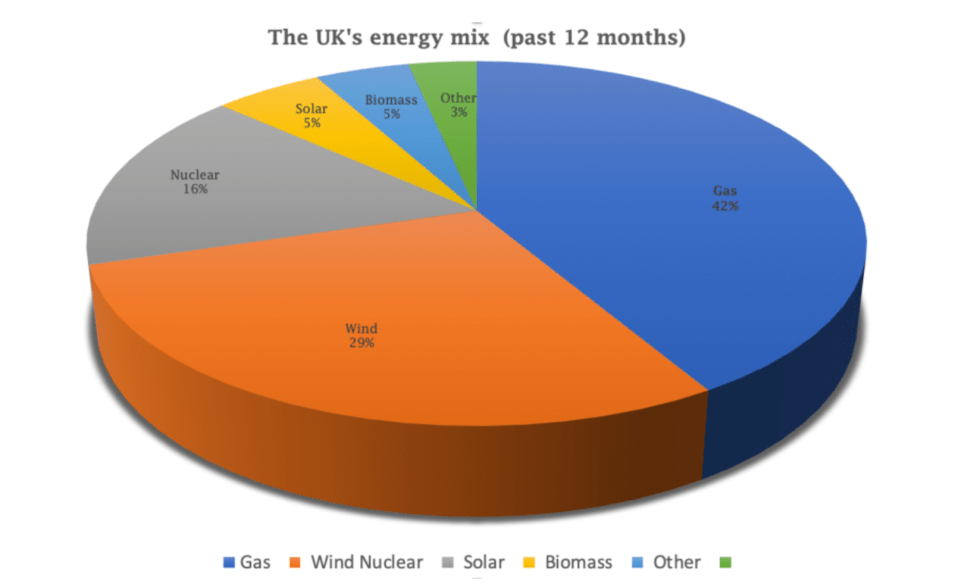

The competitive nature of CfDs has significantly driven prices down, placing solar and wind among the cheapest forms of electricity generation.

In the last allocation, offshore projects landed CfDs at a strike price of £37.35 per megawatt-hour, but there have been growing concerns in the industry that inflationary pressures and challenging economic conditions would put prices under pressure.

When approached for comment, the government told City A.M. they were confident of attracting applicants for the allocation round.

A spokesperson said: “We are taking significant action to encourage investment in renewable generation, including our renewable energy auctions, which just last year contracted record capacity of almost 11GW of clean energy.

“At the spring budget, we confirmed significant financial backing for this years’ auctions, which will be the first of our CfD round to run annually.

“This is a valuable signal to the market, introduced in response to calls from industry to run more frequent auctions and is set to bolster further investment into the sector every year. We will also review whether to increase the budget after the application window has closed.”

Experts raise concerns over rising costs

The industry body’s latest warning follows last week’s report into the industry from offshore wind champion Tim Pick, who was appointed by the government to assess the sector.

Pick argued that sustained low prices in the renewables sector would be difficult to maintain in the current economic environment.

He said: “We should recognise that as a result of supply chain constraints as well as increasing costs of capital, CfD strike prices for fixed bottom offshore wind are unlikely to continue their downward trajectory”.

Adam Bell, head of policy at Stonehaven, told City A.M. he expected prices for generation to rise, chiefly because demand would rise beyond the capabilities of UK supply chains, with the government targeting a ramp up from 14GW to 50GW by the end of the decade.

“I think some of the higher inflation-driven costs will only impact in the short run, but very high demand towards the end of the decade will continue to impact prices. What will be interesting is the extent to which the supply chain scales up to meet that demand and, important politically, where that scaling up happens,” he said.

In his view, the UK had a chance to boost its own domestic industry and “get a larger slice of the pie” if the government and private sector invested wisely.

Bell concluded: “A lot depends on reinvigorating port infrastructure as well as having a coherent industry strategy that picks out the components where we have some advantage, such as in blades on the Humber and cables at Hunterston.”

Meanwhile, Stuart Dossett, senior policy advisor at environmental the think tank Green Alliance, suggested the latest difficulties made the case for an investment relief in the Electricity Generator Levy more compelling.

He said: “This decade is key for rolling out renewables and the success of this auction is crucial. Giving renewables an investment allowance in their profits levy, like that given to oil and gas producers in their windfall tax, is a first step in minimising the risk of a failed auction.”