Government ‘does not have any spending plans’ after March 2025, OBR chief says

Judging the reliability of the government’s fiscal commitments is difficult when the government does not have any detailed departmental spending plans, the chair of the Office for Budget Responsibility (OBR) watchdog said today.

Speaking to MPs on the Treasury Select Committee, Richard Hughes said: “It is very difficult to assess the credibility of the government’s spending plans because, after March 2025, the government does not have any spending plans.”

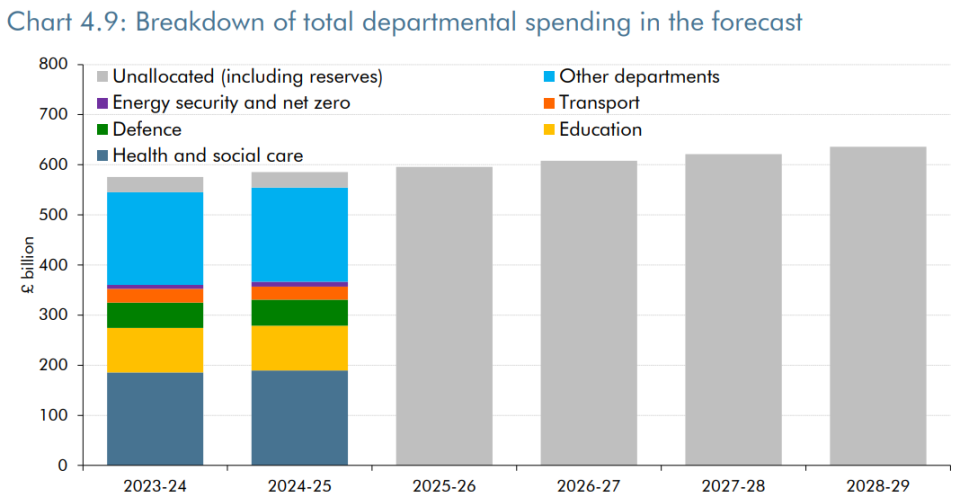

Hughes pointed out that 40 per cent of government expenditure – including spending on health, education and transport – falls under departmental spending plans, which come up for review in March 2025.

Until then, the OBR is reliant on Treasury figures which provide a single number for capital spending and day-to-day spending across all departments.

According to Treasury figures, day-to-day expenditure will increase by 0.9 per cent in real terms from 2025, but capital spending will remain unchanged. Many economists have warned this will amount to a significant cut in real term spending given the impact of inflation.

By 2027-28, the OBR forecast that real total departmental spending will be £19.1bn lower than it forecast in March.

Asked whether the plans were realistic, Hughes said he could not know whether the plans were “plausible or not” because Hunt had “not provided any detail in the choices involved in delivering those numbers.”

He added: “It is an unusual feature of our system that the government does not tell us anything about their spending plans beyond the end of a review period,” he said.

Tom Josephs, a member of the Budget Responsibility Committee, pointed out that this lack of detail was a big reason the OBR had made errors when trying to forecast government borrowing.

The OBR takes stated government policy as its starting point. But when it comes to departmental spending reviews, governments tend to increase spending by an average of £30bn over and above initial projections, Josephs said.

“It is certainly one of the biggest risks to our forecast, by some magnitude,” Hughes said.

In last week’s Autumn Statement, Hunt announced a range of tax cuts, including what he described as the “largest business tax cut in modern British history,” making full expensing permanent in an attempt to boost UK investment.

The Chancellor also announced a surprise cut in the rate of employee national insurance by two per cent, from 12 per cent to 10 per cent, as well as a shakeup of taxes for the self-employed.

A Treasury spokesperson said: “Total departmental spending will be £85 billion higher after inflation by 2028-29 than at the start of this Parliament, including record funding for the NHS.”

“We are focused on creating a more productive public sector, not a larger one, by reducing admin workloads, introducing early interventions and safely bringing in new tech like AI,” they continued.