Falling inflation helps government borrow much less than expected in boost for tax cut hopes

The government borrowed much less than expected in December, helped by falling interest payments, in a boost for the government’s hopes of cutting taxes in the Spring Budget.

According to figures from the Office for National Statistics (ONS), the government borrowed £7.8bn in December, significantly lower than the £14bn expected by the Office for Budget Responsibility (OBR).

The figures for December 2023 were also £8.4bn less than a year earlier, when energy support measures were still in place.

According to the ONS, tax receipts were lower in December than the OBR had predicted, suggesting the beneficial impact of fiscal drag on the state coffers was fading.

However, expenditure was significantly lower than forecast, largely thanks to a £5.5bn undershoot on debt interest payments. The government paid £4bn in interest payments in December, £14.1bn less than the year before.

December’s figures brings total borrowing in the financial year-to-date to £119.1bn, £5bn lower than forecast by the OBR.

However, it still means the government has borrowed more so far this year than in every year since records began excluding the financial crisis and Covid.

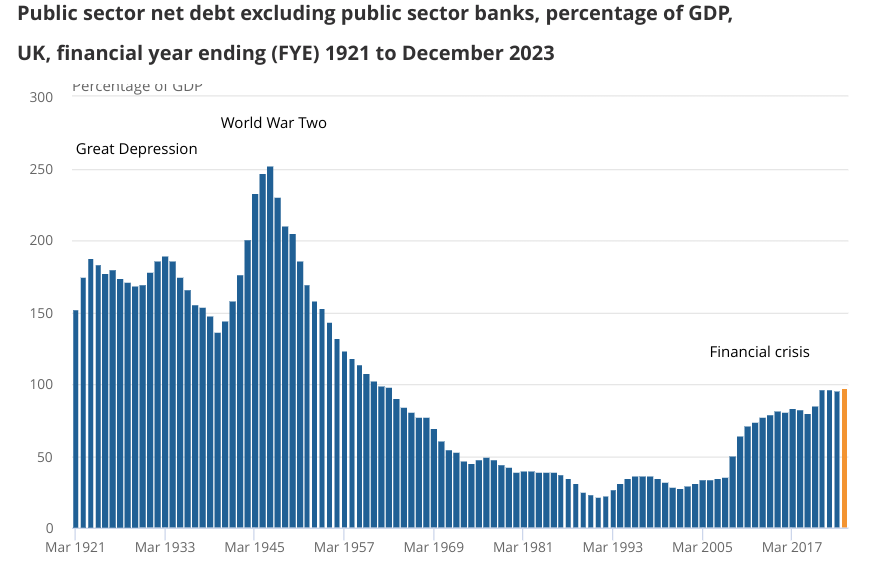

Public sector debt was estimated at around 97.7 per cent of GDP, which was 1.9 percentage points higher than a year earlier. National debt stands at levels last seen in the early 1960s.

Chief Secretary to the Treasury, Laura Trott said: “Protecting millions of lives and livelihoods during Putin’s energy shock and a once in a century pandemic has created economic challenges.

“However, it is right that we pay back these debts so future generations are not left to pick up the tab,” she continued.

Ruth Gregory, deputy chief UK economist at Capital Economics, said the figures will give the Chancellor “a bit more wiggle room for a big pre-election splash”.

The government has made its intention clear to reduce taxes in the Spring Budget. According to the OECD, the UK’s total tax-to-GDP ratio hit 35.3 per cent in the 2023 financial year, the highest since its records began in 2000.

In the Autumn Statement last year, the government unveiled a range of tax cuts, including a 2p reduction in National Insurance, in an attempt to win over voters. Last week, Rishi Sunak said there was “more to come” in terms of tax cuts.

The government’s tax cuts hopes have been given a boost over the past few months by the sharp fall in inflation at the end of last year, which has fallen faster than than the OBR predicted back in November.

As inflation has fallen, so too have gilt yields. Gilt yields reflect the cost of government borrowing.

Thanks to the lower cost of government debt, ING estimates that the Treasury will have an extra £12bn in headroom to meet its key fiscal target of having debt falling in the fifth year of the OBR’s forecasts.