Government borrowing smashes expectations but debt-to-GDP highest since 1960s

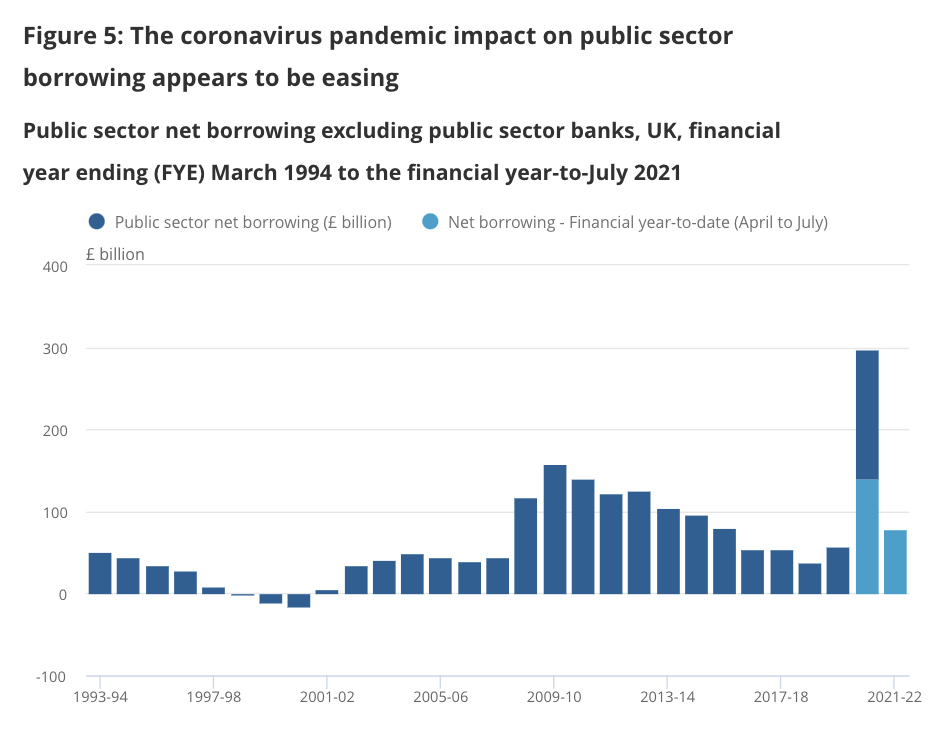

Government borrowing smashed official forecasts last month as the deficit narrowed by nearly half its levels registered at the height of the Covid crisis, official figures released today reveal.

Data released by the Office for National Statistics shows in July of this year, public sector borrowing reached £10.4bn, the second highest figure for the month since records began in 1993.

However, the figure is down £10.1bn from the amount borrowed in July last year at the height of the Covid crisis.

The sharp reduction in public borrowing was mainly driven by an increase in tax receipts and a fall in spending to deal with the Covid crisis as the economy steered toward its pre-pandemic normal functioning.

So far in the financial year in 2021, the government has borrowed £78bn, down £61.6bn over the same period last year, highlighting that the impact the Covid crisis is having on the public sector finances is receding.

The total amount the government borrowed in the financial year-to-date is markedly lower than official forecasts published by the government’s spending watchdog.

Latest forecasts by the Office for Budget Responsibility predicted government borrowing to reach £104bn over the period.

Martin Beck, chief economic adviser to the EY ITEM club, said: “Both receipts and spending continue to perform better than the OBR anticipated, largely due to the strength of the recovery through the summer which has comfortably exceeded the OBR’s very cautious near-term forecast.”

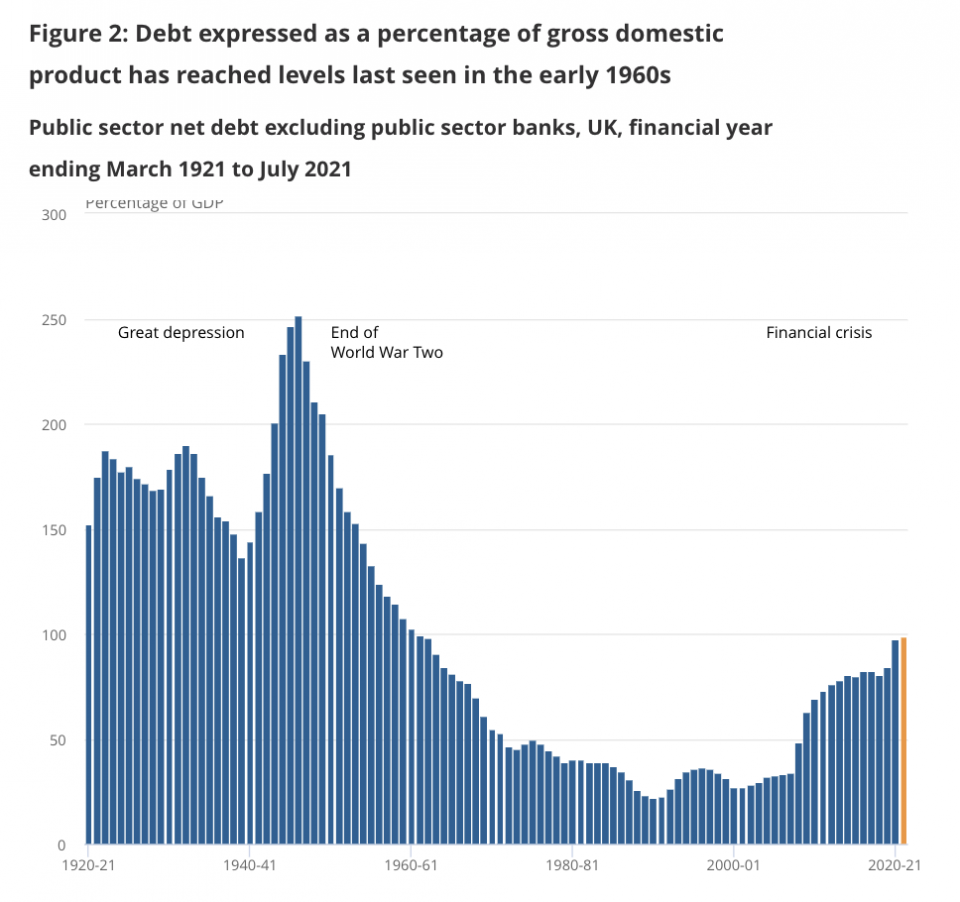

Despite the narrowing deficit, the UK government’s stock of debt relative to the economy swelled to its highest level since the 1960s, driven by the expensive response to quash the impact of the Covid crisis wreaking havoc on the public finances.

The ONS said net debt reached £2.2 trillion at the end of July 2021, representing 98.8 per cent of GDP, the highest ratio since March 1962.

Rishi Sunak, chancellor of the exchequer, said: “Our recovery from the pandemic is well underway, boosted by the huge amount of support Government has provided.”

“But the last 18 months have had a huge impact on our economy and public finances, and many risks remain.”

Isabel Stockton, research economist at the Institute for Fiscal Studies, said: “Today’s figures show that borrowing over the year to July was still high compared to the long-run pre-COVID average of 2.5 per cent.”

“Even if, as recent revisions to economic forecasts suggest, some of this improvement persists the coming spending review will still require some very difficult decisions and, most likely, more generous spending totals than currently pencilled in by the chancellor given the myriad pressures on public services and the benefit system following the pandemic.”

“We’re committed to keeping the public finances on a sustainable footing, which is why at the Budget in March I set out the steps we are taking to keep debt under control in the years to come,” Sunak added.

The amount the government spent on repaying debt pulled back from June’s record levels last month.

“Interest payments on central government debt were £3.4bn in July 2021, £1.1bn more than in July 2020 but £5.4bn less than the monthly record of £8.7 billion in June 2021,” the ONS said.

Meanwhile, a recovery in the jobs market helped to ease central government expenditure on schemes launched to stem the impact of the Covid crisis, mainly driven by spending on the furlough falling significantly in July.

Michal Stelmach, senior economist at KPMG UK, said: “Spending on the furlough scheme continued to fall, bringing outlays to its lowest level since the start of the pandemic.”

“This was due to reduced generosity of the scheme beginning in July and a lower take-up, reflecting a decline in furloughed workers as the economy reopened.”

Central government bodies spent £79.8bn in July 2021, £2.9bn lower than in the same month last year.