Government borrowing higher than expected as interest payments hit November record

The Treasury borrowed more than economists had anticipated in November with interest payments on government debt hitting a monthly high.

According to figures from the Office for National Statistics (ONS), the government borrowed £14.3bn in November, slightly higher than the £12.9bn City analysts were expecting.

While the figure was £900m less than this time last year, it was still the fourth-highest figure recorded for November since monthly records began in 1993.

“Payments relating to the energy price schemes that began in October 2022 have now stopped; however, these reductions in spending were offset by other inflation-related costs, such as increased benefit payments,” the ONS noted.

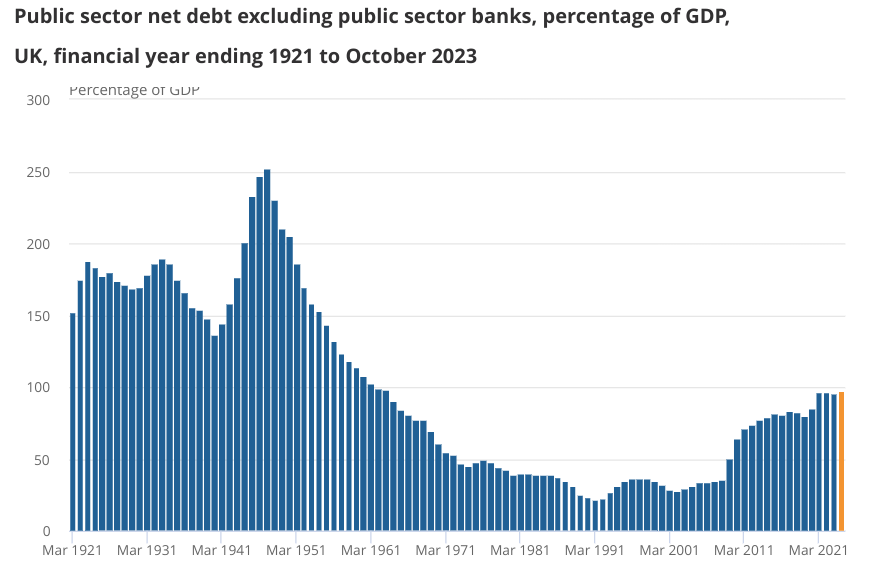

With the government having to pay more to service its debt, interest payments on government debt rose to £7.7bn in November, the highest November total since monthly records began.

The financial year-to-November borrowing figure was the second-highest amount on record, totalling £116.4 billion, the ONS said.

Chief Secretary to the Treasury, Laura Trott said: “We are taking difficult decisions in the national interest to control our borrowing needs and improve productivity, so that we deliver the public services people need while keeping inflation down.”

Although borrowing across this year has been high in historical terms, government borrowing has actually undershot expectations as higher inflation has dragged more people into higher tax bands, increasing tax revenue.

In March 2023, the OBR forecast that borrowing would settle at £152.4bn in the 2024 financial year. In its November forecasts, the OBR reduced this estimate by £24.1bn to £128.3bn.

Falling rate expectations are likely to give the Chancellor some extra breathing space going into the new year as markets have brought forward their expectations for when interest rate cuts will begin.

According to Oxford Economics, the recent fall in rate expectations has given Hunt an extra £11bn in headroom compared to the OBR’s November forecasts.

Ashley Webb, UK economist at Capital Economics, said “we expect this to give the Chancellor more wiggle room to unveil a further pre-election splash at the Sprint Budget”.