Government in bid to slash taxes for shale explorers

THE UK government today outlined plans to slash tax on shale gas by more than half, in a move it hopes will kick-start investment and help unlock the UK’s potentially vast shale resources.

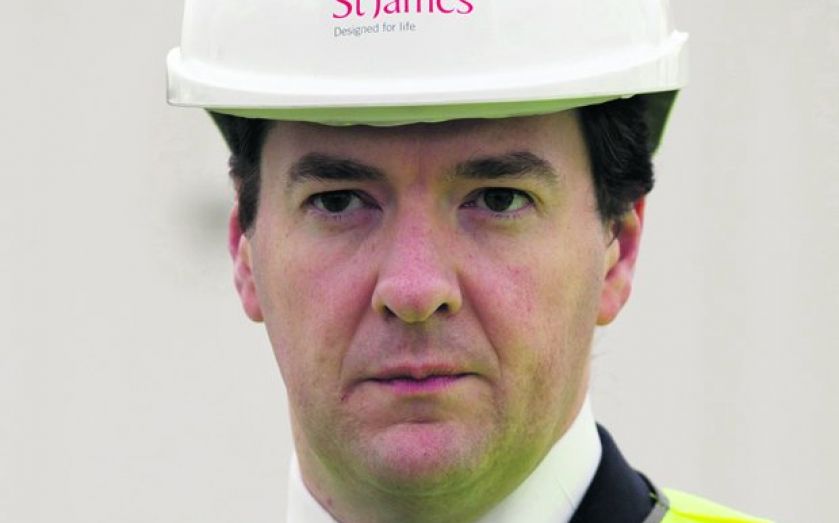

In a consultation released this morning, the Treasury proposes a so-called shale gas pad allowance, which would lower tax on production income from 62 per cent to 30 per cent. “We want to create the right conditions for industry to explore and unlock that potential in a way that allows communities to share in the benefits,” said chancellor George Osborne.

As announced at the spending review, the government has also proposed that operators provide at least £100,000 in community benefits for every fracked well, plus no less than one per cent of their overall revenues.

“The allowance will mitigate the fairly fearsome tax rate of 62 per cent on shale,” John Overs at Berwin Leighton Paisner told City A.M.

Overs added that the tax breaks would be based on the field allowances introduced by Alistair Darling in 2009 and extended by the chancellor last year to incentivise the oil and gas industry, by encouraging production in small fields.

A report by the British Geological Survey last month claimed that the UK is sitting on enough shale gas to power the country for the next 40 years, raising hopes of a US-style shale boom.

As well as increasing the UK’s energy security, shale gas projects could create thousands of jobs and lift tax revenues from the oil and gas industry, the government said.

Cuadrilla, the only operator to have fracked in the UK’s Bowland Shale, welcomed the plans.

“Whilst we are still in the exploration phase, we believe that shale gas has the potential to make a considerable contribution to the UK’s energy supply and security,” said chief executive Francis Egan.