Spring Budget 2024: Government banks largest monthly surplus on record before March statement

The government recorded its largest monthly surplus since records began in January, helping borrowing in the year-to-date come in over £9bn below official forecasts.

According to figures from the Office for National Statistics (ONS), the government banked a surplus of £16.7bn in January.

This was more than double the surplus recorded last year and the highest since records began in 1993, although it was slightly lower than the £18bn surplus expected by the Office for Budget Responsibility (OBR).

January’s tax receipts are always higher than other months, due to receipts from self-assessed taxes. Receipts from self-assessed taxes hit £21.6bn in January, £2.4bn less than the OBR expected.

The Treasury also paid significantly less interest on government debt than expected reflecting the recent fall in interest rate expectations.

“January’s surplus is the largest in nominal terms since monthly records began in 1993, although borrowing in the year to January is only slightly lower than the same period last year,” ONS deputy director for public sector Jessica Barnaby said.

Falling interest rate expectations and the closure of the energy support scheme have improved the government’s fiscal position ahead of the Spring Budget.

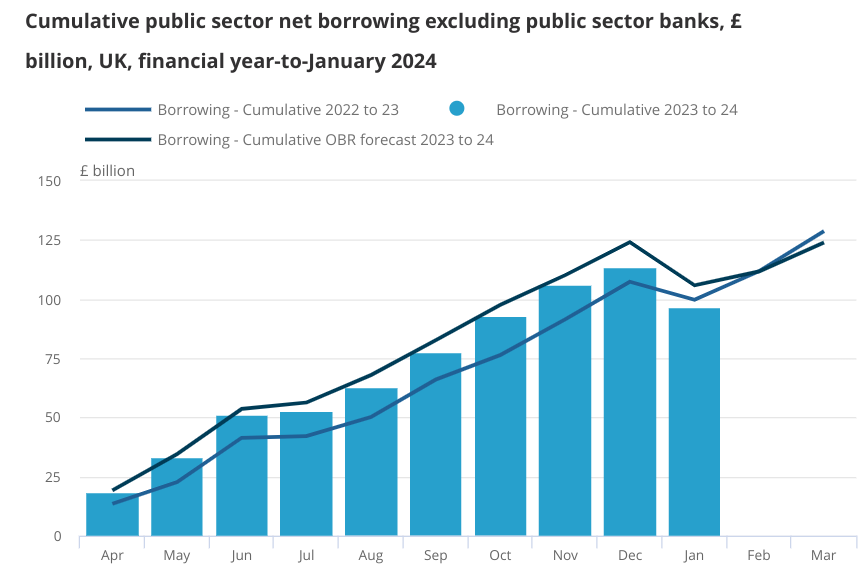

Borrowing in the financial year-to-date came in at £96.6bn, which was £9.2bn less than forecast by the OBR back in November.

However, the UK’s public finances remain in a fairly parlous state with debt totalling 96.7 per cent of GDP.

January’s figures are the last round of monthly borrowing figures before the Spring Budget, which is scheduled to be held on 6 March.

Thanks to falling interest rate expectations, which will lower debt interest spending, the government is expected to have as much as £20bn to spend on cutting taxes.

Although Chancellor Jeremy Hunt has tried to temper expectations slightly among the increasingly fractious Conservatives, the government is still widely expected to cut taxes in the Budget.

Options on the table include cutting the basic rate of income tax by 1p or cancelling the Personal Allowance freeze, both of which would cost around £7bn. The planned increase to fuel duty will also almost certainly be scrapped at a cost of £2bn next year.

Laura Trott, chief secretary to the Treasury, said the government “will not speculate over whether further reductions in tax will be affordable”.

This would come after a hefty round of cuts to both business and personal tax rates in November, which cost the Treasury around £20bn.

The ONS’s figures also showed that the Treasury transferred the Bank of England £11.2bn in the past three months to cover losses relating to quantitative easing, roughly equal to the budget of the justice department.