| Updated:

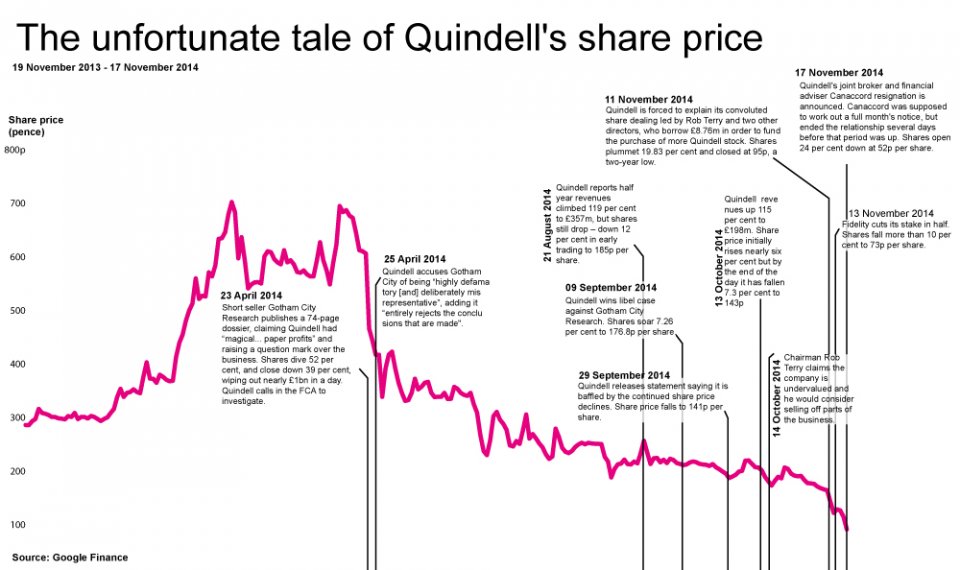

From Gotham City to Fidelity and Canaccord: The unfortunate tale of Quindell’s share price

You'd be forgiven for forgetting the full detail behind the story of Quindell – here, we wrap up the last seven months of headache-inducing stories that kept the insurance outsourcer in the headlines.

April 23 – Mysterious short seller Gotham City Research publishes a 74-page dossier, claiming Quindell had “magical… paper profits” and raising a question mark over the business. Shares dive 52 per cent, and close down 39 per cent, wiping out nearly £1bn in a day. Quindell calls in the FCA to investigate.

April 25 – Quindell accuses Gotham City of being “highly defamatory [and] deliberately misrepresentative”, adding it “entirely rejects the conclusions that are made".

August 21 – Quindell reports half year revenues climbed 119 per cent to £357m, but shares still drop – down 12 per cent in early trading to 185p per share.

September 9 – Quindell wins libel case against Gotham City Research. Shares soar 7.26 per cent to 176.8p per share.

September 29 – Quindell releases statement saying it is baffled by the continued share price declines. Share price falls to 141p per share.

October 13 – Quindell reveals revenues up 115 per cent to £198m, with adjusted core profits up 141 per cent to £83m. Share price initially rises nearly six per cent but by the end of the day it has fallen 7.3 per cent to 143p.

October 14 – Chairman Rob Terry claims the company is undervalued and he would consider selling off parts of the business.

November 11 – Quindell is forced to explain its convoluted share dealing led by Rob Terry and two other directors, who borrow £8.76m in order to fund the purchase of more Quindell stock. Shares plummet 19.83 per cent and closed at 95p, a two-year low.

November 17 – Quindell's joint broker and financial adviser Canaccord resignation is announced. Canaccord was supposed to work out a full month's notice, but ended the relationship several days before that period was up. Shares open 24 per cent down at 52p per share.

November 18 – Quindell confirms that chairman Rob Terry will step down alongside non-executive director Steve Scott. Former head of investment banking at Investec, Dave Currie, is taking over the role on a temporary basis. Shares initially rose by 15 per cent, but within 20 minutes of the markets opening were falling again.