Gooooood morning Forty! Party time as Bitcoin breaches $40,000

Greetings from Canary Wharf, London, where my guests are currently arriving to celebrate the (belated) third birthday of Crypto AM.

Apart from the serious business of celebration and ‘Unlocking Summer’ as no doubt the rain clouds burst in true British style it will give me great pleasure to confirm that the Crypto AM London Blockchain & DeFi Summit will be held on the September 29 and 30.

Day One will be held in two Pavilions hosting the Crypto AM City of London Roundtables so that delegates can meet and network with each other and learn from great discussions and talks. Day Two will be Summit day at the Leonardo Royal Hotel, St Paul’s, finishing with the gala dinner where the winners of the Crypto AM Awards 2021 will be revealed.

Tickets will be strictly limited and by application.

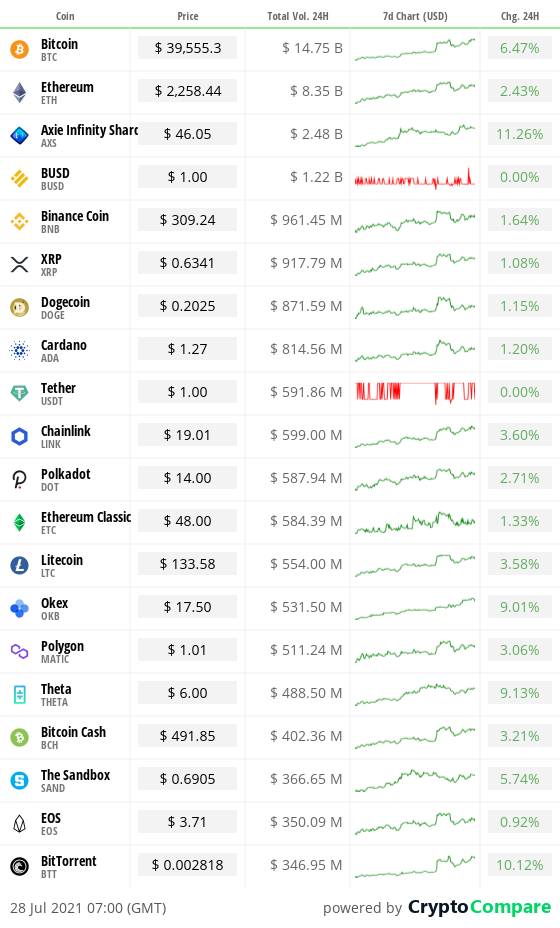

Crypto at a glance

The Bitcoin price is back up at around the $40k level this morning after dipping as low as $36k yesterday, as the markets continue to look volatile this week. It’s currently up more than 7% over the last 24 hours and 30% since last Wednesday.

The price activity and recent glut of adoption news courtesy of Elon Musk and Jack Dorsey does seem to have brought back the positive vibes to the market, though. The Fear and Greed index, which measures market sentiment, is up at 50 in ‘neutral’ – the highest it’s been since early May. The Fear & Greed index dropped as low as 10 on Wednesday, July 21, and has since seen steady growth as the overall sentiment has improved. We’re still some way off the euphoria witnessed from November till March, which saw the index rarely fall below 90, but could momentum be shifting?

Even more positively, the daily trading volume for Bitcoin reached $9.2 billion on Monday, which was the highest since June 22. In a report by Arcane Research and Luno, it was noted: “The increasing volume amid Bitcoin’s strength suggests that the strong recovery was supported by an influx of buyers, a healthy sign for the market.

“However, it should be noted that the trading volumes were trending downwards and saw four consecutive days below $3 billion before bursting amid yesterday’s recovery. Overall, the seven-day average trading volume remains substantially below its yearly average, and trading activity in Bitcoin seems to be low so far this summer.”

The big question now is whether yesterday’s spike was a one off, or the start of a broader trend shift.

The recovery today comes as calls continue for increased regulation around cryptocurrency in the US, developments that would usually spook the market but seems to have had limited impact. In an open letter to US Treasury Secretary Janet Yellen on Monday, US senator and long-time crypto skeptic Elizabeth Warren urged the Financial Stability Oversight Council (FSOC) Yellen develop a regulatory strategy to “mitigate the growing risks that cryptocurrencies pose to the financial system”.

Regulation has historically had a positive impact on adoption, so if handled correctly then it could be a win-win.

Today Cudos proudly presents the Crypto AM 3rd Birthday Unlocking Summer Party at Boisdale of Canary Wharf

An amazing champagne drinks reception in partnership with World Mobile, followed by a three course summer lunch washed down with beautiful Mirabeau Azure Rosé! Followed by the chance to finally catch up and network with the community to the intoxicating beats of a Mediterranean beach club.

There will be a main keynote from Pete Hill of CUDOS, a community Keynote from Jason A Deane of Bitcoin Pioneers and a panel discussion around the ‘State of the Crypto Union’ moderated by Dr Chris Cleverly of Tingo International Holdings & KamPay. On the panel are Julian Sawyer of Bitstamp, Jeanette Seng of Mantle, Rufus Round of GlobalBlock Digital Trading Assets, Martha Reyes-Hulme of BEQUANT and Konstantin Anissimov of CEX.IO

I’m also delighted to announce that Ted Byron Baybutt the Director of British Sci-Fi Thriller ‘Slammer’ will be exhibiting an exclusive screening of the trailer to the film. He’s bringing his film crew so who knows? Attendees might end up featuring in the film.

I’m hugely grateful to our partners CUDOS, World Mobile, BEQUANT, Bitstamp, CryptoCompare, CEX.IO, Bitcoin Pioneers & GlobalBlock Digital Asset Trading whose generosity is enabling everyone to attend free of charge.

Would you like to help spread the adoption and education of Bitcoin in the UK and even stack some Sats while you’re doing it? Well, now you can!

The Bitcoin Pioneers community, backed by Barry Silbert’s Digital Currency Group, was created to introduce Bitcoin to a mainstream audience in a meaningful way and now has members right across the UK.

We share tips, stories and ideas on how to encourage others to try Bitcoin for the first time. And, thanks to support from Luno, each Pioneer gets £500 of Bitcoin a month to share with beginners, helping them get started.

So, if you’re passionate about Bitcoin, why not join today? Click here to find out more!

All feedback on Crypto AM Daily in association with Luno is welcome via email to James.Bowater@cityam.com ??

Yesterday’s Crypto AM Daily in association with Luno

In the markets

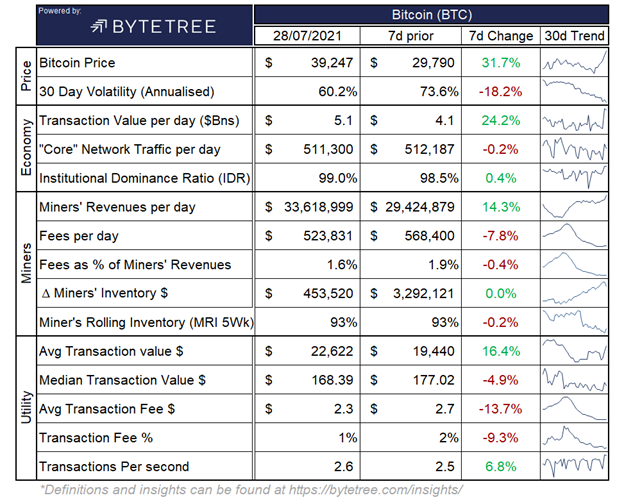

The Bitcoin economy

*Definitions and insights can be found at https://bytetree.com/insights/

Total crypto market cap

The total capitalisation of the entire cryptocurrency market at time of writing is currently $1,546,946,846,506.

What Bitcoin did yesterday

We closed yesterday, July 27 2021, at a price of $39,406.94, up from $37,337.53, the day before.

The daily high yesterday was $39,406.94 and the daily low was $36,441.73.

This time last year, the price of Bitcoin closed the day at $10,912.82. In 2019, it closed at $9,552.86.

Bitcoin market capitalisation

Bitcoin’s market capitalisation at time of writing is $742.97 billion. To put it into context, the market cap of gold is $11.459 trillion and Facebook is $1.042trillion.

Bitcoin volume

The total spot trading volume reported by all exchanges over the last 24 hours was $37,165,810,948, down from $40,680,137,837 yesterday. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of Bitcoin over the last 30 days is 53.4%.

Fear and Greed Index

Market sentiment today is 50.

Bitcoin’s market dominance

Bitcoin’s market dominance today is 49.21, Its lowest ever recorded dominance was 37.09 on January 8, 2018.

Relative Strength Index (RSI)

The daily RSI is currently 70.05. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

Convince your Nan: Soundbite of the day

“I definitely do not believe in getting the price high and selling, or anything like this. I would like to see Bitcoin succeed.”

– Elon Musk, spaceman

What they said yesterday

Huge sums…

People have a lot of time on their hands…

HODLing…

Crypto AM editor’s picks

Steve Jobs’ 1973 application to be auctioned in original format AND as an NFT

Surf legend Kelly Slater is ready to ride the crypto wave

Cardano leapfrogs Bitcoin as eToro clients most held cryptocurrency

Coinbase gets green light from German regulators

Crypto AM: Longer Reads

City AM Markets: What is Decentralised Finance (DeFi) by Aave

Crypto AM: Conversation with James Bowater

Crypto AM: Market View in association with Ziglu

Crypto AM: Technically Speaking in association with Zumo

Crypto AM: A Trader’s View with TMG

Crypto AM: Mixing in the Metaverse with Dr Chris Kacher

Crypto AM: Visions of the Future, Past & Present with Alex Lightman

Crypto AM: Talking Legal

Crypto AM: Spotlight

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Definitively DeFi

Crypto AM Parliamentary Special

Part one of two – April 2021

Part two of two – April 2021

Five-part series – March 2021

Part one…

Part two…

Part three…

Part four…

Part five…

Crypto AM Events

For those of you who missed the Crypto AM DeFi & Digital Inclusion online summit – you can now watch the event in two parts via YouTube…

Part one:

Part two: