Goldman Sachs slashes its oil price forecast for the next five years

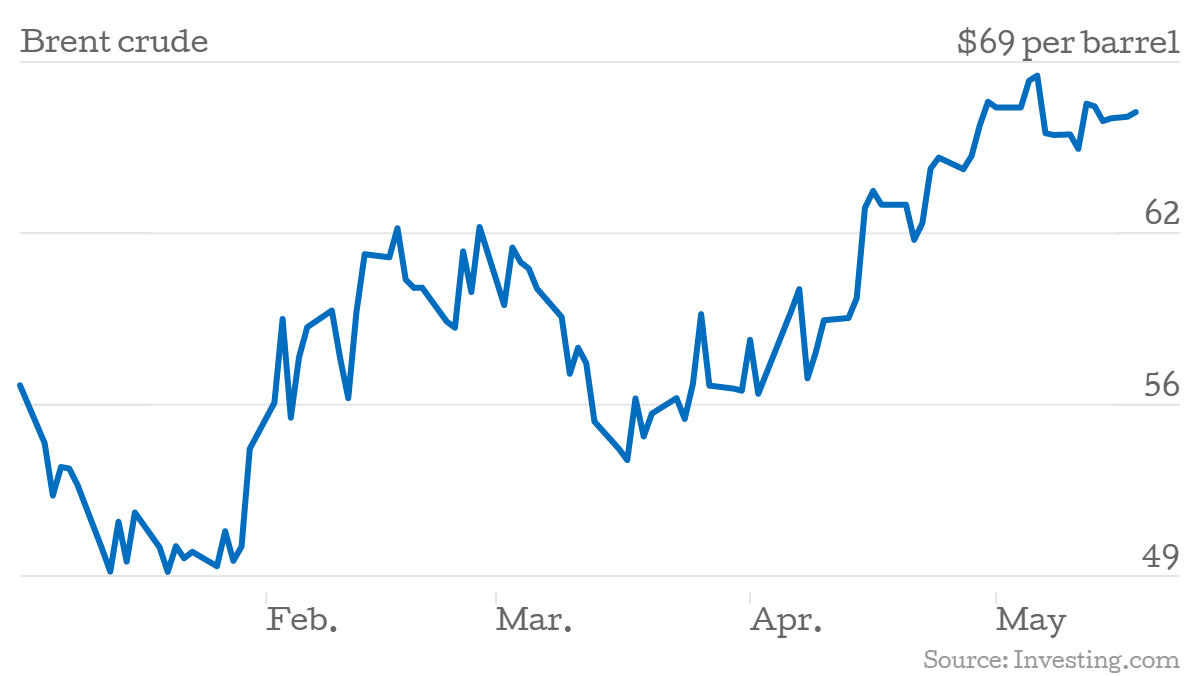

The good news is that after months of falls, oil prices have begun to tentatively rise (although that was thanks to fighting in Yemen and Iraq). The bad news is that Goldman Sachs doesn't think it's going to last: the investment bank has slashed its oil price forecasts for the next five years.

In a note published over the weekend, Goldman said the average 2016 Henry Hub natural gas price (a benchmark used by the industry) will fall to $3.50 per mmbtu (a measure of the energy content in fuel), down from $3.80 earlier, thanks to the glut in US shale supply and Opec's refusal to cut productivity. It added that throughout 2016-2020, there's likely to be a $5 per barrel spread between Brent and WTI crude.

It added that throughout 2016-2020, there's likely to be a $5 per barrel spread between Brent and WTI crude.

However, it also raised its expectations for Brent crude this year, to $58 per barrel from $52, while its outlook for WTI crude rose to $52 per barrel, from $48.

Earlier this month, Goldman said the the recent rally in oil prices was "premature", and that they are likely to fall further in the coming months, despite fighting in the Middle East.