Gold prices propped up by bullish demand in Asia despite hawkish Fed

Gold prices are trapped in a narrow pricing corridor, with robust demand in Asia propping up the precious metal despite strong headwinds in the US.

Currently, the investment staple has rebounded one per cent this morning, trading at $1,661 per ounce.

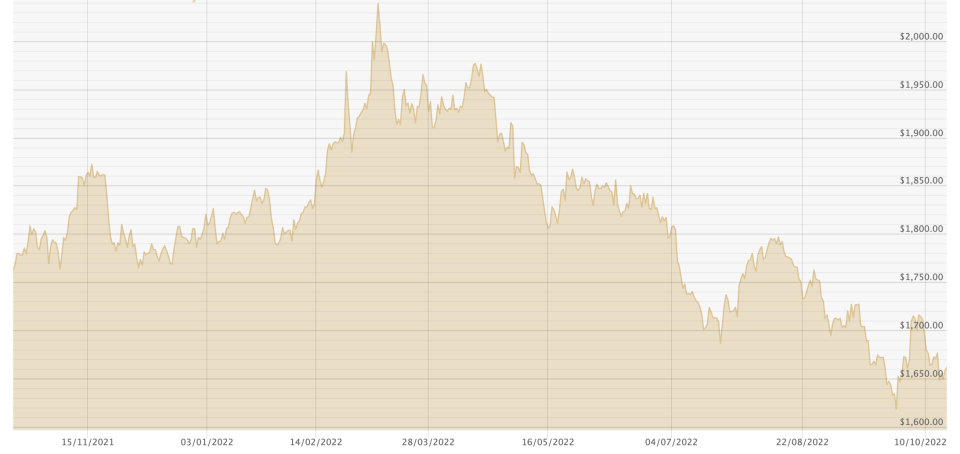

However, it remains well below previous levels recorded this year following a spring rally for safe haven assets when prices peaked at $2,034 per ounce in March after Russia’s invasion of Ukraine.

Since then, prices have slipped over $300, reaching a nadir of $1,627 per ounce last month.

This follows persistent inflationary pressure, which has been matched with heavy interest rate hikes by the Federal Reserve.

Since then, prices have moved less than $100 in either direction, as strong demand in Asia has ensured the floor for prices remains resilient, while hawkish monetary policy Stateside has ensured a tight ceiling.

With inflation rates still historically high at over eight percent, it is widely expected the central bank will raise interest rates in both November and December – potentially by as much as 75 basis points.

Rupert Rowling, market analyst at Kinesis Money said: “In this environment where central banks are more focused on the size of any rate hikes rather than whether to raise interest rates at all, it is hard for gold to find any significant support with the precious metal’s lack of yield making other interest-paying assets, notably bonds, more attractive to low-risk seeking investors.”

Forecasting future price movements, Craig Erlam, senior market analyst at OANDA, said: ” The recent economic data hasn’t offered cause for much optimism but that could change over the coming months, with central banks now surely not far from their terminal rates. That could favour gold, especially as the economy falters.”