Gold is the new gold: Why the safe haven investment could shine in 2020

The start of 2020 has certainly been a rude awakening for traders returning to work after the Christmas break.

Oil prices spiked after the US assassination of Iranian general Qasem Soleimani ignited tensions in the Middle East. Equities were shaken, and investors flocked to safe haven assets in a bid to shelter from the storm.

Although tensions between the US and Iran appear to have receded for now, global geopolitical uncertainty remains high. One asset class above all looks set to benefit from this turbulence: gold.

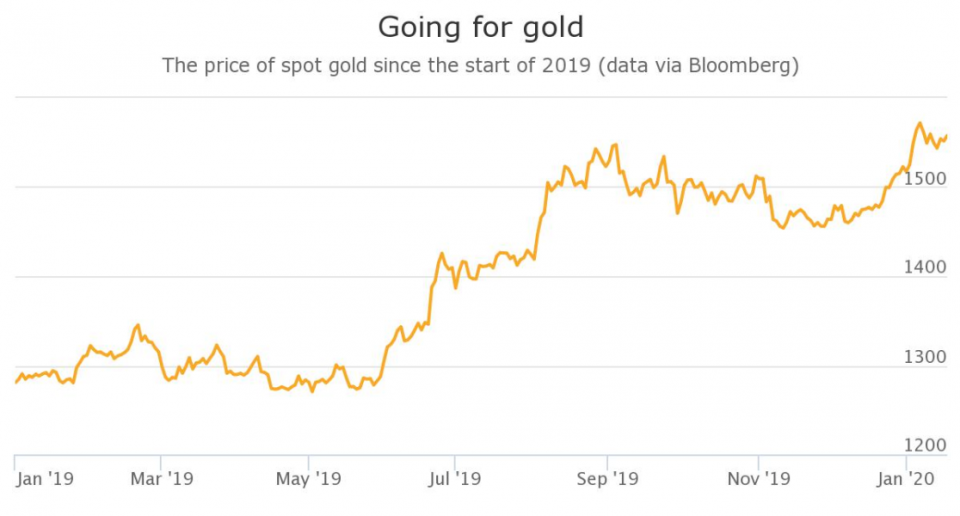

The precious metal has climbed steadily over the past few months even as traders flitted between risk and retreat, with prices spiking in the aftermath of Iran’s retaliatory attacks on Iraqi bases housing US troops.

Gold surged over two per cent following the attacks to a seven-year high, breaking through the $1,600 (£1,228) per ounce barrier for the first time since 2013 as investors poured money into the asset.

But can the yellow stuff retain this level of appeal — or gain even more — in the coming years?

A solid gold bet?

Bridgewater, the world’s largest hedge fund, certainly thinks so. Co-chief investment officer Greg Jensen last week backed gold for a record climb above $2,000 as geopolitical uncertainties mount.

While the precious metal does tend to benefit from periods of global stress, the poor performance of another classic safe haven asset — government bonds — is also helping gold rise.

With debt-hungry investors helping to saturate the market, bonds have become less appealing thanks to low, and sometimes even negative, yields.

Bond yields move inversely: as demand (and therefore prices) increase, yields fall. Because of this, it generally no longer pays to hold bonds; instead, investors must be willing to stump up for the security they offer.

“I see gold doing well as a safe haven asset over the coming years because bond yields are so low and because the opportunity cost of holding gold is relatively low,” says JP Morgan Asset Management global multi-asset strategist, Thushka Maharaj.

Low starting yields also dent the protective power of bonds to act as a liquid store of value, insulating investors against rising inflation, while gold tends to do well in periods of both very high and very low inflation, she explains.

Low bond yields send investors looking for pot of gold

In August last year, trade tensions between the US and China, coupled with mounting concerns over the rising risk of recession around the world, sparked a global bond rally.

Investors rushed en masse to the safety of government bonds, sending the yield on the benchmark 10-year US Treasury note diving below 1.5 per cent for the first time since 2016.

Ole Hansen, Saxo Bank’s head of commodity strategy, said this dramatic drop in yields “really helped bring the focus back to gold, which had been kind of left alone for the previous four years”.

Hansen is confident this “renewed demand is going to stick”, because gold can essentially act as an “insurance policy for rainy days” for fund managers and investors at a time of high valuations, low earnings expectations, and low bond yields.

Maharaj agrees that the trend in favour of gold “will continue as long as bond yields remain low, and we do expect bond yields to remain low in the coming years”.

Sign up to City A.M.’s Midday Update newsletter, delivered to your inbox every lunchtime

No such thing as a perfect safe haven

But, of course, there is no one single asset that can perfectly protect investors during turbulent times.

All safe haven assets have their own opportunity costs — for gold, this is a relatively low expected return compared to many other assets.

“There’s no one safe haven asset. You have to think about diversifying the safety in your portfolio just as much as you think about diversifying the return-seeking aspect,” says Maharaj.

As well as balancing gold alongside other prominent safe havens such as bonds or sovereign currency, there are also many different ways to invest in the precious metal.

“Normally I would say if you are looking to have exposure to gold, just go through some of the major exchange-traded funds (ETFs) which have shown their robustness throughout the past 10 years,” says Hansen.

“If you are going for the purest form of gold, i.e. physical gold, then there are a few challenges with storage, transportation, and insurance,” he adds.

You’re golden

Gold is certainly enjoying a resurgence of popularity at the moment, reasserting its status as an archetypal safe haven asset.

Although he doesn’t name a figure, Hansen agrees with Jensen’s prediction that the yellow stuff could soon hit another record.

“I would definitely not go against the potential for gold making a new high,” he says. “Whether it’s going to be this year or next really depends on how other markets develop.”

With global tensions rumbling on — in some cases, very close to the surface — gold doesn’t seem set to lose its current shine anytime soon.