Global volatility fuels short interest with more than $100bn worth of shares on loan, up 14 per cent

Global markets got off to a shaky start in 2016, with last year's fears, of the Chinese slowdown and the ongoing energy and commodities rout, ever present.

The winners in all this are the short sellers: demand to borrow shares grew 14 per cent over the last 12 months and the value of shares on loan at the moment is $100bn, according to the latest data from Markit.

Short selling is when an investor borrows shares in order to sell them at a pre-arranged price later, thereby making a profit when the price falls. It is effectively betting a company’s share price will fall. Short interest is the number of shares sold short as a percentage of total shares held, or shares outstanding.

Read more: The most shorted shares of 2016

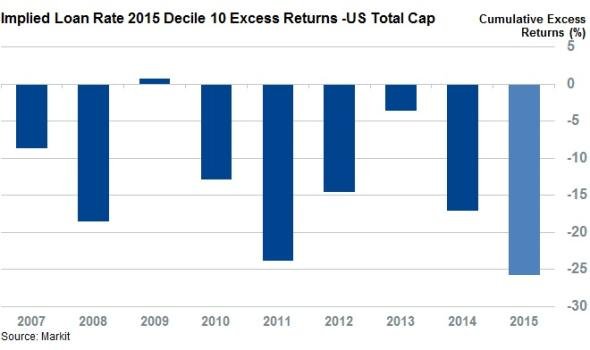

US short sellers have had the most successful year: the most expensive 10 per cent of shares borrowed – conviction shorts – under performed the market by 27.5 per cent.

Conviction shorts in Asia under performed the market by 12 per cent and by seven per cent in Europe.

In fact, 2015 was the best ever year for short selling since the genesis of the Implied Loan Rate factor in 2007, as shown by this chart which tracks the returns for short sellers:

2015 was even better for short sellers than during the recession in 2008, when conviction shorts only under performed the market by 18.5 per cent.