Global uncertainty strengthens case for UK oil and gas, says industry boss

Emerging geopolitical challenges are strengthening the case for domestic oil and gas production, argued the boss of the country’s offshore energy trade association.

David Whitehouse, chief executive of Offshore Energies UK (OEUK), told City A.M. that domestic fossil fuel production was vital for energy security in increasingly unpredictable international markets.

“When you see things like the war in Ukraine, and unrest now in the Middle East, I think more and more it makes you recognise that it is in a country’s interests to be producing their own energy,” he said.

Hamas’s attack on Israel, followed by Israel’s military operations in Gaza has raised the prospect of conflict escalating in the region – which is home to some of the world’s largest oil producers including Saudi Arabia and Iran.

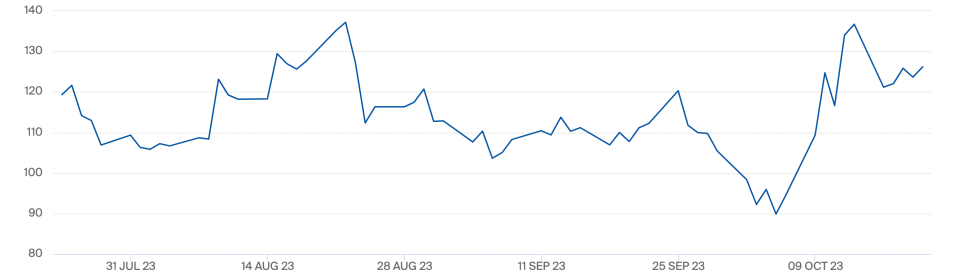

This could potentially put pressure on supplies and trigger further sanctions, exposing markets to fresh volatility with oil and gas prices soaring this month.

Whitehouse called on the government to adopt a “very pragmatic” approach to “take care” of energy security in such difficult circumstances.

He said: “I think that is absolutely highlighted by global events.”

His comments follow the latest report from the National Infrastructure Commission which has backed government plans to decarbonise the electricity grid by 2035, and to reduce the UK’s reliance on fossil fuels – urging the effective scrapping of the country’s gas network.

It predicted the UK will be exposed to volatile wholesale costs, which rose to record highs last year following Russia’s invasion of Ukraine, as long as the country was dependent on oil and gas to meet its consumption needs – meaning households will be on the hook for higher energy bills.

This is in line with warnings from the International Energy Agency that the climate goals of developed economies such as the net zero target for 2050 and the commitments of the Paris Agreement will not be met if new fossil fuel projects are sanctioned.

Currently, 80 per cent of the UK’s energy needs are still met by oil and gas, with the government estimating fossil fuels will make up to 25 per cent of the supply mix in 2050 – although this calculation is not recognised by the Climate Change Committee.

However, Whitehouse feared increased dependence on potentially unreliable partners during the transition to renewables and low carbon sources, with major oil producers such as Russia and Iran both under Western sanctions.

“Fundamentally, the more you develop your own homegrown energy, the more secure you are,” he said.

OEUK pushes for stability in oil and gas tax regime

OEUK represents over 400 companies operating in the North Sea including not just oil and gas producers but also hydrogen developers, offshore wind firms and carbon capture projects.

While Whitehouse was pleased with Rosebank’s recent approval – the largest undeveloped oil and gas field in the North Sea – in line with the government’s commitment to further exploration and development, it was only “one step in the right direction.”

“We need to unlock more investment actually across the energy spectrum,” he said.

Whitehouse believed the government had to “move away from windfall taxes,” with the body currently engaging in the government’s ongoing fiscal review of the North Sea – as it looks to establish the investment climate from 2028 when the Energy Profits Levy expires.

As it stands, oil and gas producers face an effective 75 per cent tax through the levy and a special corporation tax rate for the next five years, with companies pulling out of new projects in the region and withdrawing investment.

The energy boss called for an industry that was “truly encouraging” of investment.

He said: “There is no doubt windfall taxes discourage investment, and mapping out a future where we see ourselves moving to a long-term fiscal regime is really important.”

When approached for comment, a Treasury spokesperson said: “The continued investment by generators in the industry is vital to our long-term energy security and this levy still leaves companies with a share of profits at times of high wholesale prices, while our Contracts for Difference scheme is supporting our renewable energy sector by protecting generators against price fluctuations.

“The Energy Profits Levy on oil and gas producers has helped us pay around half of the typical household’s energy bill between October and June, while the £375bn the sector has raised in production taxes since its introduction pays for our public services like schools and the NHS”.