Global pension values soar to nudge same levels as US GDP

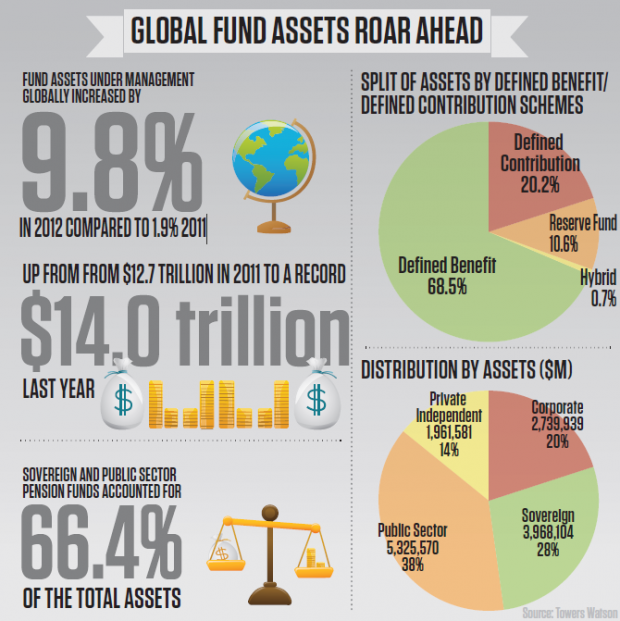

THE VALUE of stocks, bonds and property held by the world’s 300 biggest pension funds soared in value last year to reach a record

$14 trillion, closing in on the same value as America’s annual GDP (around $15.7 trillion), data shows.

Pension fund assets grew by $1.3 trillion in 2012, a 9.8 per cent rise in pension fund asset values. This is more than five times higher than the 1.9 per cent increase recorded for 2011, according to the figures from consultant Towers Watson.

The surge in value will cheer pension trustees who have had to deal with low returns on government bonds and volatile stock markets for the past five years. Annualised returns since 2008 have been just three per cent.

“The recent relative stability is very welcome and should be encouraging for investors, however they should not become too complacent,” Towers Watson global head of investment Carl Hess said, citing issues such as the ongoing Eurozone crisis and US fiscal cliff.

The bulk of pension fund assets are made up of government owned securities, such as those held in sovereign wealth funds and public sector pension funds.