Global league table of ‘caring’ investors: Americans more focused on sustainability than Europeans

The US is the only developed country to make the top 10 of a sustainable investment league table that gauges consumer habits and investing actions.

Countries in the developing world dominated the top ten while European countries occupied the middle and lower half of the league table.

The results of the Schroders Global Investor Study (GIS), which measures attitudes among individual investors across 30 countries, ranked the US fourth. Countries regarded to be emerging markets filled nine out of the top 10 places.

Responses from Indonesians indicated they were most focused on sustainability while India was in second place and China in third.

Thailand (5th), South Africa (6th), Brazil (7th), the UAE (8th), Chile (9th) and Taiwan (10th) made up the rest.

European and developed Asian countries dominated the bottom half of the table. This is despite policymakers in the EU and Japan having a real focus on encouraging long-term and more sustainable approaches to investment.

The study, which surveyed more than 22,000 investors across the globe, asked people about their understanding of what it means to invest sustainably, how they behaved sustainably in their everyday lives and how much they invested in sustainable products.

The backdrop is one of rising demand for sustainable investments, almost two-thirds of investors (64%) had increased their holdings of sustainable investments compared to five years ago while 76% said sustainable investing was somewhat or significantly more important.

Sustainable investment has seen a huge increase in interest in the last decade globally. At the core, it involves finding companies that are best-in-class on environmental or social issues and are proactively preparing for change.

On aggregated responses used to form the league table, Portugal (11th) was the highest ranked European nation followed by Sweden (12th). Attitudes in France (18th) and the UK (21st) put their investors towards the bottom end of the league table while Germany (24th) ranked even lower.

There are a number of possible explanations behind the rankings. Indonesia’s first place may be explained in part by the strong demand for Shariah-compliant funds, which follow the moral code and religious law of Islam and may be considered to be socially-responsible investments.

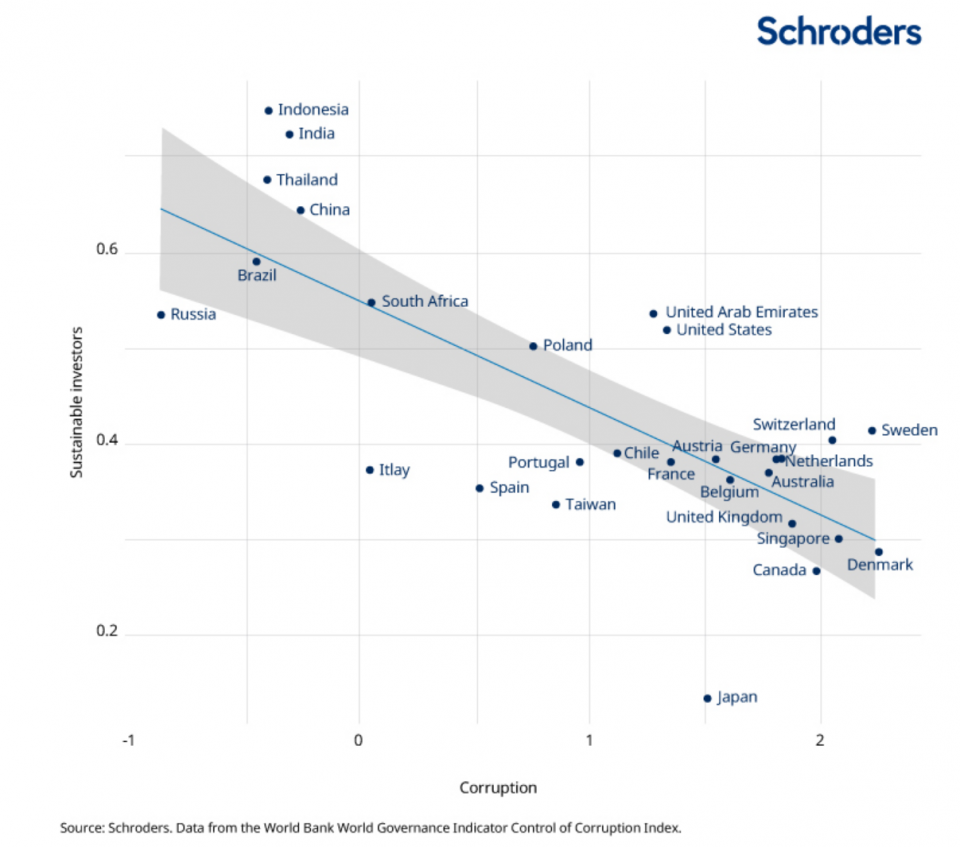

Comparing the Global Investor Study findings with data from the World Bank shows that for countries with more corruption, investors are more likely to invest sustainably, as shown below.

What sustainability issues are investors worried about?

The study expanded to include questions on what sustainability areas they would like companies to improve on. Bribery and corruption comes top scoring 7.9 on a scale of 10. Other issues like pollution from operations, treatment of company workforce and climate change scored slightly lower at 7.6, 7.4 and 7.3, respectively. There was a surprising consistency in the ranking of issues regionally.

Schroders has been a leader in engaging with companies and working with them to improve their environmental, social and governance (ESG) practices.

Jessica Ground, Global Head of Stewardship at Schroders, said:

“This survey underlines the rapid growth of interest in sustainable investing. The fact that 64% of investors have increased their allocation to sustainable investments in the past five years tells you how important this is for so many people.

“More interestingly, we think of this as a developed market trend, but consumer interest from Emerging Markets is surprisingly strong. There is an opportunity for many of these countries to develop innovative sustainable investment solutions that address the very specific needs and demands that come through in this survey.

“Another ground breaking result came through in the engagement priorities, which were surprisingly consistent around the world. While policymakers are focused on global issues like climate change, investors seem to prioritise more local concerns like pollution and bribery and corruption. We will feed this work into the engagements that we undertake with companies, holding them to better account on these concerns.

“Overall it seems that where people are faced with challenges first-hand they look towards their investment portfolios to be part of the solution. It’s heartening to see such high levels of engagement with these issues. Investors seem to have a greater understanding that selecting companies that take sustainability seriously is a sensible approach. Not only is that the right thing to do but those companies are dramatically improving their long-term prospects. That can only be good news for their investors.”

Read more:

- The potential income shock awaiting pension savers

- Why 70% of people keep investing after retirement

About the research:

Schroders commissioned Research Plus Ltd to conduct, between 20th March and 23rd April 2018, an independent online study of 22,338 investors in 30 countries around the world, including Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, the Netherlands, Spain, the UK and the US. This research defines ‘investors’ as those who will be investing at least €10,000 (or the equivalent) in the next 12 months and who have made changes to their investments within the last ten years. These individuals represent the views of investors in each country included in the study.

Important Information: The views and opinions contained herein are of those named in the article and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. The sectors and securities shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell. This communication is marketing material.

This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. The opinions in this document include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. Issued by Schroder Investment Management Limited, 1 London Wall Place, London, EC2Y 5AU. Registration No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.