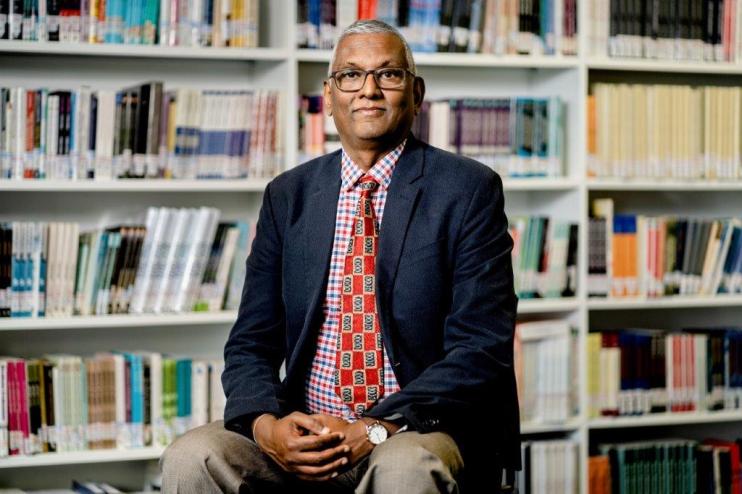

Global financial sector is facing an ‘ethical crisis,’ new book warns

The financial sector is facing an “ethical crisis” that is undermining the sustainability of the global economy, according to a new book by business ethics professor Dr Atul Shah.

The current approach to teaching business ethics, in both academic and professional contexts, is narrowly-focused and detached from real-life, Shah’s new book, Inclusive and Sustainable Finance,says.

It argues a lack of proper education has played a major part in fueling the growing number of scandals in the global accounting and finance sectors – particularly in big investment banks and the world’s four largest accountancy firms.

Most egregiously, the ethical crisis has seen industries that play a core role in the global economy – such as the legal, accounting, and banking sectors – become “enablers” of financial crime, the book says.

Speaking to City A.M., Shah called for the business ethics curriculums to be overhauled, as he argued the current approach, which focuses on abstract “ethical principles,” is detached from the real impacts of business on the world. “The context has been removed,” Shah said.

Shah, himself a follower of the Jain tradition, argues Jainism and other religious traditions offer models that could inform modern rationalistic approaches to business, by specifically focusing on the culture of the financial sector and the way it influences professional decision-making.

“The Jains developed ethical finance” Shah said, referring to the Indian tradition’s unique approach to business, that has seen an array of high-profile Jains rise to top positions within boardrooms across the globe.

It argues the Jain approach, which encourages trade and commerce whilst maintaining a commitment to doing no harm, could help businesses boost sustainability and rebuild trust.

Shah’s book notes many of the world’s biggest and most successful businesses – including Barclays which traces its roots back to a Quaker family – were founded by religious communities that placed trust and sustainability at the heart of their operations.

All in all, Shah says the immense diversity within the City of London could be used to Britain’s advantage, as he argues the traditions brought into the UK’s financial centre offer a means of strengthening the country’s economy.

“The City is a diverse city, but the beliefs and cultures that form that diversity do not currently have an influence on how the city is run,” Shah says.