Global dividends plunge to record quarterly low

Global dividends plunged by a fifth to $108.1bn in the second quarter, with payouts in the UK and Europe the worst affected.

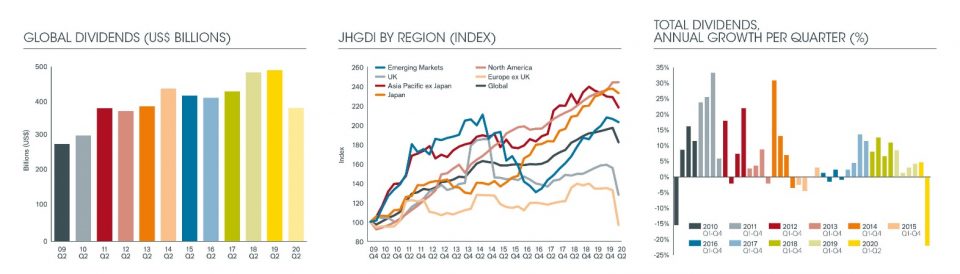

As companies scrambled to conserve cash as coronavirus cases increased, payouts fell 19.3 per cent on an underlying basis to $382.2bn, according to Janus Henderson’s global dividend index.

It is the worst quarterly drop since the index started at the end of 2009 following the global financial crisis.

Twenty seven per cent of firms cut dividends, with more than half of the group cancelling them outright. But the impact of the pandemic varied across industries and from country to country. Payouts fell in every region except North America, which was helped by the resilience of Canadian payouts.

Europe and the UK were significantly hit. Payouts fell by two fifths on an underlying basis, as the continent’s largest dividend payer, France, saw total dividends reach their lowest level in at least a decade. In contrast, Swiss payments barely budged year-on-year.

European companies tend to pay dividends just once a year in the second quarter so cancellations tend to have an adverse impact on the annual total.

Investment director Jane Shoemake suggests this could mean a rebound next year. “For the UK, the rebound will be smaller as several companies, not least oil giants Shell and BP, have taken the opportunity to reset their payouts at a lower level.”

The healthcare unsurprisingly provided most resistant to cuts, alongside communications dividends, but financial and consumer payouts fell sharply.

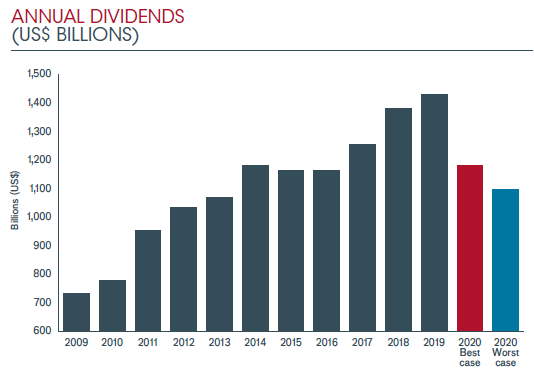

As a result, the asset manager has revised its best and worst case scenarios for payouts in 2020. Janus Henderson had previously predicted global dividends could fall as much as 35 per cent this year.

It forecast the best case scenario would see payouts drop 15 per cent, which has now been revised to 19 per cent bringing dividends to $1.18 trillion. However the worst case scenario has improved slightly to see payments fall 25 per cent this year to $1.10 trillion.

“Despite the cuts witnessed so far, we still expect global dividends to exceed $1 trillion this year and next,” Shoemake said.

“A temporary halt in dividends does not change the fundamental value of a company, though it can affect short-term sentiment, and it remains important for income investors to be diversified both by geography and sector”.

Get the news as it happens by following City A.M. on Twitter.