Global debt spirals while bond markets are undergoing transformation

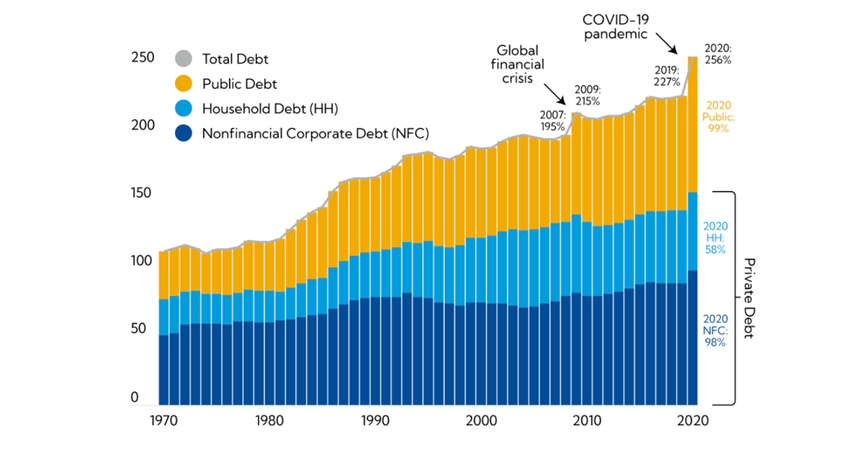

Given the headline, you can be forgiven for possibly thinking ‘so what how does this impact my business or me?’ Well unfortunately when you borrow money you usually must pay it back and, in 2020, according to the IMF, global debt increased by a massive 28% – surging to an all-time high of 256% of global GDP and reaching an incredible $226 trillion.

Global debt as a % of the world’s GDP…

Source: IMF

The definition of inflation is that it is the result of too much cash chasing too few goods and based on the inflation numbers that are being reported globally it would appear that inflation is certainly rising which if the case it is highly like so will interest rates which will make it harder for governments, companies and individuals that have become so indebted to service their borrowings.

So why is relevant to blockchain and digital assets. Well, we are increasingly seeing blockchain technology being used when it comes to debt instruments. There have been a number of banks that have issued bonds using blockchain technology:

- European Investment Bank (EIB) issued and settled its first-ever digital bond in June 2021

- Swiss Exchange in November 2021 SIX placed the first senior unsecured digital CHF bond

- World Bank announced in August 2019 it has raised an additional $33.8 million for its bond-I Blockchain bond in conjunction with Commonwealth bank of Australia

- In November 2021 Santander issued its first bond on a blockchain-powered platform

The trend is clear. More and more institutions are using blockchain technology to issue debt because it is proving to be more efficient and cheaper than traditional bond issues. In another development we have recently seen a German company called Cadeia working with Frick bank (based in Liechtenstein) carry out a corporate loan securitisation transaction on a Blockchain-powered platform. As Constantin Ketz at Cadeia said: “The complete transaction, including securities issuance and settlement, ongoing covenant testing, and rule-based cash flow management via predefined waterfall structures, is processed through a series of automatically created smart contracts on the Ethereum blockchain.”

The use of blockchain technology to issue bonds and loan securitisation is significant for smaller business as well as larger ones as it means that potentially small to medium sized firms will be able to access the fixed interest markets. As the transaction costs are reduced it become more cost effective to have smaller debt issues.

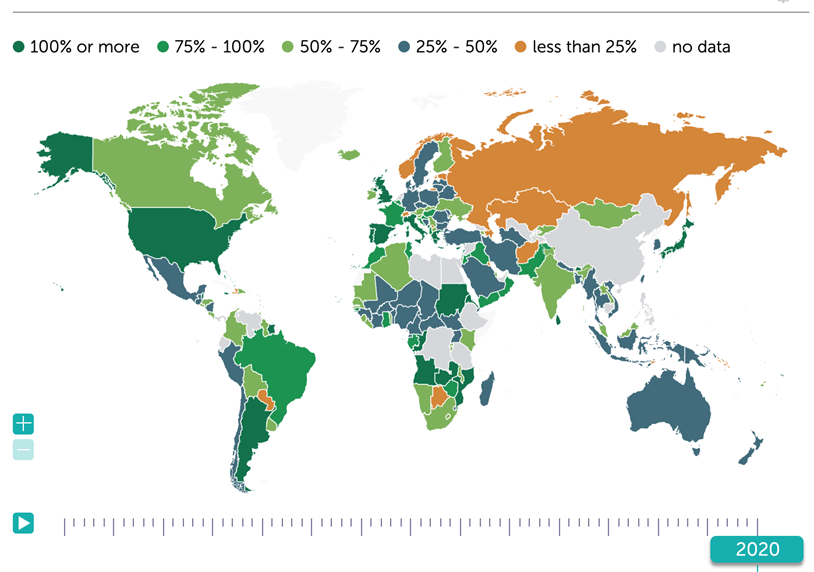

Government debt as a % of GDP

Source: IMF

We have already seen the UK increasing interest rates as it starts the temporary inflationary pressures and in the US they are reducing the their bond buying program and no doubt we will see interest rates being raised in Q1 2022.

In closing, while a little scary, you may find this chart interesting and, if you click here, you can then go to the IMF website and see how world debt has changed since 1950! So, while it may be getting cheaper to issue debt instruments the challenge is how will all this debt get repaid or will inflation just make it easier to manage and, in effect, destroy the value of those that hold the debt. Who are the holders of debt typically pension funds and so-called lower risk investors?