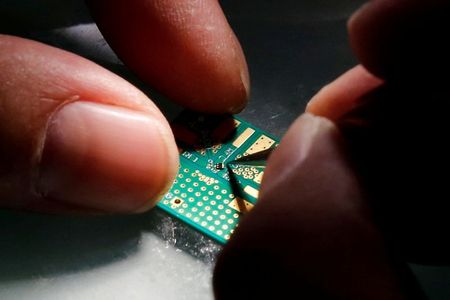

Global chip crisis boosts Arm sales amid Nvidia takeover row

A global chip shortage has helped drive a surge in sales at British semiconductor giant Arm ahead of its planned $40bn (£29bn) takeover by US rival Nvidia.

Cambridge-based Arm reported a 57 per cent rise in total net sales to $675m in the three months to the end of June thanks to increases in both royalty and non-royalty revenue.

Arm’s primary revenue comes from royalties earned when it licences its chip designs to semiconductor manufacturers.

Surging demand for computer chips in recent months — which has disrupted supply chains and hampered car manufacturers — has driven up prices and boosted royalty payments for the company.

Arm has also benefited from increased shipments of 5G smartphones and network equipment used for building new mobile networks, according to parent company Softbank.

Non-royalty revenue also doubled over the period as Arm pumped more money into research and development to expand its product portfolio into areas such as server processors, automotive electronics and AI.

Pre-tax profit for the quarter hit $80m, up from a loss of $60m in the same period last year.

The upbeat trading comes amid growing scrutiny over Softbank’s planned $40bn sale of Arm to US chip giant Nvidia.

Global regulators are probing the merger, while rivals including Google and Microsoft have filed objections to the deal on competition grounds.

Last week it emerged that the government is considering blocking the deal on national security grounds after an initial review raised worrying implications about the sale of the prize British asset.

It came as Softbank’s Vision Fund reported a sharp fall in profit to $2bn in the first quarter, down from a record $8bn in May.

The Japanese group’s investments have slumped as Chinese regulators target tech listings with a regulatory crackdown.