Glimmers UK will avoid recession this year emerge as experts cheer return to growth in PMI

Warnings that the UK is headed for a recession may have been misplaced after figures out today revealed private businesses returned to growth for the first time in half a year.

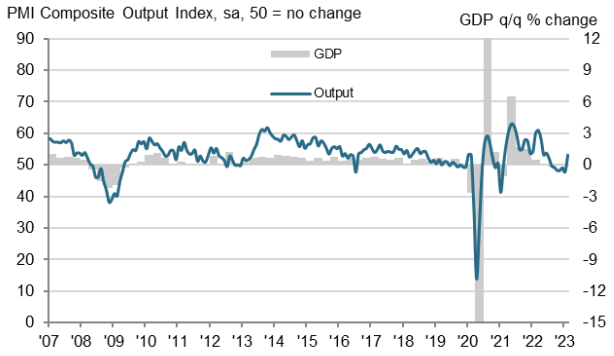

S&P Global and the Chartered Institute of Procurement and Supply’s (CIPS) composite flash purchasing managers’ index (PMI) for February hit 53 points, up from 48.5 points last month.

It marked the first time the composite PMI has topped the 50 point threshold that separates growth and contraction in six months.

It was also the best reading in eight months and smashed analysts’ expectations for the survey to have remained firmly in contraction territory yet again.

Experts have been warning for the past year or so that the UK is hurtling toward its first recession outside the Covid-19 pandemic since the financial crisis.

However, a string of data recently has hinted that GDP is holding up much better than feared.

PMI in shock return to growth

Earlier this month, numbers from the Office for National Statistics revealed the economy narrowly escaped a recession in the final months of last year, while a huge unwinding in international energy prices has raised the prospect of inflation – in double digits for several months – falling rapidly this year.

Today’s PMI does not mean the UK will definitely skirt a recession, but suggests any slump “will be mild,” Thomas Pugh, UK economist at consultancy RSM, said.

“We still think that GDP will drop in both Q1 and Q2, as households’ real disposable incomes continue to decline in response to further increases in consumer energy prices, and as households refinancing mortgages continue to cut back,” Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said.

Stronger than expected economic activity raises the risk of Bank governor Andrew Bailey and co lifting interest rates again on 23 March, possibly by 25 basis points to 4.25 per cent, to trim spending to curb price rises.

The Bank is worried businesses will keep raising prices to offset higher wage costs.

“Prices charged inflation eased only fractionally, especially in the service economy. Many firms commented on the need to pass on higher wages, food costs and energy bills,” the PMI survey found.

Overall private economy output was dragged higher by the services PMI re-scaling far above the 50 point threshold to 53.3 points, smashing analysts’ forecasts.

Services output accounts for around £1 in every £3 produced in the UK.

The manufacturing economy contracted in February.