BP finance boss Brian Gilvary commits to dividend as bid talk continues

BP finance chief Brian Gilvary yesterday reconfirmed the company’s commitment to sustaining its dividend payout while shrugging off questions about potential bids for the oil giant.

The group announced an interim dividend of 10 cents, or 6.67p, per share yesterday, and Gilvary said keeping the shareholder payout at the top of its agenda had made BP “keenly aware of balancing [its] cash in a lower oil price environment”.

BP posted a $2.3bn (£1.5bn) profit before tax for the first quarter of 2015. This was down from $5.3bn for the same period last year but it beat market expectations.

Augustin Eden, analyst at Accendo Markets, commended BP for “being pro-active in dealing with the oil price slump by concentrating more effort away from expensive exploration and production activities”.

However, Eden added: “There’s still a lot of work to be done, and the path back up to previous levels of profitability will remain somewhat slippery.”

Meanwhile, Gilvary refused to be drawn on what he called “leading questions” from analysts referring to reports that the government has vowed to block any potential takeover bids for the company.

“Our focus here at BP is on delivering the things we have said we would deliver for shareholders,” he said.

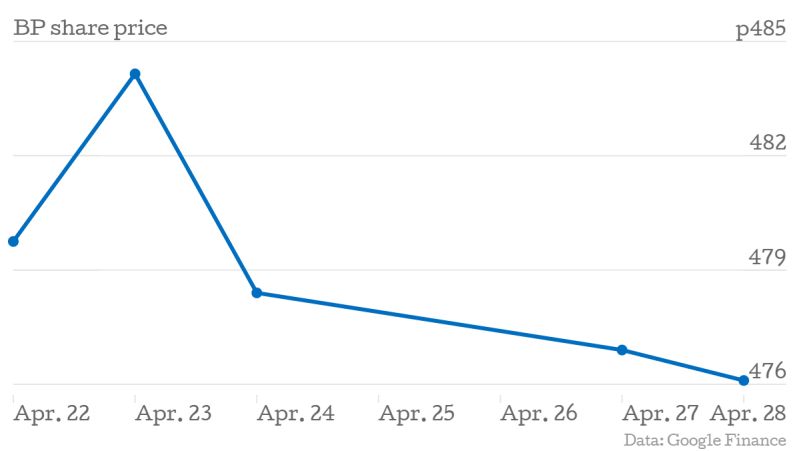

Shares in BP closed down 0.17 per cent yesterday.