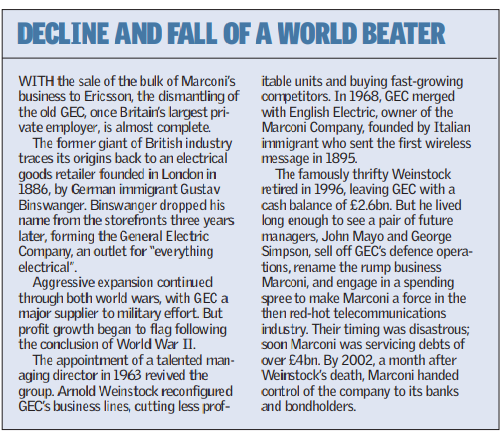

Giant laid to its rest

With the rump of Marconi set to be rebranded as telent, Laurie Laird looks at what the future might hold in store for a once-great telecoms company brought to its knees in recent years

From the mighty GEC, to Marconi, to Ericsson, to telent. It’s an ignominious end for a once-glorious company. After months of negotiations, Marconi revealed yesterday its intention to sell the lion’s portion of its business to Ericsson. The Swedish wireless networking giant will pay £1.2bn for 75 per cent of Marconi’s operations, including the bulk of its equipment and a large chunk of its service operations.

The rump of Marconi — its British telecoms services unit and British and German value added services units — will be rebranded as telent, and will retain Marconi’s listing on the London Stock Exchange.

“It’s bad for Britain in a historic sense, but it’s good for Europe,” said Julian Hewett, of technology consultancy Ovum. “It’s helping Ericsson to retain its position as one of the global leaders in telecom equipment.”

Ericsson is certainly paying a full price for the privilege, between 1.2 and 1.3 times sales, say analysts, for a collection of businesses that was loss-making last year.

The Swedish giant is attempting to capitalise on the move toward integration of wireless and fixed-line services. Operators are seeking more ways in which to deliver broadband internet services into homes and to consumers on the move. “The two sides of the industry have been proceeding on parallel tracks, but are coming together as demand for broadband access grows,” said Hewett.

Ericsson dominates the wireless transmission arena, while Marconi brings strength in the transport of voice and data over longer distances to the enlarged company. “The acquisition of the Marconi business has a compelling strategic logic and is a robust financial case,” said Carl-Henric Svanberg, chief executive of Ericsson. “As fixed and mobile services converge, our customers will substantially benefit from the powerful combination.”

Ericsson believes the acquisition will be earnings neutral next year. Marconi’s assets will begin to enhance earnings by 2007. The announcement surprised no one.

Marconi essentially put itself up for sale in April, after failing to win a portion of BT’s £10bn network upgrade contract. BT, the country’s biggest fixed-line operator, had been Marconi’s biggest customer. Marconi shares halved in value following the disappointing news; the former GEC had only just regained its footing after a disastrous spending spree on over-priced dot.com era assets nearly led it to bankruptcy.

Saddled with debt, Marconi handed control of the company to banks and bondholders in August of 2002. Shareholders were left with just 0.5 per cent of the business.

Mike Parton, the man brought into restructure Marconi following its near-death experience, will remain as chief executive of telent, while finance director Pavi Binning also retains his role in the new company, along with three other directors. Shareholders will receive payment of 275p per ordinary share, broadly equivalent to the share price on August 5, the day before Marconi revealed that it had entered talks to sell the company. That cash return, totalling approximately £577m, is scheduled for the first quarter of next year.

Analysts were busy attempting to value telent yesterday, and estimates varied wildly, from 54p a share to 125p. The highest estimate implies a market value of £250m.

The rump of the Marconi business actually earned a greater return than the bits for which Ericsson is paying over a billion. Telent posted profits of £37m last year, on revenues of £336m. “Its margins were 11 per cent, a reasonable return in this industry,” said Ovum’s Hewett. “It’s unglamorous but it will tick over for as far ahead as you can see.”

Telent will also benefit from its enhanced standing with Ericsson following the deal; Ericsson has agreed to regard it as a “preferred partner” in all its British business.

Three quarters of Marconi employees will transfer to Ericsson after the deal completes, with nearly 2,100 remaining with telent. However both groups hinted that jobs could go. “It is possible that a number of overhead savings will need to be made in the legacy equipment business and in telent’s central functions,” said a statement outlining the deal. Morgan Stanley, Lazard & Co., and JPMorgan Cazenove are acting for Marconi, while Enskilda Securities has advised Ericsson.