German politicians rule out new gas contracts with Russia amid spiking gas prices

New gas contracts between Russia and Germany are inconceivable following its invasion of Ukraine, argued Michael Roth, the chair of Germany’s foreign affairs committee today.

Roth warned German broadcaster RTL he can no longer imagine deepening economic relations with Russia.

He said: “That has failed. In the end, we have to work faster than planned to make ourselves less dependent on an authoritarian regime.”

Meanwhile, economy minister Robert Habeck has argued Germany can guarantee security of supply, even without Russian gas or oil.

Commenting on Nord Stream 2, Habeck said: “We will have to buy more gas, but also coal from other countries.”

The minister also revealed that he didn’t see the Nord Stream 2 pipeline, which the Chancellor Olaf Scholz put on hold earlier this week, being approved in the short or medium term.

This follows similarly bullish comments from EU Commission President Urusula von der Leyen last week.

She said the trading bloc could deal with a partial disruption to Russian supplies – following top-ups in liquefied natural gas (LNG) from the US.

The decision to suspend Nord Stream 2’s certification process, which would have doubled exports from Russia, alongside the Kremlin’s decision to invade Ukraine has further raised fears of supply shortages.

UK and European gas prices, with Dutch TTF Futures prices rising 31.1 per cent, while the UK Natural Gas benchmark soared 30.6 per cent.

The West has not yet imposed any energy sanctions on the country, and Russian President Vladimir Putin and gas giant Gazprom have both committed to maintaining energy agreements.

However, the escalating situation is considered increasingly unpredictable and conflict in Ukraine could cause disruption to supplies running through the country.

Speaking to City A.M., Callum Macpherson, head of commodities at Investec said: “As Russia needs the income from selling gas and Europe needs the gas, neither side has an incentive to deliberately disrupt or sanction those flows. In which case, the main risk would perhaps be the outbreak of war leading to infrastructure being damaged, that accidentally disrupts flows. How likely that is depends on how extensive the fighting in Ukraine becomes, whether Putin’s ambition is to force regime change in Kiev to make the Ukraine subservient to him then leave, or the much more complex task of occupying the country.”

Europe’s gas in short supply ahead of escalating crisis

Europe’s strained energy grid is under immense pressure, with Gazprom cutting export growth into the continent to less than five per cent over the winter – missing its output targets for the region in its full-year results.

Currently, Gazprom supplies are at decade lows within European storage, with natural gas levels 45 per cent below normal levels following two consecutive months of eastward flows on the Yamal-Europe pipeline.

The continent relies on Russia for around 40 per cent of its natural gas supplies, with Germany depending on half of its gas imports from the country.

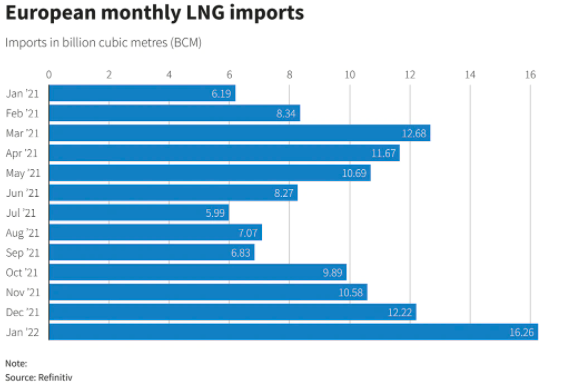

Europe has instead staved off blackouts this winter, and met rebounding consumer demand from the pandemic courtesy of LNG imports.

Reports earlier this year from investment bank Stifel and think tank Bruegel suggested Europe would struggle to meet demand beyond a short-term supply shock.

However, there is hope the combination of spring approaching and the boost in LNG will reduce pressures on the continent.

Germany’s defiant messaging concerning Russia gas supplies follows the US imposing sanctions on Nord Stream 2 AG, the Gazprom-backed company responsible for operating the gas pipeline.

The measures target both the company and chief executive Matthias Warnig.

Commenting on the sanctions, US President Joe Biden explained: “These steps are another piece of our initial tranche of sanctions in response to Russia’s actions in Ukraine. As I have made clear, we will not hesitate to take further steps if Russia continues to escalate.”