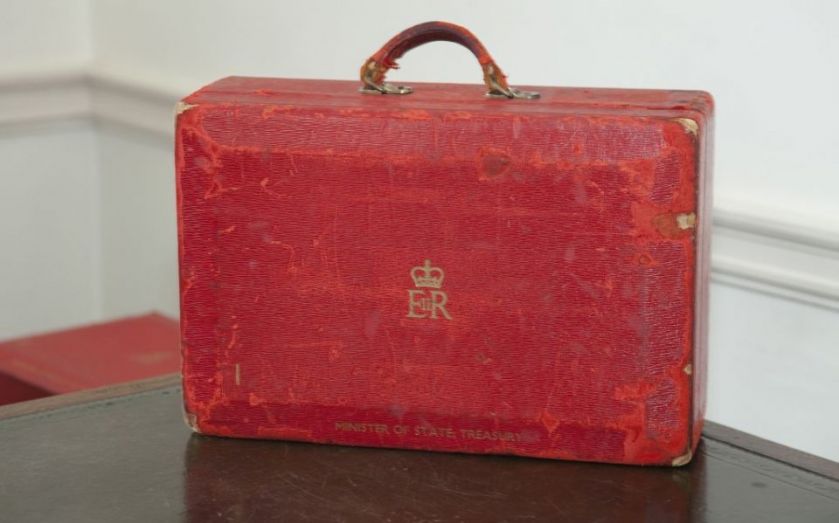

Budget 2015: George Osborne plays to the crowd with a populist plan

Despite the chancellor promising not to pull a rabbit from the hat, there were in fact plenty of Budget bunnies to be seen this year. With the UK now growing ahead of its major international competitors and an General Election coming up so soon, it’s clear that George Osborne felt confident enough to splash out on a raft of mini-giveaways in his Budget speech yesterday.

The launch of the Treasury’s review into business rates is welcome but long overdue. However, there is likely to be a long period of review and consultation so that any benefits of change are unlikely to filter through until well into the next Parliament.

As expected, the chancellor is pushing ahead with the Diverted Profits Tax aimed at tackling tax avoidance by multi-national companies. Personal tax avoidance also featured highly, with a range of measures announced.

Another populist move was the continued raid on the banks, with an extra £5bn to be raised from an increase in the bank levy, but with no tax deductions for compensation payments, such as PPI, made to customers. It’s a good job that banks don’t vote.

The creation of eight so-called enterprise zones should be a boost to businesses in deprived areas and the oil and gas industry has been a natural beneficiary of this Budget, given the difficulties caused by the recent falls in the price of oil.

However, tax cuts for individuals is where the real battle ground for the election starts and the coalition parties have clearly laid out their stall to attract voters. The increase in the personal allowance was very well trailed and will be welcomed by low and middle earners alike. Higher rate tax payers will also benefit from the increases in the tax band above inflation.

More flexibility for pensioners with annuities will have a significant appeal to the older age groups as will the removal of tax on interest-related savings of up to £1,000 per year. At the other end of the age scale, the newly announced Help-to-Buy ISA for first time buyers will be welcomed by younger generations struggling to get on the property ladder.

But what was left out? As is becoming a worrying trend, there was very little in the Budget to help mid-sized businesses. Despite a building rhetoric behind the scenes, any suggestion of how HMRC may start to adopt a more considerate and focused approach to these businesses was missing.

There was also very little in the way of incentives for Britain’s medium-sized exporters. We would like to see much more for this engine room of the UK economy from whomever wins the General Election in May.

More information on BDO’s Budget analysis can be found at www.bdo.co.uk/budget