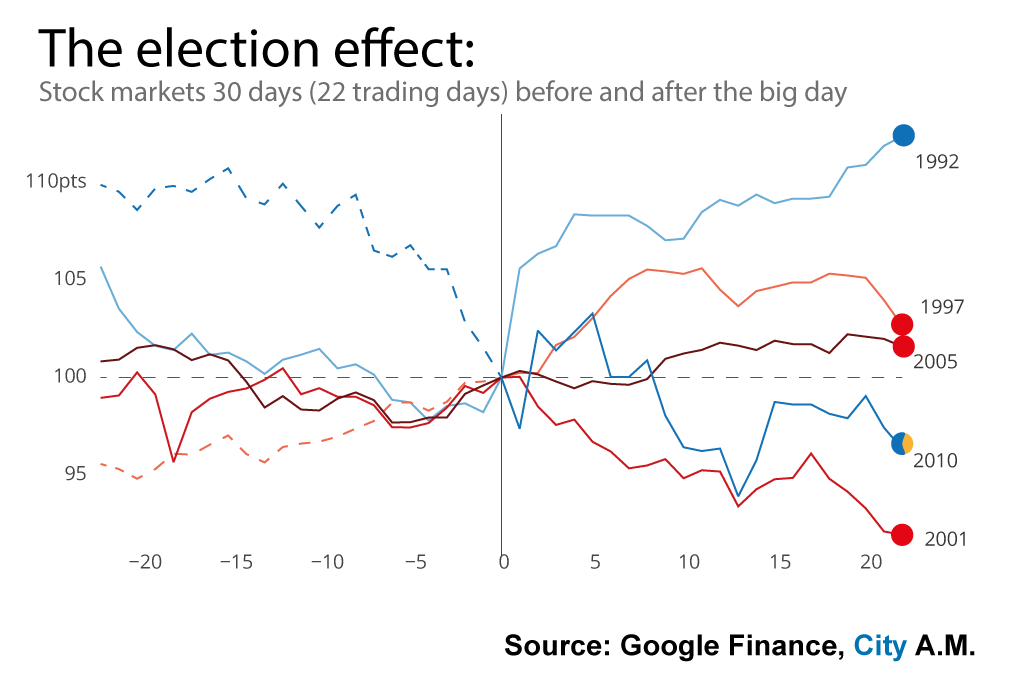

General Election 2015: How will the FTSE 100 be affected by political uncertainty as we head to the polls?

Elections are times of great volatility for the markets, and 2015's edition looks like it could hold a roller-coaster 60 days in store.

Looking back to 1992 and 2010 – the two most close and dramatic elections in recent years – it's clear that markets don't like the uncertainty and respond with plenty of jitters and opportunities for traders.

As Naeem Aslam of AvaTrade points out, the deluge of policies and the fluctuations of polls drive the markets into undulations:

The general trend [before elections] is an increase in the volatility due to the uncertainty in the market – and this what we have established. [Traders]… will have many opportunities with much bigger swings in the market because every headline makes noise in the market.

This year the election stands on a knife edge again as the polls suggest there may well be no clear winner. That leaves the SNP, Ukip or the Liberal Democrats as potential kingmakers, with the deciding vote most likely to come from north of the border.

What can we expect then, based on the impact the last five elections – and in particular, the dramatic races of 1992 and 2010 – have had on the FTSE 100?

colour of line indicates winning party, dotted line that the party in power changed

Major v Kinnock, 1992

In 1992, the UK was suffering the effects of a global recession, and the government was unpopular due to changes to council tax, the first Gulf War, and the signing of the Maastricht treaty. What's more, the ruling Conservative party had suffered a bruising leadership competition in 1990, after the resignation of Margaret Thatcher.

Labour were initially favourites, but the Tories fought back to win.

Compared with other years, the FTSE 100's jump after the election was large – at 5.6 per cent it was significantly higher than in 1997, 2001 and 2005, which showed rises of 1.4 per cent, 2.6 per cent and 1.2 per cent respectively.

Brown v Cameron (v Clegg), 2010

The 2010 General Election is still fresh in the memory: the narrative was simple, the Tories wanted the electorate to confiscate the keys from the politicians they said crashed the car, while Labour said the crisis was a global one and that its stimulus programme was bearing fruit, even if it hadn’t saved the world.

The polls were close and many expected a hung parliament, which added to market uncertainty.

The jump after election day was big here too – about five per cent – especially bearing in mind the average change per day across all years was less that one per cent.

Cameron v Miliband (v Ukip and the SNP), 2015

In 2015, Europe is a key point of contention, with a recent report suggesting the majority of business leaders are against a Brexit. Alongside this issue are the looming possibilities of more Scottish power in British politics (with the possible accompaniment of clamour for a second Scottish independence referendum), and the parties different approach to austerity and taxes.

If the past is anything to go by, we’re in for quite a ride.